Inflation Rate Jumps to 8.5% as Energy, Food and Gasoline Prices Skyrocket

This is not going to be news to CTH readers and intellectually honest analysts. The Bureau of Labor and Statistics has released the March consumer pricing data [DATA HERE] showing the recent surge in energy, gasoline and food costs that we have all felt.

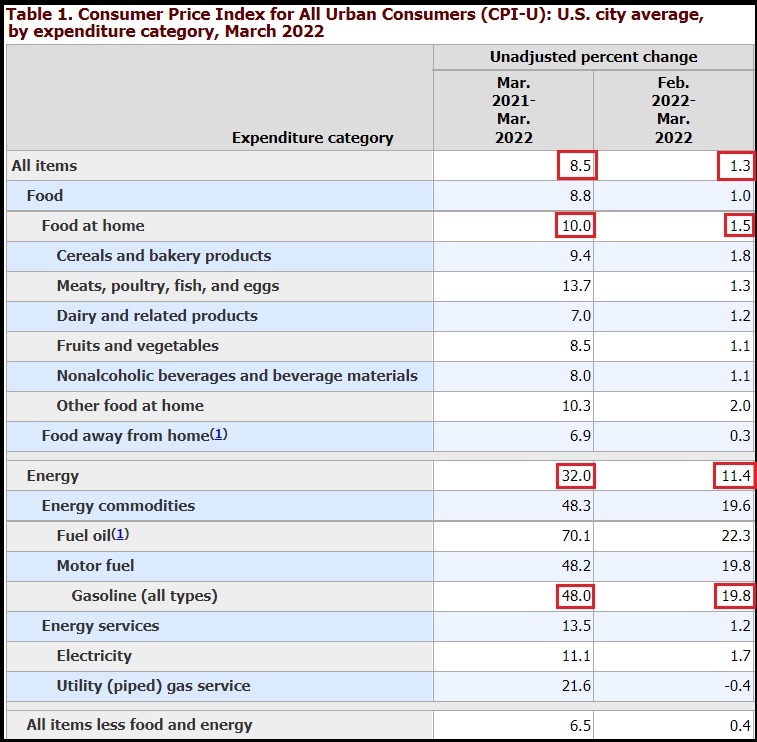

The monthly increase of 1.3% brings the annual rate of inflation to 8.5 percent year-over-year. However, the details tell the exact story we have been outlining for well over six months. This is the second wave of inflation being recorded. Grocery store prices (food at home), energy prices, and gasoline prices are all driving the inflation rate. [BLS Table 1]

Again, I modified Table-1 to take out the noise. The data shows what we have felt for the past two months. Working class families are feeling the pinch as their wages cannot keep pace with the increase in prices on products that are a priority. Food, housing, gasoline, energy.

If we were using the old CPI method for analysis, current inflation would be well above 20%.

That said, there are issues also inherent and visible in the data for the non-food and energy segments, what I would call the durable goods side. First, we are seeing the beginning of the durable good contraction getting quantified as we have previously discussed. The prices for used vehicles, electronics, appliances and other non-critical durable goods are now flatlining, or even dropping in price.

Every indication within the economy indicates this is being caused by a demand contraction. People are not purchasing durable goods because their disposable income is gone. This lack of demand also shows up in wage rate suppression. Despite high employment, wages are not rising – in part because there is excess productivity in the durable good economy.

You will note from Table-2 [available here] that food away from home, restaurant food, is not climbing as high as food at the grocery store (0.3% -vs- 1.5%). Restaurants are trying to keep prices down and their profit margins are being eroded. They are in a tough place, because if restaurants raise prices, they may lose customers who are already feeling pain in their checkbooks. However, they cannot hold out much longer before raising prices, because the price increases are permanent.

The good news is the March data appears to quantify the apex of the second wave rate of inflation. The rate of increase in food, fuel and energy will now start to moderate and slow down. The prices may, likely will, keep going up, but they will go up less dramatically than they have in the past six months. This price plateau will hopefully remain in place until late summer, that’s when the next harvest food costs will hit in Wave-3.

The good news is the March data appears to quantify the apex of the second wave rate of inflation. The rate of increase in food, fuel and energy will now start to moderate and slow down. The prices may, likely will, keep going up, but they will go up less dramatically than they have in the past six months. This price plateau will hopefully remain in place until late summer, that’s when the next harvest food costs will hit in Wave-3.

On the durable goods, what we will see now is a typical demand side issue. Price increases for durable goods will quickly, if they are not already, be less connected to material costs and more connected to demand. Obviously, the cost to manufacture, create, produce, transport and deliver durable goods is still experiencing upward pressure due to raw materials. However, the demand variable will now enter more dominantly.

With wage growth meek and prices still rising on essentials like food, housing, energy and gasoline, demand for non-essential durable goods will drop. The demand decline should naturally put downward price pressure on appliances, electronics, used vehicles, etc. Unfortunately, this also contracts the overall economy, creates unemployment, and indicates “stagflation.”

(MSM) – […] The consumer price index leaped 8.5% annually, the fastest pace since December 1981, the Labor Department said on Tuesday, likely cementing Federal Reserve plans for an unusually large half-point interest rate hike early next month. That increase is up from 7.9% in February and inflation now has notched new 40-year highs for five straight months. (more)

We will need to watch the service side closely now to see if consumers start to lessen travel, entertainment, and other service side expenses.

Protect your family. Be frugal, wise and smart with expenses. However, do not trouble yourself with dark imaginings.

If you are like most here, you have prepared yourself with commonsense actions and you are a doer who fixes problems, not a naysayer who sits around mulling over them. Your family, kids and/or grandkids as well as your community can benefit from wise, albeit sometimes stern, counsel. Stand strong, stand firm and stand resolute.

All of these challenges are simply that, challenges. Work any problem as it arises, including for the kids. And also remember, God is in charge, not you. So, listen to his instructions. Listen to that instinct he buried within you. Draw upon the strength that a loving God constantly provides.

Be a vessel for those who need hope. Be a guiding light for those who feel distressed. Be cheerfully strong among everyone around you, and thankful for all the kindness you experience. If you get stuck, start giving….

Post a Comment