Fed Will Push JoeBama Agenda: Rapid Inflation, Diminished Purchasing Power, Pain Upon Middle Class

The federal reserve has announced they will support the economic agenda of the Biden administration by allowing rapid inflation. The FED is trying to provide cover for JoeBama’s economic plan. The era when the FED could impact inflation is long past. However, the Joe Biden policy impact will be clear, immediate and concise. The U.S. middle-class and blue-collar worker are about to be crushed under rising prices for consumable products.

Increases in inflation hit the working class (Main St) much harder than the investment class (Wall St) and financial elites. Factually the multinationals benefit from U.S. inflation as it puts pressure on domestic companies to ship their manufacturing overseas. Wall Street likes that. This dynamic has been an issue not-discussed by the financial media for decades. First, the Reuters article (when you see “commodity prices” think about the term “consumables”):

Increases in inflation hit the working class (Main St) much harder than the investment class (Wall St) and financial elites. Factually the multinationals benefit from U.S. inflation as it puts pressure on domestic companies to ship their manufacturing overseas. Wall Street likes that. This dynamic has been an issue not-discussed by the financial media for decades. First, the Reuters article (when you see “commodity prices” think about the term “consumables”):

REUTERS – The U.S. Federal Reserve has signaled it will tolerate faster inflation for a time to cement the post-pandemic recovery and boost employment, but the side effect is likely to be a faster rise in commodity prices.

[…] After its latest meeting on Wednesday, the Federal Open Market Committee confirmed it will seek to achieve the *twin objectives of maximum employment and inflation at the rate of 2% over the longer run.

[*NOTE: in the new era of global economics these two are mutually exclusive. The FED is intentionally ignoring this point.]

[…] The committee noted price rises have been running persistently below target, so it aims to achieve inflation moderately above 2% for some time to make up the shortfall and anchor expectations at around the 2% level.

[…] The plan is to run the economy hot to achieve faster job gains, especially among disadvantaged groups that are marginally attached to the labour force, before shifting back to inflation control later in the cycle.

But the resulting pressure on global supply chains while the Fed pursues employment increases is likely to generate significantly quicker price rises for raw materials and a range of manufactured items. (read more)

This perspective is fundamentally false and based on assumptions that are decades old economic arguments. The reality of what will happen is exactly the opposite on the employment front.

The JoeBama administration is attempting to hide their economic program behind the smokescreen of a COVID economic bound; but the reality of what will happen is exactly the opposite. Employment is going to drop far below pre-COVID numbers.

The problem that people do not understand, and the federal reserve will intentionally not consider, is that Macro Economic principles no longer apply in the era of global economics and multinational trade. I have outlined this dynamic for years. What did Trump see that politicians were intent on hiding?

WHAT WAS THE PROBLEM?

Traditional economic principles have revolved around the Macro and Micro with interventionist influences driven by GDP (Gross Domestic Product, or total economic output), interest rates, inflation rates and federally controlled monetary policy designed to steer the broad economic outcomes.

Additionally, in large measure, the various data points which underline macro principles are two dimensional. As the X-Axis goes thus, the Y-Axis responds accordingly… and so it goes…. and so it has historically gone.

Traditional monetary policy centered upon a belief of cause and effect: (ex.1) If inflation grows, it can be reduced by rising interest rates. Or, (ex.2) as GDP shrinks, it too can be affected by decreases in interest rates to stimulate investment/production etc. However, against the backdrop of economic Globalism -vs- economic Americanism, CTH is noting the two dimensional economic approach is no longer a relevant model. There is another economic dimension, a third dimension. An undiscovered depth or distance between the “X” and the “Y”.

Traditional monetary policy centered upon a belief of cause and effect: (ex.1) If inflation grows, it can be reduced by rising interest rates. Or, (ex.2) as GDP shrinks, it too can be affected by decreases in interest rates to stimulate investment/production etc. However, against the backdrop of economic Globalism -vs- economic Americanism, CTH is noting the two dimensional economic approach is no longer a relevant model. There is another economic dimension, a third dimension. An undiscovered depth or distance between the “X” and the “Y”.

