There It Is, The Canadian 2022 Budget Authorizes a Central Bank Digital Currency

CTH noted earlier, in the aftermath of the COVID-19 control mechanisms, things were being done legislatively to follow a ‘new world order’ for western democracies {Go Deep}. One of the nations we noted following this new direction, was Canada. Today, a review of the proposed Canadian 2022 budget finds something to align with the new version of democracy – the establishment of funding to create a central bank digital currency.

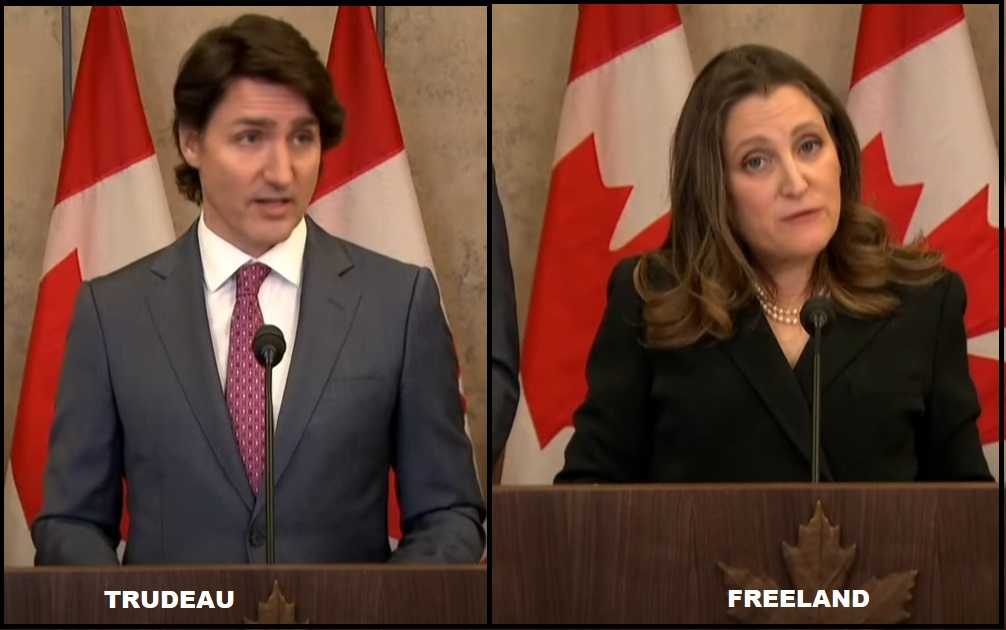

That should not necessarily come as a surprise. After all, despite a massive amount of denial from the Canadian Finance Minister and Canadian Prime Minister toward the context of CTH research {Go DEEP}, the direct evidence we were looking for is now discovered.

