U.K Energy Reaches Crisis Point, Britain Announces New Oil and Gas Leases and Lifts Moratorium on Fracking

There is a particular historical irony in the timing. On the same day King Charles III ascends the throne, previously Europe’s most isolated from consequence – yet loudest voice in chasing the catastrophic climate change energy policies, the British government is forced to reverse course on years of energy regulations and restrictions.

Britain’s new Prime Minister Liz Truss announced, “a new round of oil and gas licensing will come next week with more than 100 licenses issued. A moratorium on fracking will be lifted and planning permission can be sought where there is local support,” in an urgent emergency effort to lower energy costs for British citizens.

The move comes in combination with a government plan to help citizens and businesses cope with skyrocketing prices for electricity and home heating fuel. The climate change chickens have come home to roost throughout Europe and the British government is urgently trying to head-off the calamitous consequences.

Inside the media announcements of the Truss plan, the biggest concern expressed is how the financial and multinational banking sector (the ESG investment groups) will respond to the government position. After decades of ideological “green” outlooks flowing into the energy industry, the biggest concern expressed in the financial analysis is how a reversal by such a large economic system will reverberate.

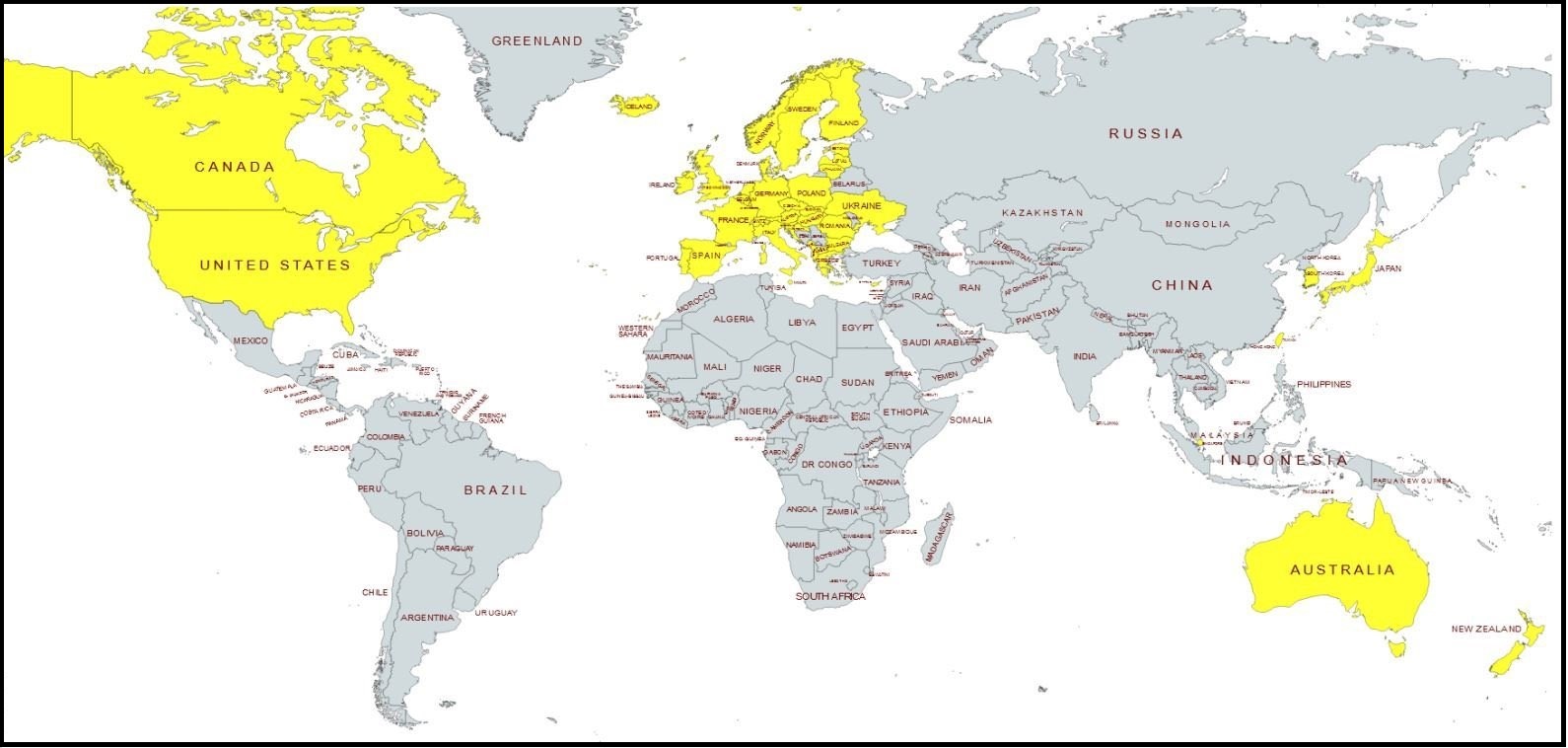

The climate change ideology has a stranglehold on the energy sector of the economy, this move by Great Britain would be the most significant push-back in decades. The minority green activists are apoplectic that they may lose control over the majority of opinion. The economics of a reversal in energy policy could reverberate throughout the western alliance, particularly in Europe. It will be interesting to see whether this shift in U.K. policy has ripple effects in the U.S.

LONDON, Sept 8 (Reuters) – Britain’s move to green-light dozens of new oil and gas fields will leave investors and banks with a tough PR job as Britain struggles to shore up its energy security whilst sticking to its climate commitments.

Starting new oil and gas projects runs counter to the world’s shift away from fossil fuels in the fight against global warming and a commitment at last November’s U.N. climate talks to phase down their use.

Yet runaway inflation amid conflict in Ukraine has forced the hand of new British prime minister Liz Truss as Russian President Putin seeks to use energy as a weapon this winter.

Britain will launch a new round of oil and gas licensing next week with more than 100 licenses issued, part of a wider package of measures to tackle the energy crisis announced by Truss on Thursday.

And Britain’s not alone in reassessing its energy strategy. Germany, for example, has been forced to turn back to even dirtier thermal coal to help fuel its power plants and keep the lights on, hampering short-term efforts to rein in climate-damaging carbon emissions.

But for energy companies and the investors, bankers and insurers that finance them, new investment in fossil fuels also presents a challenge given many have made their own pledges to reach net-zero emissions by mid-century.

“This will absolutely hinder companies’ … ability to hit their climate targets,” said Pietro Bertazzi, global director of policy engagement and external affairs at non-profit environmental disclosure platform CDP. (read more)

This is the first crack in the western alliance and the ‘climate change’ agenda of the World Economic Forum as it relates to energy policy and ultimately control over human life within the alliance.

The war in Ukraine was being used as a justification to explain the consequences of European energy policy, particularly rapidly increasing costs for energy and food, but the war in Ukraine was not the cause. The true root cause of the exploding inflation and economic mess was the Build Back Better agenda, and the series of policies dictated from within it, that each nation willingly accepted.

Post a Comment