When Looking at Treasury Nominee Saule Omarova, Do Not Forget Elizabeth Warren’s Consumer Financial Protection Bureau

One thing CTH does is to look at proposed leftist advancements through the prism of previously blocked moves. The Joe Biden nomination of avowed communist Saule Omarova to the Treasury Department Office of the Comptroller of the Currency (OCC) should be considered in a similar perspective.

There’s a couple of different issues surfacing in the Omarova nomination. Obviously, she is aligned with the view that controlling money is another way to control the behavior of businesses and people; Omarova’s previous statements {Go Deep} about intentionally bankrupting oil and gas companies is indicative of the former – and the most recent statements are aligned with the latter. WATCH:

Obviously, Saule Omarova is interested in the concept of an all controlling central bank that would eliminate the need for private banking interests. As she states, “There will be no more private bank deposit accounts, and all of the deposit accounts will be held directly at the fed.” The basic premise is that all employers would funnel their payrolls into a centralized federal depository, where they would be then be taxed and re-distributed, electronically, to the workers.

One central bank, owned and operated by the federal government, would replace all the purposes within the private banking system. Given her upbringing in the former Soviet Union, and considering her education at the University of Moscow, perhaps this outlook shouldn’t be surprising. However, her nomination alone should be viewed as astonishing.

♦ Big Picture – The COVID Passport concept, now currently deployed in Europe and Australia, then becomes the vector for entry into a digital identification process. At the end of that digital ID process is a centralized database, which, not coincidentally, directly aligns with the capability of the U.S. federal government to trigger what Omarova is advocating in that video – a centralized system to control all financial deposits and transactions through the digital ID previously created.

