No End in Sight as Another Inflation Measure Spikes

By just about any measure, the economy is in terrible shape. There are several measures of inflation in data coming out of January that just aren’t good. New data out today continues to not only confirm that it’s not good but getting worse.

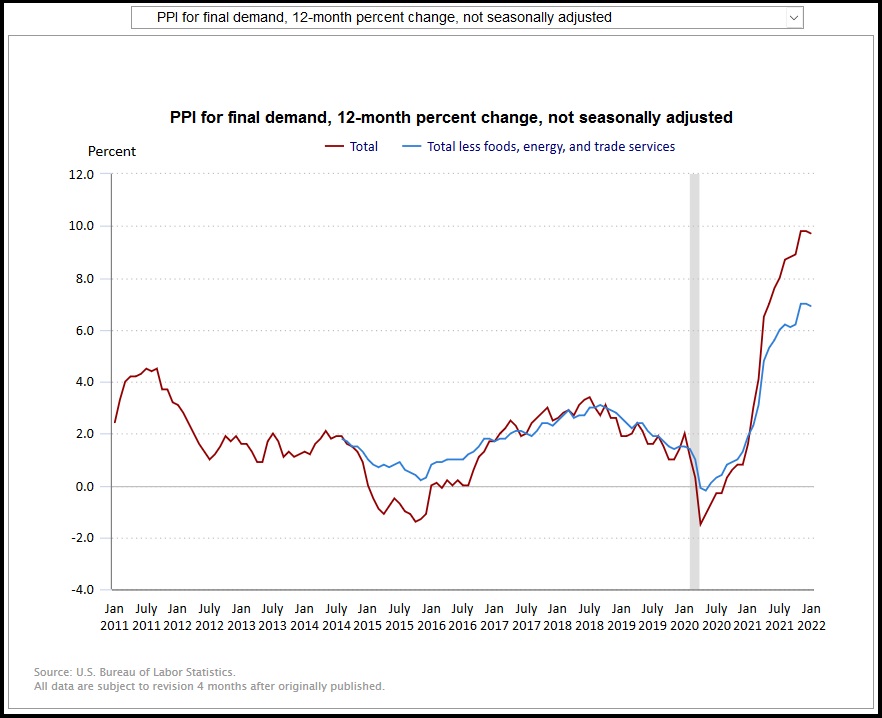

The producer price index is showing similar data to what we saw in last week’s reporting.

New York (CNN Business)America’s high prices didn’t budge in January. Another key inflation measure showed prices rising last month.

The producer price index, which tracks average price changes America’s producers get paid for their goods and services over time, rose 9.7% in the 12 months ended in January, not adjusted for seasonal swings, the Bureau of Labor Statistics reported Tuesday. That was far higher than economists had expected, albeit a 0.1 percentage point decrease from the revised series high set at the end of 2021.

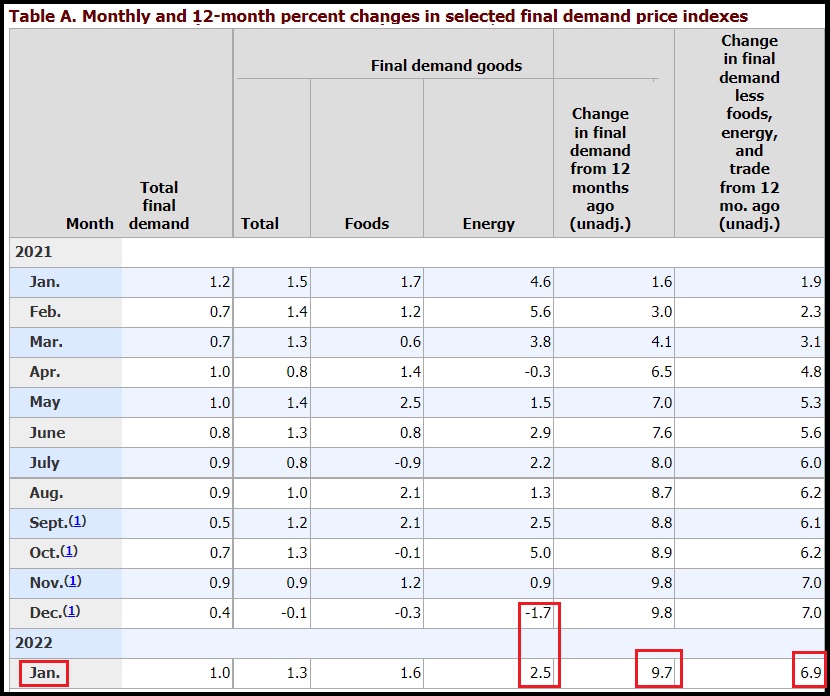

For the month of January alone, prices rose 1%, adjusted for seasonal swings, dwarfing both the price increase from December and economists’ expectations. Forecasts had only been for a 0.5% price increase.

Stripping out food, energy and trade services, which tend to have more volatile price swings, the inflation gauge rose 0.9% in January, the biggest jump since January 2021. Over the 12-month period, core prices rose 6.9%, a 0.1 percentage point decline compared with December.

