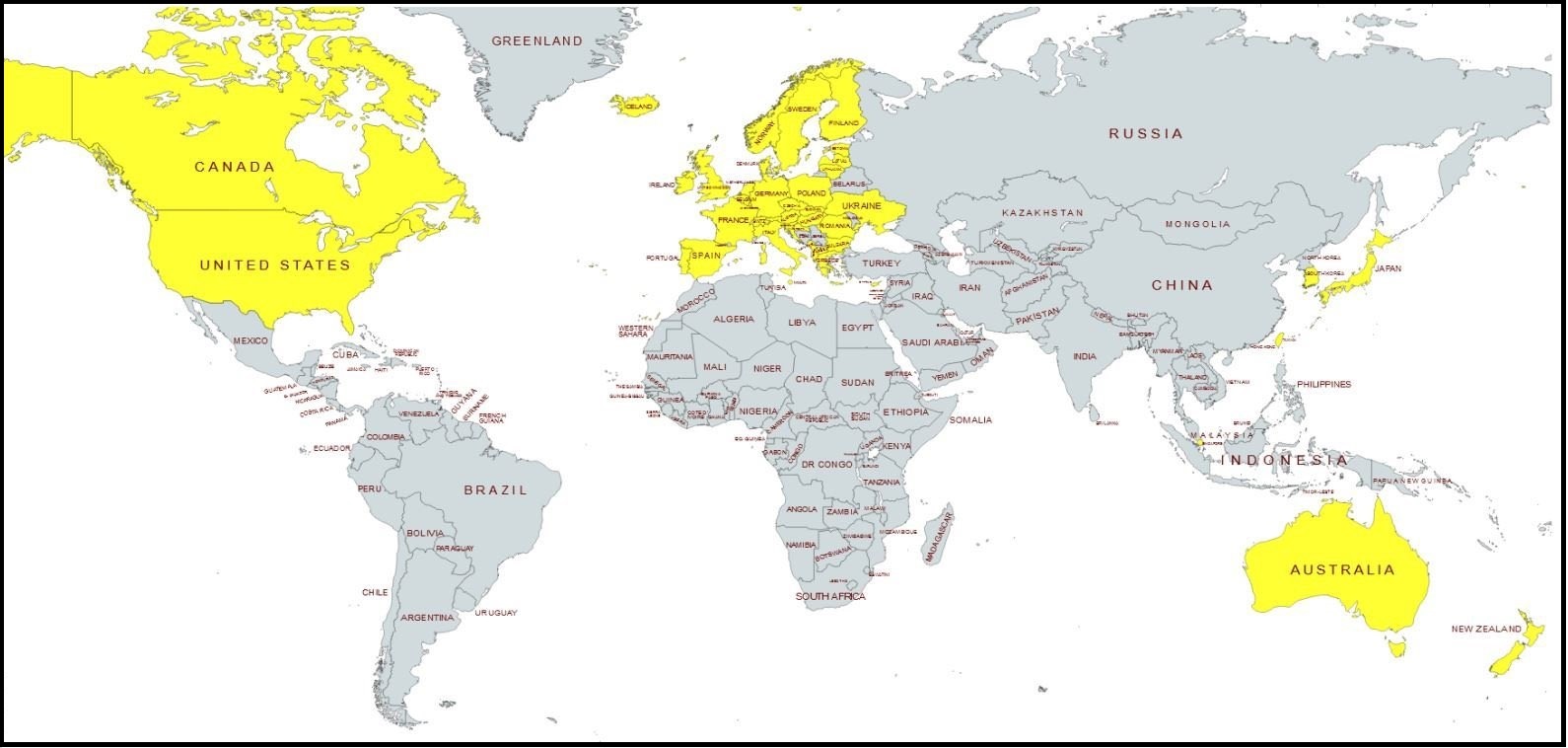

All Western Nations Following World Economic Forum Build Back Better Climate Agenda Have Identical Trends

In May the inflation rate in the U.S. increased to 8.6%, a few weeks later the European Union measured their May inflation rate to match at an exact 8.6% {link}. In June the U.S. inflation rate increased again to 9.1%, and now we see the U.K. reporting their June inflation rate today at 9.4%.

While the individual amounts of government COVID-19 spending amid the U.S, U.K. and Europe were different, the percentage of that spending in relationship to the size of their economy was very similar. As a result, the global inflation rates contain strong parallels.

While the individual amounts of government COVID-19 spending amid the U.S, U.K. and Europe were different, the percentage of that spending in relationship to the size of their economy was very similar. As a result, the global inflation rates contain strong parallels.

None of these parallels are accidental. All of this economic turmoil is running on an identical track -on a global basis- because the entire western plan was coordinated and followed. What we are seeing right now is the outcome of the “Build Back Better” roadmap. The “global inflation” is the outcome.

Joe Biden is blocking domestic energy production as he follows through with the agenda of the Green New Deal. In Europe, not coincidentally demanded by Biden, a similar outcome comes from the sanctions and blocking of Russian energy resources.

One could make a reasonable argument that the team behind Joe Biden specifically wanted the EU sanctions against Russia, because the U.S. crew wanted to keep both industrial economies mirroring each other as the U.S. energy system was dismantled. It would make sense to avoid a spotlight on the U.S. economic collapse, by forcibly pushing the EU economy into the same situation.

Taking that line of geopolitical and economic consequence one step further, and that would be part of the strategy -albeit undiscussed- behind having a consistent global cap on the price that any nation could pay for Russian oil. That approach is not about punishing Russia, it is to make all of the economic pain and problems equal amid all western nations. Globalists, and the central bankers, are good at creating economic systems to deliver equitable misery.

LONDON — U.K. inflation hit yet another new 40-year high in June as food and energy prices continued to soar, escalating the country’s historic cost-of-living crisis.

The consumer price index rose 9.4% annually, according to estimates out Wednesday, slightly above a consensus forecast among economists polled by Reuters and up from 9.1% in May.

This represented a 0.8% monthly incline in consumer prices, exceeding the the previous month’s 0.7% rise but remaining short of the 2.5% monthly increase in April.

The U.K.’s Office for National Statistics said in Wednesday’s report that its indicative modelled consumer price inflation estimates “suggest that the CPI rate would last have been higher around 1982, where estimates range from nearly 11% in January down to approximately 6.5% in December.”

The most significant contributors to the rising inflation rate came from motor fuels and food, the ONS said, with the former soaring 42.3% on the year, the highest rate since before the start of the constructed historical series in 1989. (read more)

The key point is to see how this is all being done in synergy. These geopolitical and economic outcomes may, at least initially, seem like disconnected patterns. However, when you stand back away from each assembly of pixels it is possible to see a much larger picture in focus.

Post a Comment