August Producer Price Inflation Shows Highest Increase 8.3% Since Tracking Began, Previous Record Was Last Month

The Bureau of Labor and Statistics (BLS) released the August review [DATA HERE] of producer prices for last month. August rose 0.7% with cumulative results now showing an 8.3% increase in prices; the largest year-over-year jump in prices for final demand products in the history of tracking. The prior record was July with 7.8%.

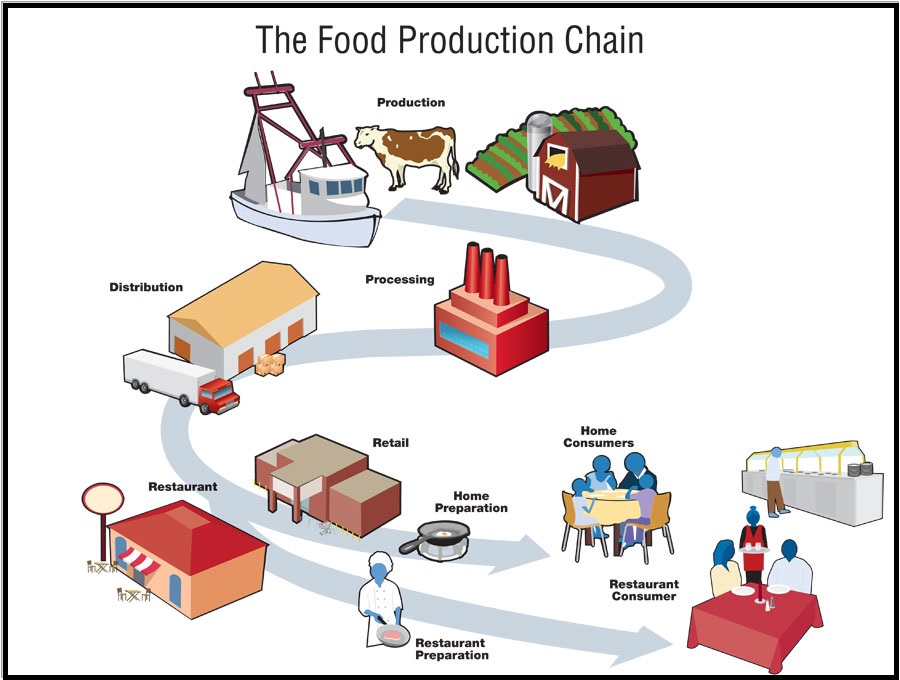

Inflation is skyrocketing for consumer goods at all levels of production: Origination (commodity/raw material), Intermediate (Mfr/Wholesale) and Final products (retail).

In part, the extreme upward cost pressure from escalating fuel and energy costs are accumulating throughout the supply chain and surfacing in the prices of the finished products. We are all witnessing this in the prices at stores; especially in the quick turning products, like groceries (fast turn consumable goods), which reflect price increases the fastest.

In part, the extreme upward cost pressure from escalating fuel and energy costs are accumulating throughout the supply chain and surfacing in the prices of the finished products. We are all witnessing this in the prices at stores; especially in the quick turning products, like groceries (fast turn consumable goods), which reflect price increases the fastest.

Final demand prices moved up 0.7 percent in August, 1.0 percent in July and 1.0 percent in June. The year-over-year inflation rate on final demand products now stands at 8.3%.

MEDIA – […] “The data comes amid heightened inflation fears fed by supply chain issues, a shortage of various consumer and producer goods and heightened demand related to the Covid-19 pandemic. Federal Reserve officials expect inflationary pressures to ease through the year, but they have remained stubbornly persistent, with Friday’s numbers indicating that the trend likely will continue.

Excluding food, energy and trade services, final demand prices increased 0.3% for the month, below the 0.5% Dow Jones estimate. Still, that left core PPI up 6.3% from a year ago, also the largest record increase for data going back to August 2014.

Final demand services rose 0.7% for the month, thanks to a 1.5% gain in trade services, or the margins received by wholesalers and retailers. Transportation and warehousing costs surged 2.8%.

About one-third of the overall gain came from health, beauty and optical goods, which jumped 7.8%. Prices related to outpatient hospital care held back the gains, falling 1.5%. Prices for final demand goods rose 1% for the month, pushed primarily by a 2.9% gain in foods which in turn came from an 8.5% surge in meat prices. Slaughtered poultry prices surged 11%. (read more)

The skyrocketing prices at the grocery store are predictable based almost entirely on Joe Biden’s pro-Wall Street and Multinational Corporation policies. Main Street is getting hammered, and the working class is suffering as a direct result.

The skyrocketing prices at the grocery store are predictable based almost entirely on Joe Biden’s pro-Wall Street and Multinational Corporation policies. Main Street is getting hammered, and the working class is suffering as a direct result.

Their specific accountability for these outcomes is why the Biden administration is trying to distract and blame COVID-19 for supply chain issues. However, it is not COVID driving the prices, it’s Joe Biden policies that benefit multinationals. {Go Deep}

Food products are fast-turn consumable goods, and the inflation in the food sector is jaw-dropping already. However, fresh and processed foods turn at different inventory levels.

Obviously fresh foods spoil fastest (think produce, fish, meats and dairy) so they are replenished more quickly, and the thin supply chain (field to fork) passes along increased costs fast. Processed foods have a longer shelf life (boxed, canned, frozen, etc), and as a consequence, have a much larger inventory level in manufacturing, warehousing and retail storerooms/shelves. Within processed foods, there is a lag between cost increase at origination and that cost hitting the stores.

The problem identified within the current ‘producer price index’, is that price increases in the raw material and intermediate material are building into the supply chain. Keep in mind, the entire supply chain is dependent on energy costs and the fuel prices that impact transportation.

The retail consumer supply chain for manufactured and processed food products includes bulk storage to compensate for seasonality. There are over 800 commercial and public warehouses in the continental 48 states that store frozen products (2020 data). The previously processed food price increases are currently reflected on store shelves (already hurting). However, the coming processed processed food price increases will be much, much higher. We will see even higher prices on processed foods in the supermarket.

The same price increases happen for restaurants, albeit faster as they follow the similar supply chain to fresh foods.

As we predicted last month, the BigAg multinationals (K-Street Lobbyists) made deals with their congressional sales-force for increases in government welfare payments (EBT and Foodstamps, WIC etc.). BigAg lobbies congress for higher reimbursement rates so they can raise the prices of food and export domestic product to other nations. Food assistance payments increase, and BigAg benefits. In essence, BigAg takes the fed food subsidies and fattens their profit margin. Then, they payback the politicians. It’s a circle of money.

Less than 72 hours after we noted the BigAg deal was likely already done, the White House announced they were increasing Food Stamp and SNAP benefits by 25 percent. It’s a rigged game, and we are suffering the consequences. Or, put another way, “it’s a big club, and we ain’t in it.”

Post a Comment