With Tariffs in Place, Watch the Canadian Dollar and Mexican Peso

In December of 2016 when we discussed the possibility of President Trump’s then new and unique tariff approach, we predicted negligible impact – if any at all. It was a theory at the time, but predicated on the looming possibility that impacted nations would inevitably devalue their currency. It was the currency devaluation, in combination with directed subsidies, that would offset any tariff impact to U.S. consumers.

By the time we got to December 2019, we were no longer discussing theory. Deflation due to currency devaluation, subsidy and a rising dollar actually became reality. The lookback data (2017 through 2019) proved the tariffs did not raise prices. In fact, the opposite happened, we were importing broad-based deflation.

Now it’s 2025 and again China is hit with tariffs, along with Canada and Mexico. With history as a reference, watch the Canadian Dollar and the Mexican Peso. Initial impact shows the same thing repeating again. The U.S. dollar is rising in value, and the Canadian dollar is dropping quickly.

If this trend holds, the 25% tariffs against Canada (and Mexico) will have minimal impact, if any at all. The lowered value Canadian dollar and Mexican peso will work as an offset and imports will be paid with higher value dollars. Depending on the scale of what happens in the next few weeks, there is a strong possibility Canada might have just walked into a trap set by Trump.

Canada doesn’t have anywhere else to go with their oil. They are pipeline dependent into the USA, and we refine their oil and ship it back the same way. The Canadian oil price is dependent on the USA taking it. Trudeau has no leverage on this.

Additionally, if the currency basket of the C-dollar and M-peso drops against the U.S. dollar, then Canada is especially trapped in a no-win scenario. We must watch the price of the C-dollar and M-peso closely to see how the market responds.

Below is a reminder of what happened before. Did Justin Trudeau just walk into a trap?

With the 2025 tariffs triggered, it is worth revisiting the 2017-2019 actual tariff outcome for U.S. consumers in order to dispel the popular myths about tariffs raising prices here at home. This might be the cited data you want to bookmark for later reference.

It was the Fourth Quarter of 2019…..

Right before the pandemic would hit a few months later, despite two years of doomsayer predictions from Wall Street’s professional punditry, all of them saying Trump’s 2017 steel and aluminum tariffs on China, Canada and the EU would create massive inflation – it just wasn’t happening!

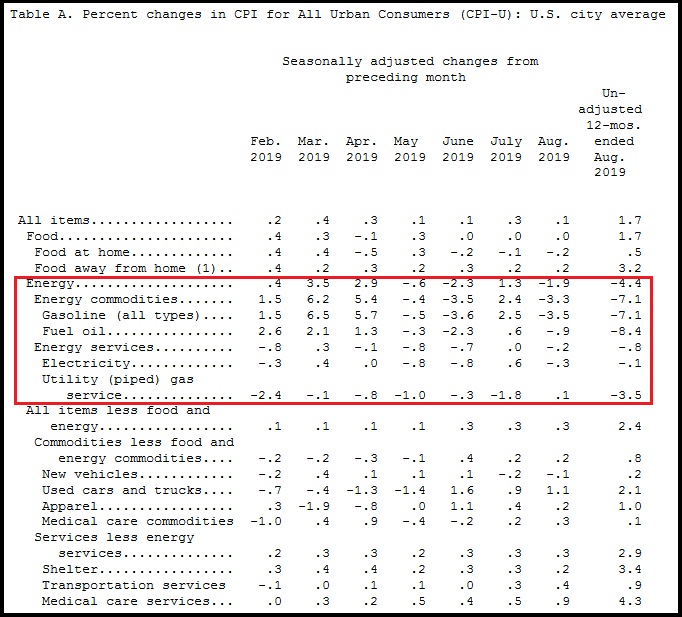

Overall, year-over-year inflation was hovering around 1.7 percent [Table-A BLS]; yup, that was our inflation rate. The rate in the latter half of 2019 was firmed up with less month-over-month fluctuation, and the rate basically remained consistent. [See Below] The U.S. economy was on a smooth glide path, strong, stable, and Main Street was growing with MAGAnomics at work.