I believe it is critical to understand this new dimension in order to understand Trump’s MAGAnomic principles, and the subsequent “America-First” economy he was building.

As the distance between the X and Y increases over time, the affect detaches – slowly and almost invisibly. I believe understanding this hidden distance perspective will reconcile many of the current economic contractions. I also predict this third dimension will eventually be discovered/admitted, and will be extremely consequential in the coming decade.

To understand the basic theory, allow me to introduce a visual image to assist comprehension. Think about the two economies, Wall Street (paper or false economy) and Main Street (real or traditional economy) as two parallel roads or tracks. Think of Wall Street as one train engine and Main Street as another.

The Metaphor – Several decades ago, 1980-ish, our two economic engines started out in South Florida with the Wall Street economy on I-95 the East Coast, and the Main Street economy on I-75 the West Coast. The distance between them less than 100 miles.

As each economy heads North, over time the distance between them grows. As they cross the Florida State line Wall Street’s engine (I-95) is now 200 miles from Main Street’s engine (traveling I-75).

As we have discussed – the legislative outcomes, along with the monetary policy therein, follows the economic engine carrying the greatest political influence. Our historic result is monetary policy followed the Wall Street engine. THIS PART IS CRITICAL:

[…] there had to be a point where the value of the second economy (Wall Street) surpassed the value of the first economy (Main Street). [This important acceptance is just common sense. The U.S. GDP is currently around $20 trillion, but the total valuation of the Wall Street stock market is much larger than our GDP. Wall Street is more valuable than Main Street. It is a simple albeit important reality to accept.]

Investments, and the bets therein, needed to expand outside of the USA. Hence, globalist investing.

However, a second more consequential aspect happened simultaneously. The politicians became more valuable to the Wall Street team than the Main Street team; and Wall Street had deeper pockets because their economy was now larger.

As a consequence Wall Street started funding political candidates and asking for legislation that benefited their interests.

When Main Street was purchasing the legislative influence the outcomes were beneficial to Main Street, and by direct attachment those outcomes also benefited the average American inside the real economy.

When Wall Street began purchasing the legislative influence, the outcomes therein became beneficial to Wall Street. Those benefits are detached from improving the livelihoods of main street Americans because the benefits are “global” needs. Global financial interests, investment interests, are now the primary filter through which the DC legislative outcomes are considered.

There is a natural disconnect. (more)