There does not appear to be any end in sight, either. American consumers are facing steep price hikes across the board, and there is no sign that inflation is slowing down. It’s got a lot of Democrats nervous, with Joe Manchin coming out to essentially say that the Build Back Better plan is dead and Nancy Pelosi doing her best to spin the situation away. But despite the spin, consumers aren’t fooled. Things are looking bleaker and bleaker.

The problem is that the Biden administration can’t really do anything substantial to reverse what’s happening. Legislation that flooded the economy with a bunch of extra money made things worse. Cutting jobs in the energy sector made things worse. Nothing they’ve done so far has made anything better.

Voters are keenly aware of what’s going on, too. This is something they feel. To dismiss it, as Pelosi did, only serves to infuriate them more. It’s a big reason both the House and Senate are in play, and why nearly six out of ten Americans disapprove of Biden’s job performance.

Unfortunately, things will continue to get worse before there is any hope of getting better. There isn’t a ceiling on inflation (or, at least, one we can see right now), and while the last jobs report was better than expected, there’s still the fact that inflation is outperforming job numbers and wage growth. The average American can’t get any relief.

Here we go folks. Jumpin’ ju-ju-bones, the first wave of producer driven inflation has just been quantified. The economic analysts are shocked, stunned, flabbergasted and surprised, because the January single month wholesale inflation of 1.0% is double what they expected.

The “producer price index” is essentially the tracking of wholesale prices at three stages: Origination (commodity), Intermediate (processing), and then Final (to wholesale). Today, the Bureau of Labor and Statistics (BLS) released January price data [Available Here] showing a dramatic 9.7% increase year-over-year in Final Demand products at the wholesale level.

Check out the single month wholesale price increases in these categories [Table 2]: Beef jumped 6.5% in January (43.9% for year). Gasoline jumped 1.9% in January, (53.9% for year). Diesel fuel jumped 9.4% in January (56.5% for year). Cooking oil 4.7% in January (36.4% for year). Home heating oil jumped 7.3% in January (47.4% for year). Pasta jumped 3.0% in January (16.2% for year). Tires jumped 4.6% in January (9.0% for year). Wholesale cleaning supplies jumped 3.8% in January (34.9% for year).

Unfortunately, there is nothing upstream in the supply chain and manufacturing pipeline to suggest that higher prices at the retail level are not coming. The price of raw materials, and the wholesale energy costs to process those materials into finished goods, are still rising.

[Modified Table-A to remove noise]

Exactly as we suspected last month, the temporary drop in gasoline was the only reason December producer inflation was not MUCH higher. However, that said, the BLS did revise December PPI inflation slightly higher putting it at 9.8%. The cumulative costs of energy price increases continue to drive inflation in the entire system of goods production.

Year-over-year PPI for November (7.0%), December (7.0%) and now January (6.9%), shows the overall inflation in the wholesale supply chain is structurally here to stay. We can expect much higher prices at retail for the foreseeable future.

Keep in mind that these figures are backward looking. In my estimation the massive price increases the bureau has just quantified in January and the preceding months is the end of the first wave of massive inflation that CTH warned about last October.

“Do what you can do now to start preparing your weekly budget in ways you may not have thought about before. Shop sales, use coupons, look for discounts and products that can be reformulated into multiple meals or multiple uses. Shelf-stable food products that can be muti-purposed with proteins is a good start. Consider purchasing the raw materials for cleaning products and reformulate them yourself to avoid these massive increases in petroleum costs.” [October Warning]

The recent announcement of price increases we have discussed, from food producers specifically (Kraft-Heinz, Proctor and Gamble, etc.), in combination with massive fertilizer and farming costs for future yield, is the second wave that has yet to be quantified. The second wave of retail inflation is only just beginning to arrive now and will extend throughout the spring/summer of 2022.

CNBC economic analyst Steve Liesman is struggling to reconcile the economic data from the last three months against his own prior claims that he could not/would not believe the economy and inflation were as bad as the BLS statistics reflect. I do not like these elitist financial analysts who have zero connection to the Main Street economy.

Today, at the end of his remarks (very end of video below), showcasing just how disconnected these analysts are, Leisman shrugs off the massive inflation impact by saying consumers seem to be “taking it just fine.” WATCH:

No doofus, we are not taking it “just fine.”

At the end of these statistics are people really suffering and trying to figure out how to take care of their families when everything costs so much. Working people who live paycheck to paycheck are being crushed by this Bidenflation, and most people are one small event away from a major checkbook crisis. A broken car, a drop in hours worked, or an unexpected household expense can be extremely stressful right now. No one is taking this “just fine“, regardless of how much we have prepared for it.

I do not like these analysts.

(Business Insider) – Producer prices in the U.S. jumped by much more than expected in the month of January, according to a report released by the Labor Department on Tuesday.

The Labor Department said its producer price index for final demand surged up by 1.0 percent in January after rising by an upwardly revised 0.4 percent in December.

Economists had expected producer prices to increase by 0.5 percent compared to the 0.2 percent uptick originally reported for the previous month.

The sharp increase in producer prices was partly due to a substantial rebound in energy prices, which spiked by 2.5 percent in January after tumbling by 1.7 percent in December.

Food prices also showed a significant rebound, jumping by 1.6 percent in January after dipping by 0.3 percent in the previous month. (more)

Post a Comment