Western Financial System to Mexico: Nice Peso You Got There, it’d be a Shame if Something Happened to It

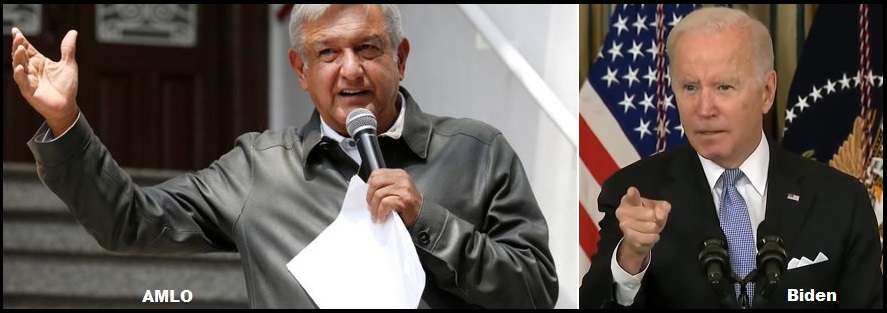

As we’ve been saying for seven months, keep watching how the globalists respond to Mexico. AMLO doesn’t want to join the economic suicide pact known as Build Back Better, or the North American version “Green New Deal.” This puts him in a precarious place.

This sentence from a recent financial analysis article in Reuters is telling, “concerns about a U.S. recession and a trade spat Mexico is embroiled in with the United States and Canada over Lopez Obrador’s energy policy, which critics call nationalist, muddy the outlook for the peso.” A “nationalist energy policy”?

What exactly is a “nationalist energy policy,” and why would international financial people be having fits about it?

In the past year the Mexican peso has outperformed the U.S. dollar, in part because Mexico is not following the economic roadmap, a World Economic Forum inspired united inflationary malaise as an outcome of unified energy policy. [Side Note: The Brazilian currency was also outperforming the western bloc and dollar; but that situation has been rectified now, Bolsonaro removed, and the central bank will start contracting the economy.]

The global financial control mechanisms now start to look at the Mexican non-compliance:

(Reuters) – Mexico’s peso, which is ending 2022 with one of its strongest performances in a decade, could have its gains wiped out in 2023 after an expected end to the Bank of Mexico’s rate hikes cycle and a possible recession in top trade partner the United States.

The peso last month clawed its way back to pre-pandemic levels and has appreciated over 5% versus the U.S. dollar in 2022, making it one of the best-performing global currencies alongside Brazil’s real.

But the peso’s impressive run may be ending as markets expect the large capital flows to Mexico in recent months, attracted by the Bank of Mexico’s restrictive monetary policy stance, could soon start to slow.

[…] Banxico, as the central bank is known, has been increasing its benchmark interest rate since June 2021 to stem inflation, and hiked it to a record 10.5% at its last policy meeting.

In the coming months, Banxico is expected to end its rate hiking cycle and likely decouple from the U.S. Federal Reserve, which is seen continuing to increase rates. That would narrow the rate differential and could spark an outflow of capital.

Concerns about a U.S. recession and a trade spat Mexico is embroiled in with the United States and Canada over Lopez Obrador’s energy policy, which critics call nationalist, muddy the outlook for the peso.

“The perception of risk could rise due to the consultations in the framework of the USMCA (trade deal), which could lead to the imposition of measures against Mexico,” said Banco Base.

Traders at the Chicago Mercantile Exchange, considered a bellwether of market sentiment, have started to bet the peso will begin depreciating. (read more)

There is no upper limit to the amount of pressure

the Western Alliance will put upon Mexico.

Post a Comment