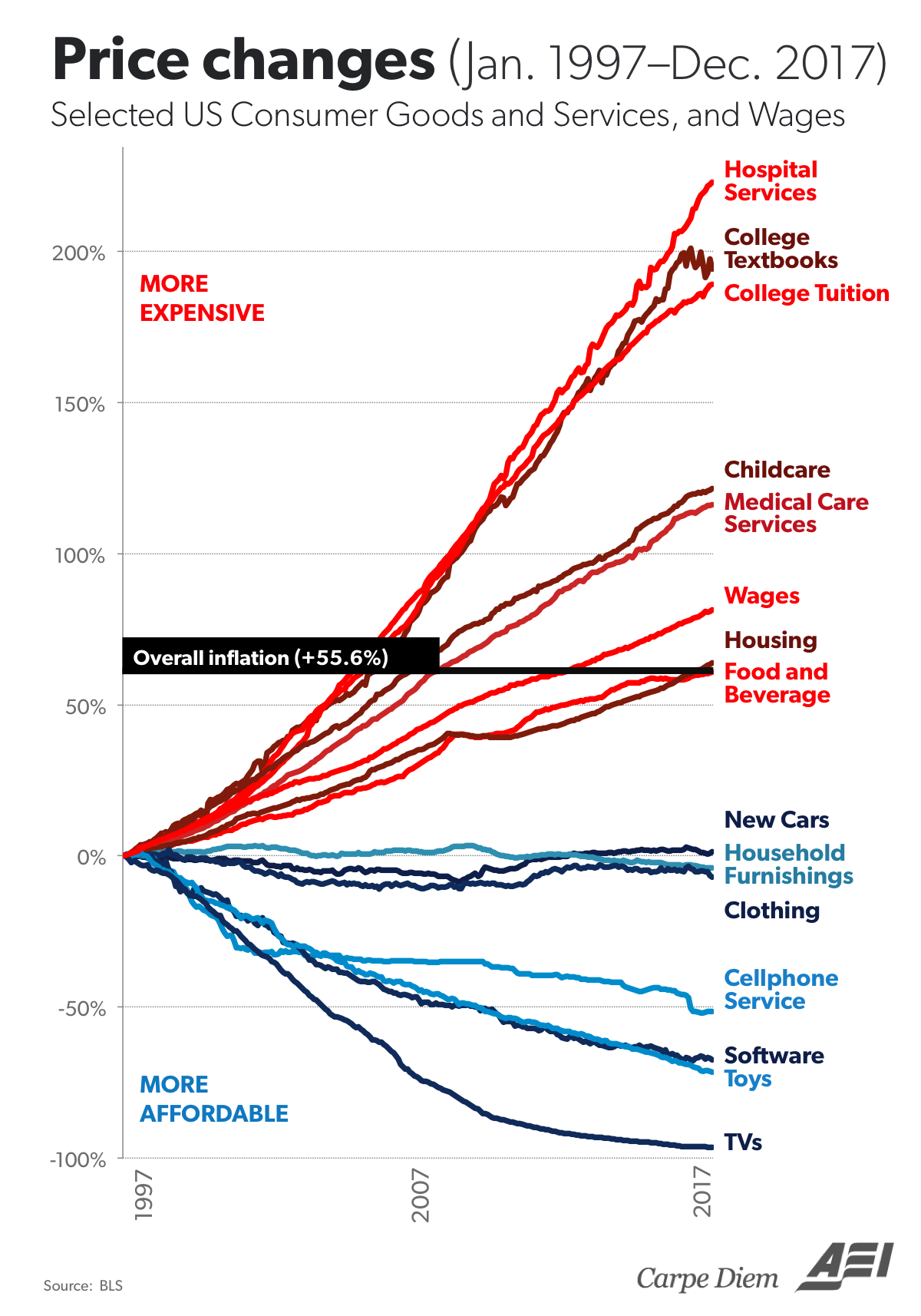

Here is an example of the resulting impact as felt by consumers:

♦ TWO ECONOMIES – Time continues to pass as each economy heads North.

Economic Globalism expands. Wall Street’s false (paper) economy becomes the far greater economy. Federal fiscal policy follows and fuels the larger economy. In turn the Wall Street benefactors pay back the politicians.

Economic Nationalism shrinks. Main Street’s real (traditional) economy shrinks. Domestic manufacturing drops. Jobs are off-shored. Main Street companies try to offset the shrinking economy with increased productivity (the fuel). Wages stagnate.

Now it’s 1990 – The Wall Street economic engine (traveling I-95) reaches Northern North Carolina. However, it’s now 500 miles away from Main Street’s engine (traveling I-75). The Appalachian range is the geographic wedge creating the natural divide (a metaphor for ‘trickle down’).

By the time the decade of 2000 arrives – Wall Street’s well fueled engine, and the accompanying DC legislative attention, influence and monetary policy, has reached Philadelphia.

However, Main Street’s engine is in Ohio (they’re now 700 miles apart) and almost out of fuel; there simply is no more productivity to squeeze.

From that moment in time, and from that geographic location, all forward travel is now only going to push the two economies further apart. I-95 now heads North East, and I-75 heads due North through Michigan. The distance between these engines is going to grow much more significantly now with each passing mile/month….

However, and this is a key reference point, if you are judging their advancing progress from a globalist vessel (filled with traditional academic economists) in the mid-Atlantic, both economies (both engines) would seem to be essentially in the same place based on their latitude.

