Here We Go, White House Warns of Extraordinarily Elevated Inflation Data to Be Released Tomorrow

She did it again. Just like in February, when Psaki (seemingly out of the blue) gave a weird proactive statement about bad economic data that was going to be released the following day {LINK}. Earlier this afternoon White House spokesperson Jen Psaki gives another proactive justification for even worse inflation data that is about to be released from the Bureau of Labor and Statistics tomorrow.

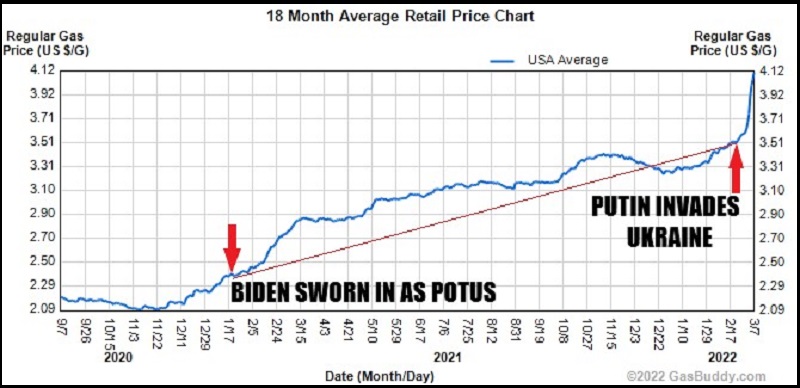

In this brief soundbite, Psaki says the March inflation data that is going to be released tomorrow is going to show “Putin’s price hikes” on U.S. consumers. However, even within the framework of her false justification, she attempts to blame Putin for gas price increases in January, when the Russian military operations did not start until February 24th. The inflation news is going to be really bad tomorrow. How bad? WATCH:

None of this will come as a surprise to CTH readers. We noted in the February inflation data (released in March), that things were going to be much worse in the April release. The reason was simple, the massive gas price increases were not yet matriculated in the February data, and the massive food inflation was not yet captured by the USDA component. All of that preceded Russia’s invasion of Ukraine. None of it has anything to do with Vladimir Putin.

The inflation data that will be released tomorrow is the first visible data assembly of the second inflation wave now upon us. Remember, inflation data lags behind the reality of the price increases. What the BLS will show tomorrow is the price results from the last half of Feb through the half of the month of March. It will likely show the largest single month inflation increase in modern history.

How bad is the data going to be?

FLASHBACK TO February: “In my estimation, the massive price increases the bureau quantified through January were the end of the first wave of massive inflation that CTH warned about last October.

“Do what you can do now to start preparing your weekly budget in ways you may not have thought about before. Shop sales, use coupons, look for discounts and products that can be reformulated into multiple meals or multiple uses. Shelf-stable food products that can be muti-purposed with proteins is a good start. Consider purchasing the raw materials for cleaning products and reformulate them yourself to avoid these massive increases in petroleum costs.” [October Warning]

The recent announcement of price increases we have discussed, from food producers specifically (Kraft-Heinz, Proctor and Gamble, etc.), in combination with massive fertilizer and farming costs for future yield, is the second wave that has yet to be fully quantified. The second wave of retail inflation, only just beginning to arrive now in the February results, will extend throughout the spring.

Next month, March data reported in April, the second wave of inflation data should carry the first big jumps in gas and diesel prices. For ordinary people, this next round of food inflation will be focused predominantly in the ‘Fresh Foods‘ categories. Fresh produce, vegetables and fruits have short life cycles, and rapid increases in transportation costs hit that segment fast and hard.

On the positive side, our victory gardens are going up in value, very quickly. A few backyard growing boxes can generate an easy $200 to $500/month in fresh produce as the price of ordinary row crops at the store starts to double and triple. Mature citrus trees are worth their weight in gold right now.

The BLS data was collected at about the time of the red arrow in this graphic below (Feb 10 to 15). You can see where the gas price goes from the point at which the inflation data was collected. That 30% spike is what will roll-up into next month’s inflation data. (Written from the March data)

Post a Comment