CPI Report – Inflation on Food, Fuel, Home Heating and Essentials Continues Growing – Overall Inflation Moderation Now Claimed as Calendar Cycles

The Bureau of Labor and Statistics (BLS) provides the latest data on consumer prices (inflation) [DATA HERE]. We explained in 2021 how inflation would grow on a month-over-month and year-over-year basis until the calendar became more friendly and the government officials could claim “diminished inflation growth.” Well, we are now entering that phase of economic parseltongue.

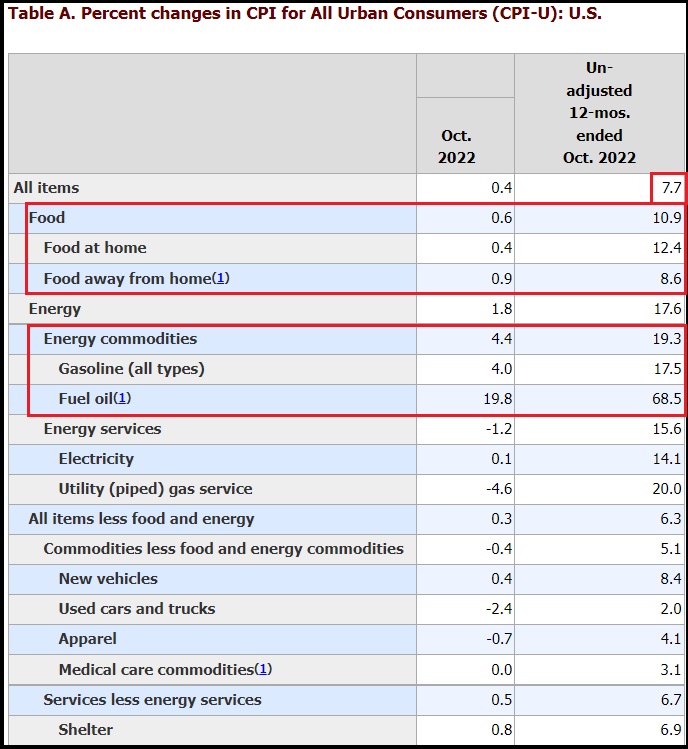

October consumer prices increased 0.4% over September. However, we are now comparing year-over-year (Y0Y) inflation to the period where last year’s prices had already skyrocketed, so YoY inflation seems to be moderating at 7.7%, it’s a false premise. {Go Deep}

October consumer prices increased 0.4% over September. However, we are now comparing year-over-year (Y0Y) inflation to the period where last year’s prices had already skyrocketed, so YoY inflation seems to be moderating at 7.7%, it’s a false premise. {Go Deep}

As expected, the energy-driven consumer inflation in the food sector has arrived. The proverbial field inflation is arriving at the fork, and the October CPI now shows the third wave of food price increases we had previously discussed.

Table 2 Details: Egg prices increased +10.1% last month and now 43% higher than last year. Butter +1.9% last month, 26.7% for year. Margarine +1.3% for month, 47.1% for year. Coffee +1.3% for the month, 15.6% for the year.

Heading into baking season we find flour +0.2% for the month, +24.6% for year. Essentially, as expected, all of the holiday foodstuffs are now rising in price as the increased field and commodity prices hit the store shelves.

Some row crops are starting to moderate in price growth, while dairy products continue rising throughout the fall season. It is going to be painful on the checkbook grocery shopping this holiday season.

On the energy front, home heating oil increased 19.8% in October and is now a whopping 68.5% higher than last October. Unleaded gasoline increased another 3.5% and now is now 20.9% higher than last year (Oct ’21), which was already 40% higher than January 2021.

Food, fuel, electricity, home heating and housing costs continue growing monthly, but give the illusion of moderating when compared to last year.

Food away from home (restaurants etc.) are starting to show the cumulative price impacts for restaurants, hotels and cafeterias. Additionally, as the kids returned to school the lunchroom prices have skyrocketed a jaw-dropping +3.8% for October and +95% compared to last year [Table 2]. Packing lunches for kids is going to become an even more important aspect for the family food budget.

The stock market is happy with the news because the lowered 7.7% (YoY) inflation number, a product of the calendar and nothing else, gives optimism the Fed may moderate the increased federal reserve rate hikes. However, don’t count on it because inflation is easily identified as embedded now. Lemons at the grocery store are now $0.99/each.

Think about that. $1 for a single lemon and roughly 50¢ per egg at the supermarket. A full shopping cart of groceries now easily exceeding $200. This is devastating for those on fixed incomes and blue-collar workers.

Wages are nowhere near keeping up with this level of price increase.

(CNBC) The consumer price index rose less than expected in October, an indication that while inflation is still a threat to the U.S. economy, pressures could be starting to cool.

The index, a broad-based measure of goods and services costs, increased 0.4% for the month and 7.7% from a year ago, according to a Bureau of Labor Statistics release Thursday. Respective estimates from Dow Jones were for rises of 0.6% and 7.9%.

Excluding volatile food and energy costs, so-called core CPI increased 0.3% for the month and 6.3% on an annual basis, compared with respective estimates of 0.5% and 6.5%.

A 2.4% decline in used vehicle prices helped bring down the inflation figures. Apparel prices fell 0.7% and medical care services were lower by 0.6%.

“The report overstates the case that inflation is coming in, but it makes a case inflation is coming in,” said Mark Zandi, chief economist at Moody’s Analytics. “It’s pretty clear that inflation has definitely peaked and is rolling over. All the trend lines suggest that it will continue to moderate going forward, assuming that nothing goes off the rails.” (read more)

The Biden energy policy is the root of the consumer inflation. Nothing will happen to moderate overall consumer inflation on Main Street until energy policy changes.

Additionally, with the 2022 election in the rear-view mirror, we should start to see layoffs and unemployment increasing now. The bureaucrats will now let the recession become evident.

Post a Comment