Cleveland Fed Chair Outlines Reasons Monetary Policy Cannot Lower Inflation When Energy Policy Is in Control

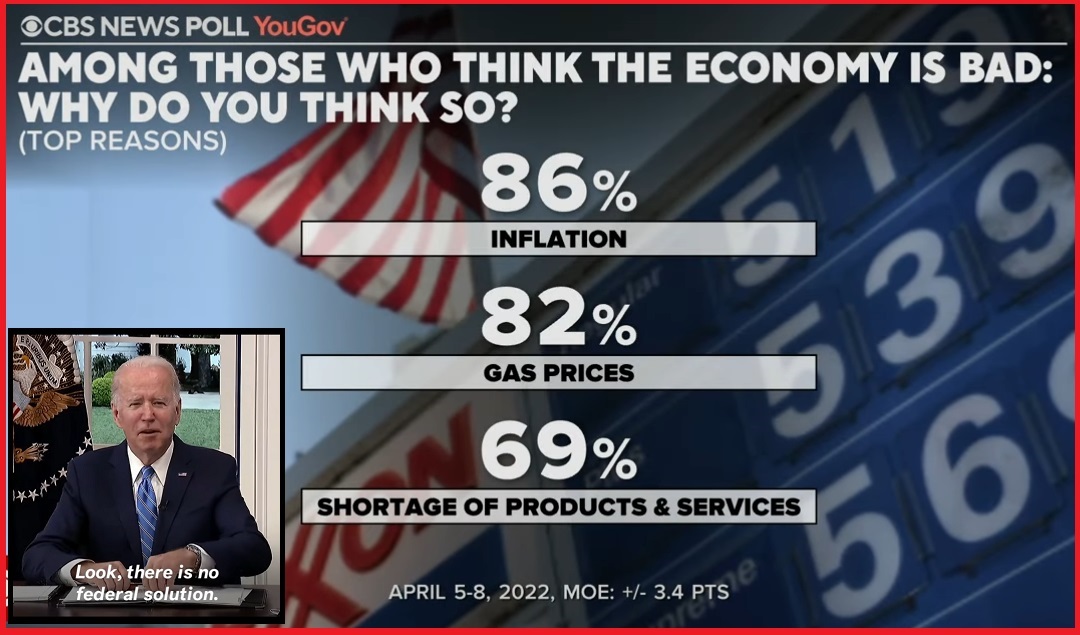

Loretta Mester, the president and CEO of the Federal Reserve Bank of Cleveland, appears on CBS Face the Nation to discuss inflation, the economy and monetary policy. Ms Mester is in a tough place, because she cannot admit the influence of federal monetary policy is far outmatched in the era where Joe Biden energy policy is limiting oil and gas development and creating massive inflation.

Mester does admit the supply chain crisis will extend well into 2023, but blows hopeful unicorn wishes by projecting that price inflation will temper by the end of this year. From the perspective that 20 to 50% price increases on critical goods (housing, food, fuel, energy) are unsustainable in repeated cycles, she is correct; the rate of inflation will lower. However, that’s only because the baseline prices will have increased so high the rate of increase measure falls. WATCH:

A $4 item that gains a $2 increase holds a 50% rate of inflation. The next year that $6 item again has a $2 increase, but the rate of inflation drops to 33%. The price increase is the same, but the rate of inflation drops. That’s what is going to happen in the second half of this year. FUBAR

The White House is doing this on purpose in order to chase their ideological dreams of sustainable energy and climate change. Energy prices underline the entire economy, because oil and gas prices touch everything. Insofar as they continue the war against coal, oil and gasoline, there’s nothing monetary policy can do to combat inflation. The Fed must however, pretend not to know things.

⸹

Post a Comment