Stocks fall to coronavirus sell-off lows with S&P 500 entering bear market, trading briefly halted

Article by Fred Imbert and Thomas Franck for CNBC Markets:

U.S. stocks fell sharply once again on Thursday after an address from President Donald Trump failed to quell concerns over the possible economic slowdown from the coronavirus.

The S&P 500 traded down 8.3% after trading paused due to a 15-minute “circuit breaker,” which temporarily halts trading at the New York Stock Exchange and Nasdaq. The broad index also joined the Dow Jones Industrial Average in bear market territory. The 30-stock Dow slid more than 2,100 points, or 9.2%. The Nasdaq Composite dropped 8.4%.

Before the open, futures contracts tied to the major indexes fell to their so-called limit down thresholds, sliding 5%. These limit down levels act as a floor for selling until regular trading begins.

Cruise line shares dropped sharply. Royal Caribbean traded 26.6% lower while Carnival and Norwegian Cruise Line slid 19% and 27.6%, respectively. Airline shares such as United, Delta and American all fell more than 12%.

The Cboe Volatility Index (VIX), widely considered the best fear gauge on Wall Street, jumped to more than 66 and hit its highest level since 2008.

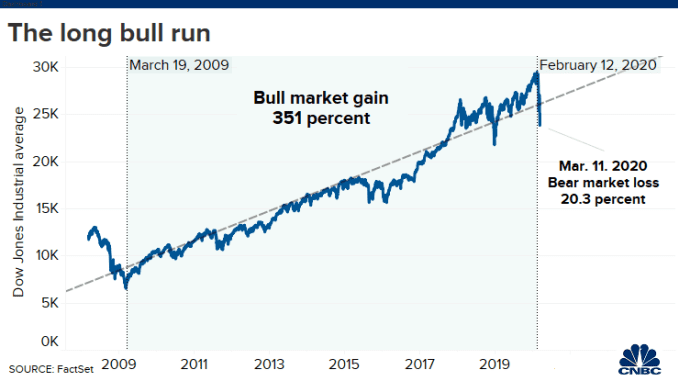

On Wednesday, the Dow ended its historic 11-year bull market run by closing in bear-market territory. A bear market marks a 20% decline from all-time highs. The S&P 500 was just shy of that threshold going into Thursday’s trading and was poised to enter bear market territory based on futures losses.

provide financial relief for workers

who are ill, caring for others due to the virus or are quarantined.

These

moves were not specific enough for investors, however, who were looking

for a more robust fiscal response to curb potentially slower economic

growth stemming from the coronavirus.

“President Trump in an extraordinary Oval Office address didn’t offer up major new ideas on stimulus and only said he’d propose a vague payroll tax holiday to Congress without strongly standing up for any firm size/magnitude,” wrote Ernie Tedeschi, policy economist for Evercore ISI, in a note. “This effectively kicks the issue to Congress which is still planning to go on recess next week.”

Also causing concern about how pervasive the virus could already be in this country was the announcement Wednesday that the National Basketball Association is suspending its season after a Utah Jazz player tested positive for coronavirus. Movie actor Tom Hanks and his wife, Rita Wilson, also said they tested positive for the coronavirus.

“The crux of the angst investors are feeling as the coronavirus spreads surrounds what might happen to consumer spending,” wrote Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

“Consumers sitting at home and not out spending money because they fear catching the coronavirus is the ultimate negative outcome,” he added. “It has been the U.S. consumer who has been driving the recovery bus during this long expansion.”

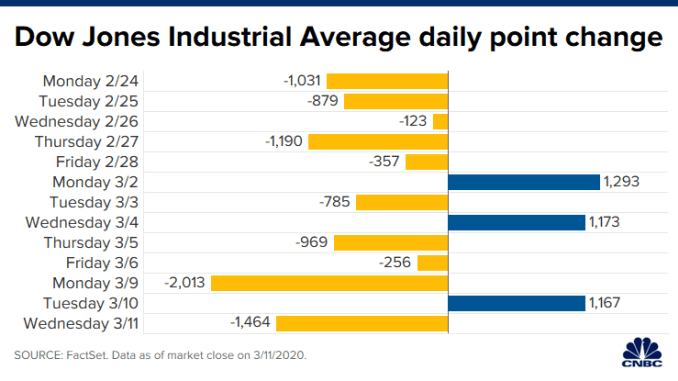

Thursday’s plunge came after yet another wild session on Wall Street and the demise of the Dow’s record-setting bull market run that began in March 2009. The blue-chip index tumbled 1,464.94 points, or 5.9%, to close at 23,553.22. The 30-stock average closed in a bear market, putting to end an expansion that started in 2009 amid the financial crisis.

