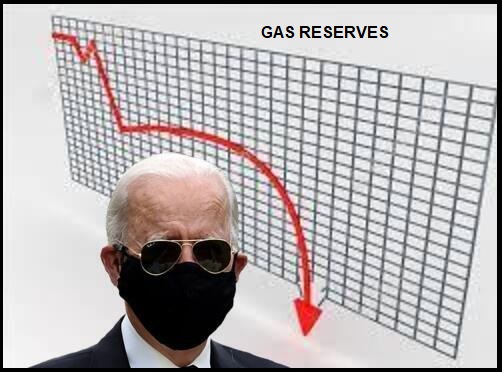

REPORT, U.S. Gas Exports are Triple U.S. Gas Production, Low Gas Reserves Now Sends Prices Soaring

Another item in the long list of ‘thanks Joe Biden‘ stuff. Shortages in natural gas in windmill chasing Europe have driven up the prices significantly. The conflict between NATO and their targeted villain in Russia is only making matters worse.

As the EU prices jump to $33/$34 per million British thermal units (BTU’s), the U.S. natural gas selling at $6 per million BTU’s is an absolute bargain.

As the EU prices jump to $33/$34 per million British thermal units (BTU’s), the U.S. natural gas selling at $6 per million BTU’s is an absolute bargain.

Liquify that stuff and send it across the pond says any smart energy capitalist.

However, that comes with a problem for us. Our supplies of natural gas are depleting quickly, our exports are now almost three times more than our production.

LONDON, April 8 (Reuters) – U.S. gas prices have climbed to their highest level in more than a decade as strong demand from overseas has emptied storage and left inventories well below average for the time of year despite a mild winter.

Front-month futures for gas delivered at Henry Hub in Louisiana have risen to $6.40 per million British thermal units, the highest in real terms since 2010. Wholesale prices in the United States are still far below those prevailing in Northeast Asia ($33 per million British thermal units) and Northwest Europe ($34).

[…] U.S. LNG exports rose 13% in the three months from November to January compared with the same period a year earlier, while gas production was up by less than 5%.

[…] Working stocks in underground storage were 316 billion cubic feet (19%) below the pre-pandemic five-year seasonal average for 2015-2019.

Because of strong exports, inventories depleted more than usual despite high prices and winter heating demand that was 8% below the long-term average.

Reflecting the low level of stocks, futures prices have moved into a strong backwardation, with nearby prices rising to reduce consumption and exports and encourage more production. (read more)

But hey, relax…. Biden is only destroying our food, fuel and energy…. I mean, it could be worse right?

Post a Comment