A couple of important points. First, unleashing the energy sector to drive down overall costs to consumers, and industry outputs was a key part of President Trump’s America First MAGAnomic initiative. Lower energy prices help the worker economy, middle class and average American more than any other sector.

Which brings us to the second important point. Notice how food prices had very low year-over-year inflation – 0.5 percent. That is a combination of two key issues: low energy costs, and the fracturing of Big Ag’s hold on the farm production and the export dynamic:

(BLS) […] The index for food at home declined for the third month in a row, falling 0.2 percent. The index for meats, poultry, fish, and eggs decreased 0.7 percent in August as the index for eggs fell 2.6 percent. The index for fruits and vegetables, which rose in July, fell 0.5 percent in August; the index for fresh fruits declined 1.4 percent, but the index for fresh vegetables rose 0.4 percent. The index for cereals and bakery products fell 0.3 percent in August after rising 0.3 percent in July. (link)

For the previous twenty years, food prices had been increasingly controlled by Big Ag, and not by normal supply and demand. The commodity market became a ‘controlled market’. U.S. food outputs (farm production) was controlled and exported to keep the U.S. consumer paying optimal prices.

President Trump’s trade reset was disrupting this process. As farm products were less exported, the cost of the food in our supermarket became reconnected to a ‘more normal’ supply and demand cycle. Food prices dropped, and our pantry costs were lowered.

The Commerce Dept. then announced that retail sales climbed by 0.4 percent in August 2019, twice as high as the 0.2 percent analysts had predicted. The result highlighted retail sales strength of more than 4 percent year-over-year. These excellent results came on the heels of blowout data in July, when households boosted purchases of cars and clothing.

The better-than-expected number stemmed largely from a 1.8 percent jump in spending vehicles. Online sales, meanwhile, also continued to climb, rising 1.6 percent. That’s similar to July 2019, when Amazon held its two-day blowout Prime Day sale. (link)

Despite the efforts to remove and impeach President Trump, it did not look like middle class America was overly concerned about the noise coming from the pundits. Likely that’s because blue collar wages were higher, Main Street inflation was lower, and overall consumer confidence was strong. Yes, MAGAnomics was working.

Additionally, remember all those MSM hours and newspaper column inches where the professional financial pundits were claiming Trump’s tariffs were going to cause massive increases in prices of consumer goods?

Well, exactly the opposite happened [BLS report] Import prices were continuing to drop:

This was a really interesting dynamic that no one in the professional punditry would dare explain.

Donald Trump’s tariffs were targeted to specific sectors of imported products. [Steel, Aluminum, and a host of smaller sectors etc.] However, when the EU and China responded by devaluing their currency, that approach hit all products imported, not just the tariff goods.

Because the EU and China were driving up the value of the dollar, everything we were importing became cheaper. Not just imports from Europe and China but actually imports from everywhere. All imports were entering the U.S. at substantially lower prices.

This meant when we imported products, we were also importing deflation.

This price result is exactly the opposite of what the economic experts and Wall Street pundits predicted back in 2017 and 2018 when they were pushing the rapid price increase narrative.

Because all the export dependent economies were reacting with such urgency to retain their access to the U.S. market, aggregate import prices were actually lower than they were when the Trump tariffs began:

[…] Prices for imports from China edged down 0.1 percent in August following decreases of 0.2 percent in both July and June. Import prices from China have not advanced on a monthly basis since ticking up 0.1 percent in May 2018. The price index for imports from China fell 1.6 percent for the year ended in August.

[…] Import prices from the European Union fell 0.2 percent in August and 0.3 percent over the past 12 months.

So yes, we know President Trump can expand the economy with tariffs and his America-First economic policy. We do not need to guess if it is possible or listen to pundits theorize about his approach being some random ‘catch phrase’ disconnected from reality. Yes folks, we have the receipts.

This was MAGAnomics at work, and this is entirely what created the middle class MAGA coalition. No other Republican candidate had this economic policy in their outlook, because all other candidates are purchased by the Wall Street multinationals.

America First MAGAnomics is unique to President Trump, because he is the only one independent enough to implement them.

That’s just the reality of the situation. They hate him for it…

Post a Comment