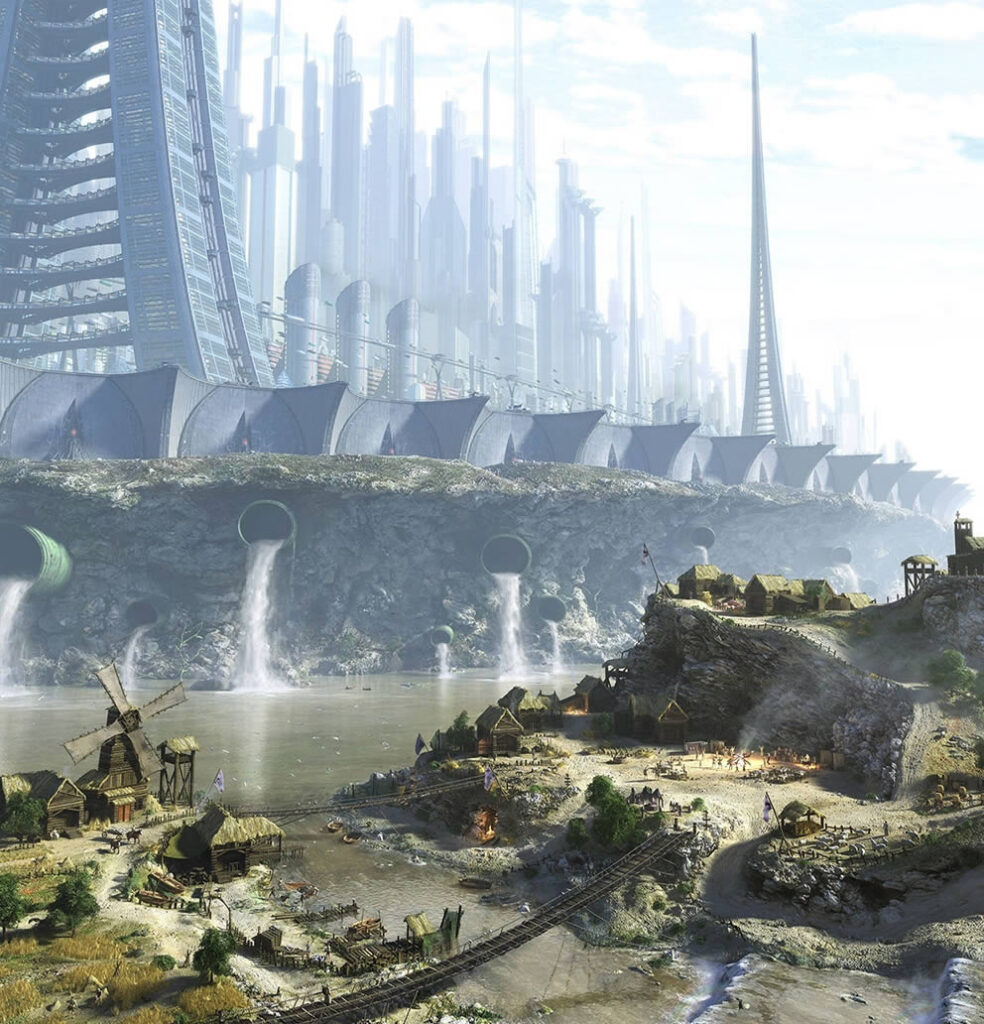

It doesn’t take a deep thinker to see how the federal government would eventually respond to having that much power over the financial accounts of Americans. Cue the visual reference:

Now, pause for a minute before you call me crazy… [although in my defense, CTH has been outlining the goals and aspirations of the specific Chicago headquartered communist ideologues for almost 15 years, while most allies on Team Freedom said we were crazy]… and consider: ‘through the prism of previously blocked moves’; because there’s a reference here most are likely to miss.

Years ago, the Consumer Financial Protection Bureau (CFPB) was constructed by Elizabeth Warren, and her progressive/communist ideologues as an extra-constitutional government agency. The CFPB originated as a reaction to the financial crisis in 2007/2008. It was an outcome of the Dodd-Frank bill that was part of the progressive “never let a crisis go to waste.” This was entirely by design. At the time of creation,the CFPB held two primary, albeit unspoken, functions.

First, it was structured as a financial holding center for fines and assessments against any private-sector financial organizations opposed by democrats, progressives and communists.

Second, it was constructed as a distribution hub for the received funds to be transferred to political allies and groups supportive of democrat, progressive and communist causes.

The CFPB monitors almost all financial products, determines if they are racist, and then issues fines to correct the problems with financial justice. To pull off this scheme, Elizabeth Warren et al ensured it was structured to allow no congressional oversight; however, it was also structured to have no executive branch oversight – and the funding mechanism for the CFPB budget was directly through the federal reserve. The lack of any legislative or executive branch oversight made the entire scheme unconstitutional according to a court decision.

In late September, the Senate voted 50 to 48 to confirm Rohit Chopra to be the next director of the Consumer Financial Protection Bureau, after months of uncertainty for the Biden administration (link). Three weeks later this happened:

WASHINGTON DC – The US Consumer Financial Protection Bureau (CFPB) ordered Thursday that several tech giants, including Amazon, Facebook, and Google to turn over information on payments-related systems and products.

CFPB ordered six technology platforms to turn over information. These six platforms are Google, Apple, Facebook, Amazon, Square, and Paypal. CFPB Director Rohit Chopra stated that the bureau would also study Chinese tech giants such as WeChatPay and Alipay.

Chopra stated that little was publicly known “about how Big Tech companies will exploit their payments platforms.” He wrote: “The CFPB’s inquiry will help to inform regulators and policymakers about the future of our payments system. Importantly, it will also yield insights that may help the CFPB to implement other statutory responsibilities, including any potential rulemaking under Section 1033 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.” (read more)

That ongoing background in the world of banking and finance is the context to look at the recent statements by Joe Biden’s nominee, Saule Omarova, for Treasury Department Office of the Comptroller of the Currency (OCC), {VIDEO LINK}. “There will be no more private bank deposit accounts and all of the deposit accounts will be held directly at the fed.”

Essentially, the CFPB is looking at ways the private sector is legally circumventing a need for the traditional U.S. banking system. While they are doing this, the COVID Passport becomes the entry vector for entry into a digital identification process.

There appears to be a likelihood these two lines of inquiry could merge in a centralized database with the capability of the U.S. federal government to trigger control over financial deposits and transactions through the digital ID previously created.

That prediction would track with the goal:

Post a Comment