The Dow’s 1,464-point drop on Wednesday was in large part thanks to outsized losses in planemaker Boeing, which fell 18.15% and suffered its worst day on Wall Street since 1974, according to FactSet data. That stock is down more than 50% over the last six months.

The S&P 500 and Nasdaq Composite fared slightly better on Wednesday, down 4.89% and 4.7% respectively. Those two indexes also remain just outside of bear market territory albeit down at least 19% from their respective record closes.

“These markets have been impossible to predict,” said David Lafferty, chief market strategist at Natixis Investment Managers. “I think of them as kind of wind-sock markets. They’re just changing with whatever way sentiment is. There’s no fundamentals under these markets right now.”

Investors continued to blame the spread and economic impact of the coronavirus for the last month’s steep losses. The virus, which has now infected more than 124,000 people worldwide and killed at least 4,589, threatens to disrupt countries like Italy that have taken aggressive action to slow its spread.

Italian Premier Giuseppe Conte announced late Wednesday that all the country’s stores except pharmacies and groceries will be closed in a move deemed both necessary to safeguard human health and a threat to the country’s output.

Wall Street worries that such measures could tip the global economy into recession, especially if Washington decides the disease is rampant enough in the U.S. to warrant similar measures. The World Health Organization declared COVID-19 a pandemic earlier on Wednesday.

“We are going into a global recession,” said Mohamed El-Erian, chief economic adviser at Allianz, on CNBC’s “Squawk Box.” “After what’s been happening the last few days, we are going to see a spread of economic sudden stops.”

“The trouble with economic sudden stops is it’s not easy to restart an economy,” El-Erian said.

https://www.cnbc.com/2020/03/11/futures-are-steady-wednesday-night-after-dow-closes-in-bear-market-traders-await-trump.html

“President Trump in an extraordinary Oval Office address didn’t offer up major new ideas on stimulus and only said he’d propose a vague payroll tax holiday to Congress without strongly standing up for any firm size/magnitude,” wrote Ernie Tedeschi, policy economist for Evercore ISI, in a note. “This effectively kicks the issue to Congress which is still planning to go on recess next week.”

Also causing concern about how pervasive the virus could already be in this country was the announcement Wednesday that the National Basketball Association is suspending its season after a Utah Jazz player tested positive for coronavirus. Movie actor Tom Hanks and his wife, Rita Wilson, also said they tested positive for the coronavirus.

“The crux of the angst investors are feeling as the coronavirus spreads surrounds what might happen to consumer spending,” wrote Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

“Consumers sitting at home and not out spending money because they fear catching the coronavirus is the ultimate negative outcome,” he added. “It has been the U.S. consumer who has been driving the recovery bus during this long expansion.”

Thursday’s plunge came after yet another wild session on Wall Street and the demise of the Dow’s record-setting bull market run that began in March 2009. The blue-chip index tumbled 1,464.94 points, or 5.9%, to close at 23,553.22. The 30-stock average closed in a bear market, putting to end an expansion that started in 2009 amid the financial crisis.

The Dow’s 1,464-point drop on Wednesday was in large part thanks to outsized losses in planemaker Boeing, which fell 18.15% and suffered its worst day on Wall Street since 1974, according to FactSet data. That stock is down more than 50% over the last six months.

The S&P 500 and Nasdaq Composite fared slightly better on Wednesday, down 4.89% and 4.7% respectively. Those two indexes also remain just outside of bear market territory albeit down at least 19% from their respective record closes.

“These markets have been impossible to predict,” said David Lafferty, chief market strategist at Natixis Investment Managers. “I think of them as kind of wind-sock markets. They’re just changing with whatever way sentiment is. There’s no fundamentals under these markets right now.”

Investors continued to blame the spread and economic impact of the coronavirus for the last month’s steep losses. The virus, which has now infected more than 124,000 people worldwide and killed at least 4,589, threatens to disrupt countries like Italy that have taken aggressive action to slow its spread.

Italian Premier Giuseppe Conte announced late Wednesday that all the country’s stores except pharmacies and groceries will be closed in a move deemed both necessary to safeguard human health and a threat to the country’s output.

Wall Street worries that such measures could tip the global economy into recession, especially if Washington decides the disease is rampant enough in the U.S. to warrant similar measures. The World Health Organization declared COVID-19 a pandemic earlier on Wednesday.

“We are going into a global recession,” said Mohamed El-Erian, chief economic adviser at Allianz, on CNBC’s “Squawk Box.” “After what’s been happening the last few days, we are going to see a spread of economic sudden stops.”

“The trouble with economic sudden stops is it’s not easy to restart an economy,” El-Erian said.

https://www.cnbc.com/2020/03/11/futures-are-steady-wednesday-night-after-dow-closes-in-bear-market-traders-await-trump.html

Post a Comment