U.S. Home Sales Drop Again in January, 12 Straight Months of Contraction

I do not see anything on the horizon that will stop this continued dropping in existing home sales. Financial analysts keep expected a month-over-month uptick, which would indicate the floor of the housing market has been reached. However, that ‘uptick’ never happens, and each report shows the month-over-month number continuing negative, meaning the slope of the decline is continuing and no bottom is visible.

The gaslighting financial media keep using terms like “the pace of the decline is slowing” in an effort to continue supporting the policies that are ultimately contracting the entire economy. The reality is behind the phrase “transitioning to the new economy,” which, by the very nature of the approach, means this is a managed decline in overall economic activity.

The gaslighting financial media keep using terms like “the pace of the decline is slowing” in an effort to continue supporting the policies that are ultimately contracting the entire economy. The reality is behind the phrase “transitioning to the new economy,” which, by the very nature of the approach, means this is a managed decline in overall economic activity.

The temperature on Fed stove is slowly being raised, so the frogs in the economic pot don’t notice it.

(Reuters) -U.S. existing home sales dropped to the lowest level in more than 12 years in January, but the pace of decline slowed, raising cautious optimism that the housing market slump could be close to reaching a bottom.

[…] Existing home sales fell 0.7% to a seasonally adjusted annual rate of 4.00 million units last month, the lowest level since October 2010, when the nation was grappling with the foreclosure crisis. That marked the 12th straight monthly decline in sales, the longest such stretch since 1999.

[…] The housing market has been the biggest casualty of the Fed’s aggressive monetary policy tightening. Residential investment has contracted for seven straight quarters, the longest such stretch since 2009. Government data last week showed single-family homebuilding and permits for future home construction declining in January. (more)

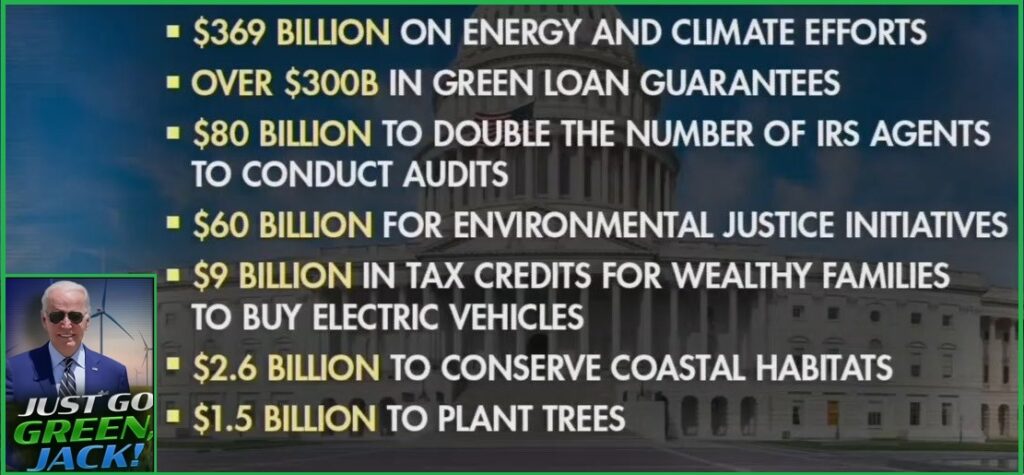

“MANAGING THE TRANSITION” – The issue is quite simple, really. When additional oil, coal and natural gas development is blocked as an outcome of policy, energy prices jump massively. We are seeing 2022/2023 price increases in electricity, home heating, fuel, gasoline, natural gas and other total energy price outcomes in the 60%+ range.

As a direct outcome of energy policy, all of the downstream products and services have massive upward supply side price pressure. When the input prices are driving upward of 60%, the downstream prices increase accordingly. Farming costs, fertilizer, feeding, transportation costs, food at retail and wholesale, and just about every petroleum-based product, which is almost everything, increases in price accordingly.

If supply side energy price increases are pushing +60%, and the Fed will only accept a 2% inflation output result, the only method of achieving the desired result is to shrink energy demand. This is the goal of the current Fed monetary policy.

Energy supply has been reduced. Now, energy demand is being curtailed to meet that diminished energy supply.

Post a Comment