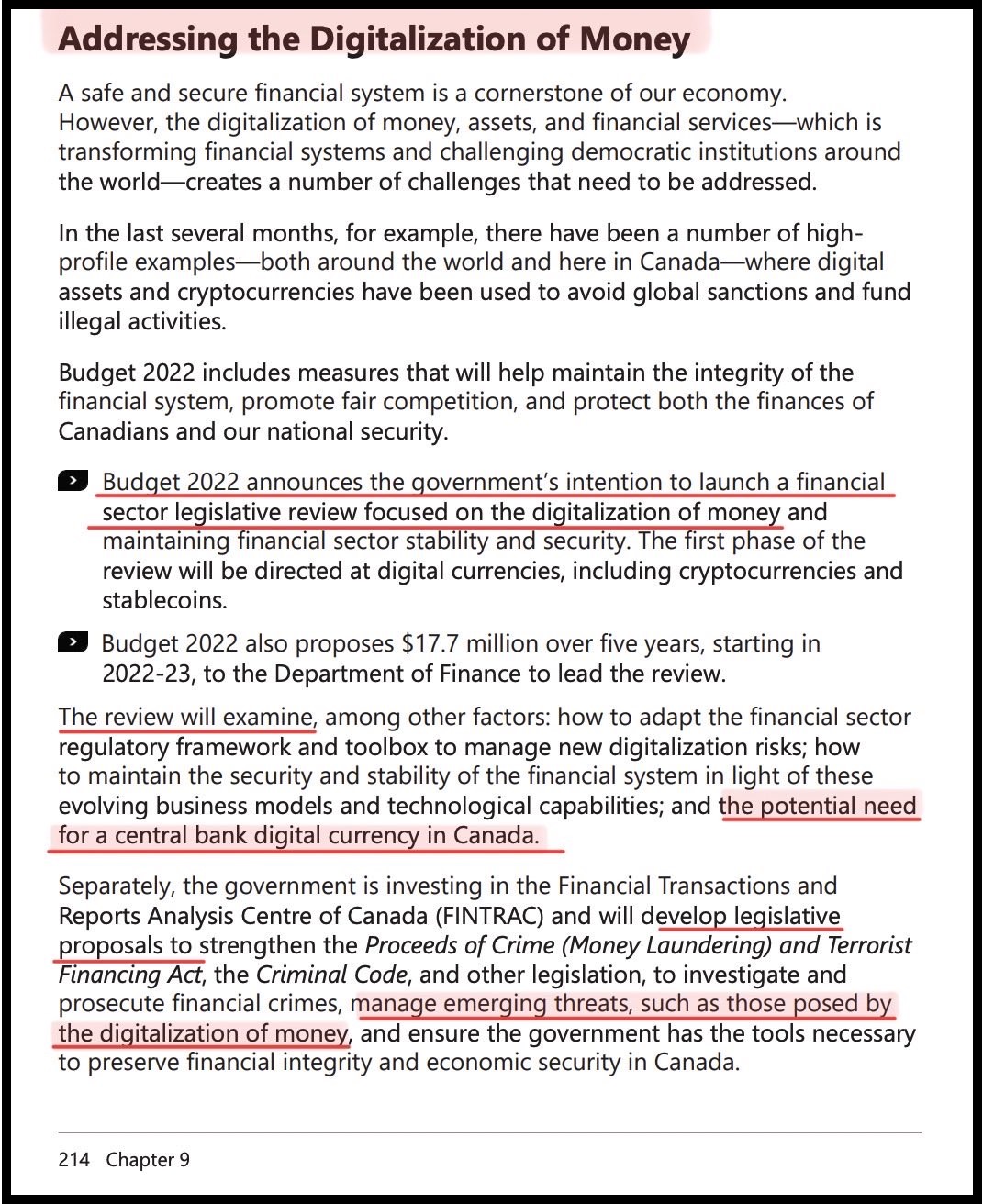

Buried deep, very deep, in Chapter 9.2 of the Canadian Budget you will find this: …”In the last several months, for example, there have been a number of high-profile examples—both around the world and here in Canada—where digital assets and cryptocurrencies have been used to avoid global sanctions and fund illegal activities.”

(Chapter 9.2) […] Budget 2022 includes measures that will help maintain the integrity of the financial system, promote fair competition, and protect both the finances of Canadians and our national security.

- Budget 2022 announces the government’s intention to launch a financial sector legislative review focused on the digitalization of money and maintaining financial sector stability and security. The first phase of the review will be directed at digital currencies, including cryptocurrencies and stablecoins.

- Budget 2022 also proposes $17.7 million over five years, starting in 2022-23, to the Department of Finance to lead the review.

The review will examine, among other factors: how to adapt the financial sector regulatory framework and toolbox to manage new digitalization risks; how to maintain the security and stability of the financial system in light of these evolving business models and technological capabilities; and the potential need for a central bank digital currency in Canada. (LINK)

Huh. Imagine that. What was called a “conspiracy theory” just a few weeks/days ago, is now the expressed intent of the same government who denied it was ever being considered.

(Source link – Chapter 9, sub section 9.2)

You may remember when Chrystia Freeland and Justin Trudeau triggered their use of the Emergency Act to confiscate the bank accounts and financial assets of protest groups. Trudeau and Freeland essentially broke the financial code of Omerta, by highlighting how easy it is for government to seize your bank accounts, credit cards, retirement accounts, insurance, mortgages, loan access and cut you off from money (without due process).

However, when Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland announced they would use the Emergency Act declaration to target the financial support systems, banks and accounts of the people who were protesting against COVID mandates, they not only undermined the integrity of the Canadian banking system – they also inadvertently stuck a wrench into the plans of the World Economic Forum and the collaborative use of the Canadian Bankers Association to create a digital id. WATCH:

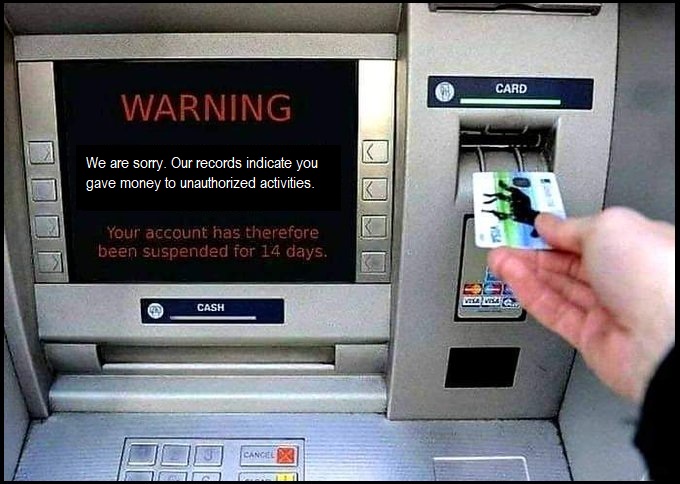

If the Canadian government can arbitrarily block citizen access to their banking institution without any due process, what does that say about the system the Canadian Banking Association (CBA) was putting into place as part of their Digital ID network?

If the CBA digital identity were in place during the trucker protest and the deployment of the Emergency Act, the same people targeted by Trudeau’s use of the Act could have their entire identity blocked by the same government measures. The realization of the issue, reflected by a severe undermining of faith in the banking system, surfaces as a dramatic problem for those working to create and promote the Digital ID.

It is not coincidental the financial targeting mechanism deployed by Trudeau/Freeland, the Canadian banking system, was/is the same mechanism being used to create the digital identity, which is now the same mechanism they are budgeting to begin establishing the Canadian digital currency.

♦ It is all one continuum.

Using the COVID-19 pandemic, they created a specific vaccine mandate. Using the vaccine mandate, they created a vaccine passport. The vaccination passport and registration process tracked/monitored human behavior. In actual substance, the vaccine passport can be looked at as the beta test for a larger mission of a comprehensive digital identity and/or social credit tracking system. Most Canadian’s complied, willingly.

Now, it is a simple process to shift into a digital identity, as noted above by the Canadian Banking Association, and presto – the government has just created the foundational infrastructure for the digital currency.

The 2022 Canadian budget provides the funding to create the digital currency mechanisms.

Once the mechanisms are in place, then it becomes a simple process to control how the digital currency is spent.

That car is not environmentally friendly, transaction denied.

You’ve exceeded your allotment of beef this month, transaction denied.

Or perhaps…

Post a Comment