From a two-dimensional linear perspective you cannot tell the distance between them.

It is within this distance between the two economies, which grew over time, where a new economic dimension has been created and is not getting attention. It is critical to understand the detachment.

Within this three dimensional detachment you understand why Near-Zero interest rates no longer drive an expansion of the GDP. The Main Street economic engine is just too far away to gain any substantive benefit.

Despite their domestic origin in NY/DC, traditional fiscal policies (over time) have focused exclusively on the Wall Street, Globalist economy. The Wall Street Economic engine was simply seen as the only economy that would survive. The Main Street engine was viewed by DC, and those who assemble the legislative priorities therein, as a dying engine, lacking fuel, and destined to be service driven only….

Within the new 3rd economic dimension, the distance between Wall Street and Main Street economic engines, you will find the data to reconcile years of odd economic detachment.

Here’s where it gets really interesting. Understanding the distance between the real Main Street economic engine and the false Wall Street economic engine will help all of us to understand the scope of the economic inflation lag during the Trump administration. Which, rather remarkably I would add, was a very interesting dynamic.

Trump was in charge… Now think about these engines doing a turn about and beginning a rapid reverse. GDP could, and as we saw did, expand quickly. However, any interest rate hikes (monetary policy) intended to cool down that expansion -fearful of inflation- would take a long time to traverse the divide. That is exactly what happened.

Jerome Powell attempted to block the America First program with interest hikes; however, his efforts were futile because of the distance between the two economic engines. President Trump was focused on assisting Main Street, and Powell’s attempts at impacting Main Street growth couldn’t impact Trump’s program.

During the Trump era we actually imported deflation because China and other nations were attempting to avoid tariff cost increases; so they devalued their currency. The problem for them was that devaluation of their currency not only made their tariffed goods cheaper, it made the non tariff goods cost less. As a result we were importing deflation from around the world.

Inflation on durable goods could not be significant until those nations stopped devaluing their currency. Simultaneously, as international trade agreements were renegotiated the originating nations of those products were forced into the same type of economic detachment described above.

The global manufacturing economies first responded to increases in export costs (tariffs etc.), by devaluing their currency; then they began driving their own productivity higher as an offset, in the same manner American workers went through in the past three decades. The manufacturing enterprise and the financial sector (connected to the consumer) remained focused on the pricing.

♦ Inflation on imported durable goods sold in America, while necessary, was -as we expected- ultimately minimal during this initial period of Trump policy. Predictably, if we stuck with the program inflation would have expanded significantly as time progressed and off-shored manufacturing found less and less ways to be productive. Over time, imported durable good prices would increase – but it was going to come much later; and by that time our own industrial base would be re-established.

♦ Inflation on domestic consumable goods ‘would’ likely rise at a faster pace. However, as we saw U.S. wage rates were respond faster, naturally faster, than any monetary policy because inflation on fast-turn consumable goods became re-coupled to the ability of wage rates to afford them…. and the labor market was on fire. Wages were factually growing faster than inflation during Trump’s term in office.

The economic policy impact lag, caused by the distance between federal monetary action and the domestic Main Street economy, was -under the Trump policy- now working in our favor. That is, in favor of the middle-class. Within the aforementioned distance between “X” and “Y”, a result of three decades traveled by two divergent economic engines, that was our new economic dimension….

What JoeBama 3.0 is proposing now, and what the Federal Reserve just announced they are going to support, is a return to the prior economic model where Wall Street multinationals benefit and the U.S. middle-class is pushed into their intentionally created “service driven economy”.

Inflation on domestic consumable goods (food, fuel, energy) hurts the U.S. middle-class, it does not hurt the multinationals, the elites and Wall Street investors. It takes a long time for inflation to push up wages when the workforce is experiencing lay-offs due to downsizing, outsourcing and expanded imports of multinational products.

But it doesn’t stop there…. If we get too granular, missing the larger picture, it is difficult to understand. However, if we stay at the elevated perspective, understanding leads to awakening. We start to see how the various JoeBama policies intersect.

