Ukraine crisis: Who is buying Russian oil and gas?

India and China have become the largest buyers of Russian oil as Western nations restrict purchases and impose sanctions.

A plan by the major G7 economies - backed by the EU and Australia - to cap the price at which Russian oil is bought has created uncertainty in global markets.

And as major oil-producing nations seek to maintain global prices by controlling output, Russia has been offering its oil at a discount to willing buyers in Asia.

How much Russian oil is going to Asia?

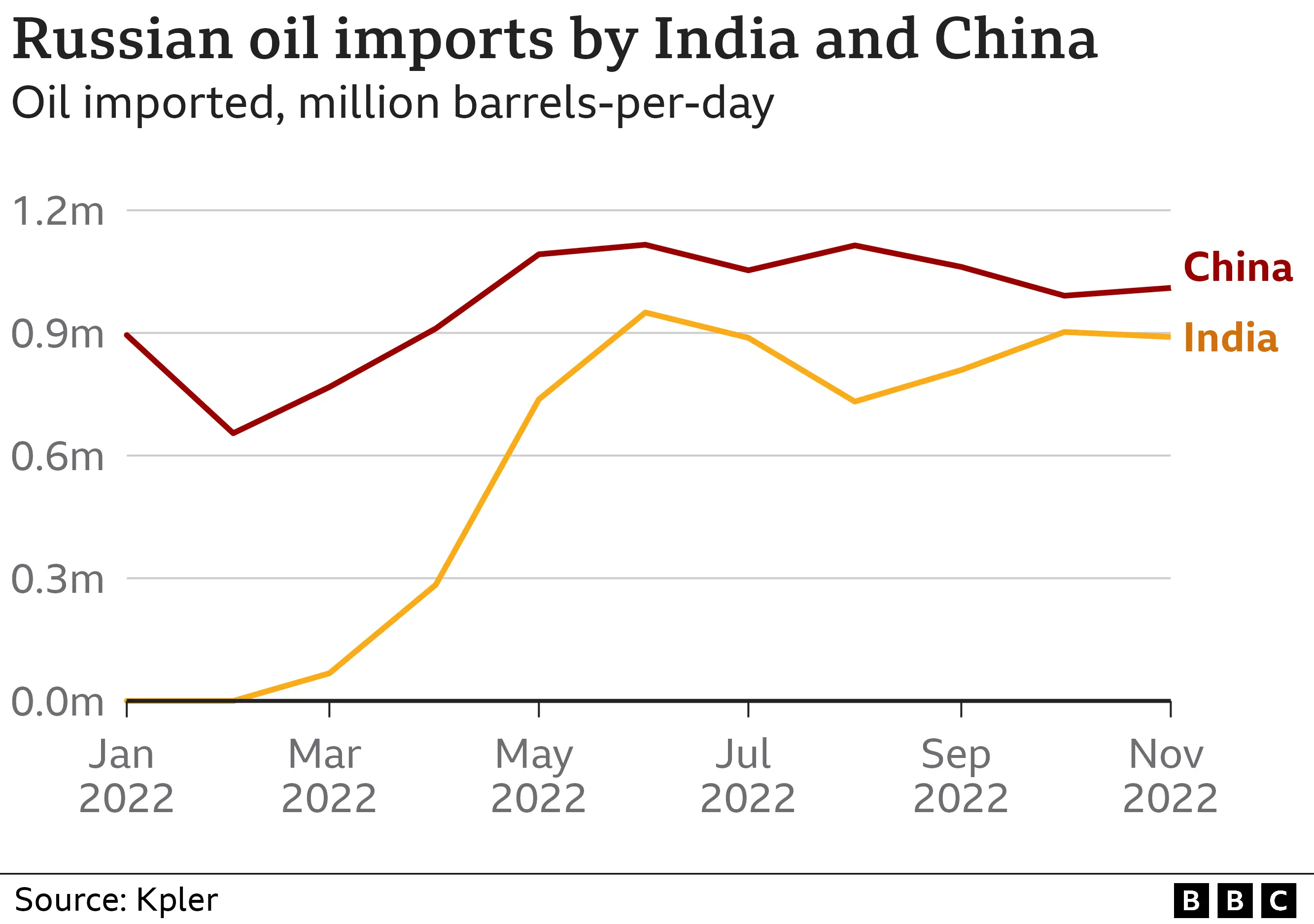

India's imports of Russian oil have risen from a very low base at the start of the year reaching a peak in June and July, and largely maintaining these levels through to November.

China's purchases of Russian oil have fluctuated this year, falling in February at the start of Russia's invasion of Ukraine, but then rising significantly in the following months.

Russia has been selling oil at a discounted rate since March this year after the Ukraine invasion.

In March, combined oil imports by China and India from Russia overtook those from the 27 EU member states. From late November, there appears to have been a renewed surge in oil purchases by India.

"It is likely a sign that loadings have pivoted away from heading to EU 27 countries and are heading to India instead," says Matt Smith, an oil analyst at Kpler.

Experts suggest that if oil supplies continue at the same levels in December, Russia could become India's largest single supplier.

Other countries have also taken advantage of discounted Russian crude - for example Sri Lanka, which has been grappling with a severe economic crisis.

Pakistan has also been negotiating with Russia to purchase discounted oil, although no deal has yet been struck.

Cheaper oil is driving the flow to Asia

Following its invasion of Ukraine, Russia had fewer buyers for its Ural crude oil, with some foreign governments and companies deciding to shun its energy exports, and its price started to fall.

At one point earlier this year, Russian Urals crude was more than $30 a barrel cheaper than Brent crude (the global benchmark).

The discount fell to $20 a barrel cheaper in September, but increased again reaching a discount of $33 a barrel compared with Brent crude in November.

The Indian government has defended its purchases from Russia, saying it has to source oil from where it is cheapest.

The US government had been critical of these purchases, although it's now made clear that it accepts that India can continue to buy discounted Russian oil.

The EU has stopped imports of Russian oil by sea completely in response to the invasion of Ukraine.

With the G7 price cap plan - to keep Russian exports at or below $60 (€57; £48) a barrel - now in force, Matt Smith of Kpler says "lax enforcement of the price cap may rule it ineffective".

But experts also point out that a total ban on Russian oil could have lead to further market instability and possible oil price rises (from which Moscow could benefit).

It's not yet clear what impact the price cap might have on countries like India and China that are already buying Russian oil at a discount.

Moscow has said will stop selling to countries that join the G7 move to impose price caps.

But Maria Shagina, a research fellow at International Institute for Strategic Studies, says that diverting oil from the EU to Asia would be "more expensive, time-consuming and cumbersome" for Russia.

https://www.bbc.com/news/world-asia-india-60783874

Post a Comment