DOGE Now Reviewing Consumer Financial Protection Bureau, The Elizabeth Warren Shakedown Racket

If you thought the USAID revelations were alarming sunlight, just wait until you see the apoplectic fits of rage about to come out from the Democrats, the DNC affiliated community activist groups, and the professional leftists who all rely upon the financial mechanism of the Consumer Financial Protection Bureau (CFPB).

According to a Politico article (also funded by USAID money), written with stunning amount of anger and apoplexy itself, Elon Musk’s DOGE team has just entered the CFPB to do a review and audit. This one is going to be beyond bananas.

Jumpin’ ju-ju bones, tell Ma, to fire up the coffee pot, we are in for a delicious treat. There’s no way for the DC outrage machine to handle this dose of Trumpian nitrous oxide directly into the intake manifold. The machine will explode.

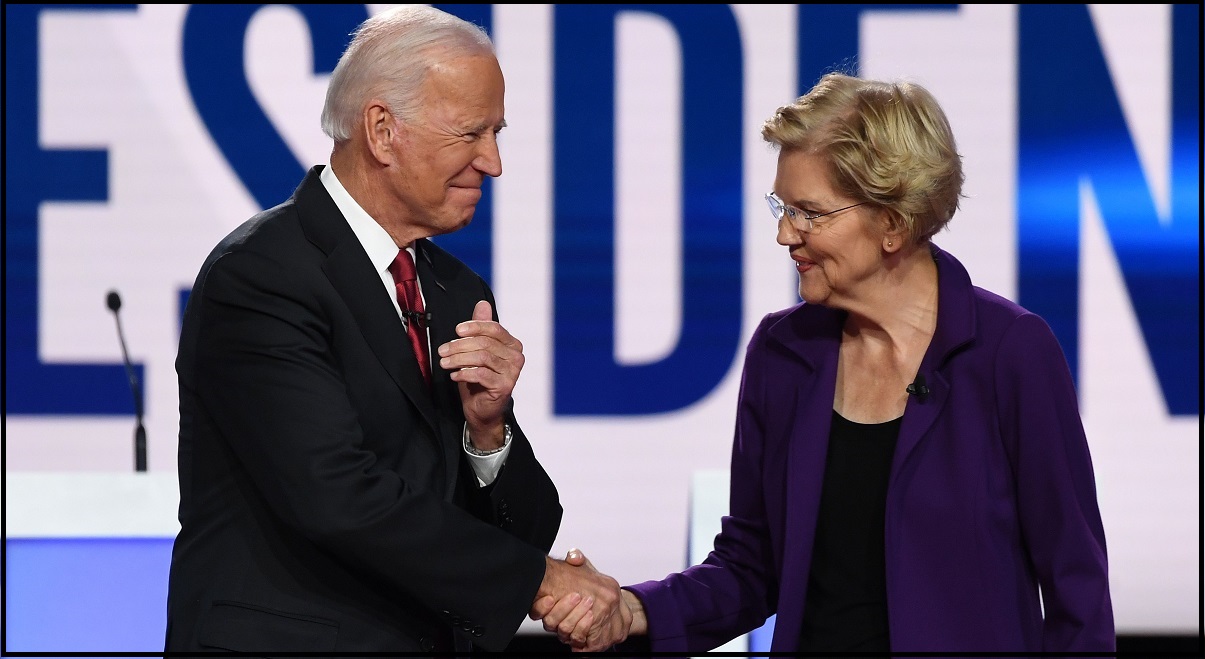

BACKGROUND FIRST – The Consumer Financial Protection Bureau (CPFB) was originally created by congress (Elizabeth Warren lead) as a quasi-constitutional watchdog agency to reach into the banking and financial system, under the guise of oversight, and extract money by fining entities for CFPB defined regulatory and/or compliance violations

Essentially, the CFPB is a congressionally authorized far-left extortion scheme in the banking sector. The CFPB levies fines; the fines generate income; however, unlike traditional fines that go to the U.S. treasury, the CFBP fines are then redistributed to left-wing organizations to help fund their political activism.

The Consumer Financial Protection Bureau (CFPB) was the brainchild of Senator Elizabeth Warren as an outcome of the Dodd-Frank legislation. Within the CFPB Warren tried to set up the head of the agency, the Director, in a manner that that he/she would operate without oversight. Unfortunately, her dictatorial-fiat-design collapsed when challenged in court. Backstory #1 – Backstory #2

A federal court found the CFPB Director position held too much power and deemed it unconstitutional. The court decision noted that giving the President power to fire the Director would fix the constitutional problem. This issue was argued extensively after President Trump appointed Mick Mulvaney as interim Director. Elizabeth Warren declaring the CFPB Director could not be fired by the executive. The legal battle worked its way to the Supreme Court.

In June 2020, the Supreme Court ruled (full pdf here) the structure of the CFPB Director position is unconstitutional and the President can fire the head of the agency. However, SCOTUS kept the CFPB agency in place by severing the part of the law that created the agency head from the rest of the law.

In June 2020, the Supreme Court ruled (full pdf here) the structure of the CFPB Director position is unconstitutional and the President can fire the head of the agency. However, SCOTUS kept the CFPB agency in place by severing the part of the law that created the agency head from the rest of the law.

The CFPB remains as a quasi-constitutional agency; the CFPB remains an extortion racket to target any organization within the banking and finance sector; however, the president can fire and appoint the Director of the CFPB.

That’s the background. Now, DOGE is looking at the books, and the DC system is going bananas.

WASHINGTON DC – Elon Musk’s team on Friday entered the headquarters of the Consumer Financial Protection Bureau, an agency that the billionaire Trump adviser has personally targeted, according to three people familiar with their actions.

Three Musk allies, some of whom are tied to his Department of Government Efficiency, have also embedded with the consumer bureau, according to the CFPB’s employees union, NTEU 335, in a sign that cuts could be coming to the agency, which Republicans have long opposed.

Chris Young, Nikhil Rajpal and Gavin Kliger’s names were added to the agency’s internal staff directory on Thursday night, the union said. They are listed as “senior advisers,” according to a person in the bureau who asked not to be named.

“CFPB Union members welcome our newest colleagues and look forward to the smell of Axe Body Spray in our elevators,” the union said in a scathing statement on Friday.

“While Acting Director [Scott] Bessent allows Musk’s operatives to bypass cybersecurity policies and wreak havoc with their amateur code skills inside CFPB’s once-secure systems, CFPB Union members fight to protect our jobs so we can continue protecting Americans from scammers with conflicts of interest like Musk,” the union said.

The CFPB did not immediately respond to a request for comment. A spokesperson for DOGE also did not immediately respond. (read more)

The CFPB racket is also how the DNC and Clyburn network get paid.

This is the core funding for the activist groups who the Democrats rely upon to manipulate election outcomes. If they get cut off from both USAID funds and CFPB funds, they lose about 75% of all their election engineering funding.

The Act Blue money laundering operation took the hundreds of millions in funds from sketchy network sources attached to the CFPB/USAID, then assigned those funds to random names in the donor files of the Act Blue system; essentially washing away the fingerprints so the FEC could not identify the larger funding mechanism behind the fraudulently assigned individual donors. This is the trail that James O’Keefe was following.

Liawatha is going to be Big Mad.

Post a Comment