In generally approximated terms 2020 has delivered a serious financial blow to Main Street businesses.

In generally approximated terms 2020 has delivered a serious financial blow to Main Street businesses.

The COVID-19 lockdowns and shutdowns have led to business in your local community suffering massive losses of income while simultaneously taking on debt directly from lenders or indirectly from government relief efforts. Main Street has been hit hard, some analysts estimate 40 to 50 percent of those service businesses may not recover.

Conversely, the COVID-19 lockdowns and shutdowns have created a massive income benefit for multinationals, Wall Street corporations and big tech. Amazon, Walmart and massive tech companies had their highest earnings ever recorded.

According to most maco-analysis somewhere around forty percent of Main Street economic wealth was lost or suspended in 2020 due to COVID-19. Simultaneously the multinational firms have seen increases in stock evaluations of forty percent. These two almost identical numbers are not coincidental. The billionaire class (multinationals) have gained wealth in an almost identical amount the middle-class (Main Street) lost.

These empirical results are accepted. No-one is challenging the shift of financial resources was/is directly related to regional COVID policy. The math is the math.

Where things change from simple economic math to downstream consequences is where the story is really told.

Where things change from simple economic math to downstream consequences is where the story is really told.

This is where we are going…

This is where we have been going ever for decades, COVID-19 has (not coincidentally) just sped up the process.

If you take out a national map and: (1) put a green pin in the areas where the lock-downs are most severe (draw a 100 mile circle); then (2) put a red pin in the areas where the riots and local anxiety was highest in summer 2020; then (3) put a white pin in the seven counties where election fraud was prevalent; then (4) put a blue pin in the areas known as “Opportunity Zones“, what you will see is a direct correlation. This is not accidental.

There are more than 8,760 designated Qualified Opportunity Zones (PDF) located in all 50 States, the District of Columbia, and five United States territories. Investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged or until December 31, 2026. (link)

If you are a member of ‘THE BIG CLUB’ with a massive influx in capital due to the benefits of the COVID-19 lockdowns, limits and regulations, the Opportunity Zones are now the perfect place to expand ownership and wealth. Take advantage of the Main Street weakness, make moves with government authorization, and do so without capital gains.

The regions where real property will be purchased at a low cost will, not coincidentally, be the “opportunity zones” where investment transactions without capital gains can be made. The areas where riots took/take place will sell cheap. “Opportunity zones” allow for mass investment moves from billionaire class without paying capital gains taxes.

The mass accumulation of wealth (multinationals) at the upper tier of Big Tech and the multinational billionaire class (technocrats) during COVID is approximately +40% since it began. 40% of Main Street businesses wiped out. Not coincidentally almost 40% of wealth has been transferred from Main Street to the Wall Street mega-corps and multinationals.

“Never let a crisis go to waste”…

Only in 2020 the “crisis” was (yet again) by design. The highest level of COVID mitigation control in the Blue states is not coincidentally in the same states with the largest number of Opportunity Zone regions. As a direct result of this mass transfer of wealth to the upper tier the “opportunity” is an unprecedented level of Main Street ownership by elite interests and foreign nationals.

It gets worse… Just like the banking and real-estate crisis of ’07/’08 the government steps in to back-fill the Main Street losses to the mass U.S. population. When an individual or family receives the relief money, they still cannot support Main Street because in many areas they remained forcibly closed. Paying down debt and making purchases in the same lock-down strata only ends up putting those relief funds into the hands of the banks and multinationals who were allowed to operate.

Continued consumer spending only feeds the beast that is -by policy via purchased politicians- designed to destroy us. In essence, we are paying the Technocrats, bankers and multinational corporations to fatten their bank accounts while the U.S. government re-opens the economy with a finger on the scale to benefit the multinationals.

This is by design….

This has always been the design…

CTH has been warning about this for well over a decade and we exhibited the (un)natural conclusion with this graphic:

Post a Comment