German Industrialists Very Worried About Trump’s Return – German Economists Say ‘Relax, We’ll Just Devalue the Euro’

Germany is the largest economy in the E.U. However, due to a confluence of horrible events, most of them self-created as an outcome of ridiculous energy production decisions, the German industrial economy has been contracting since 2022.

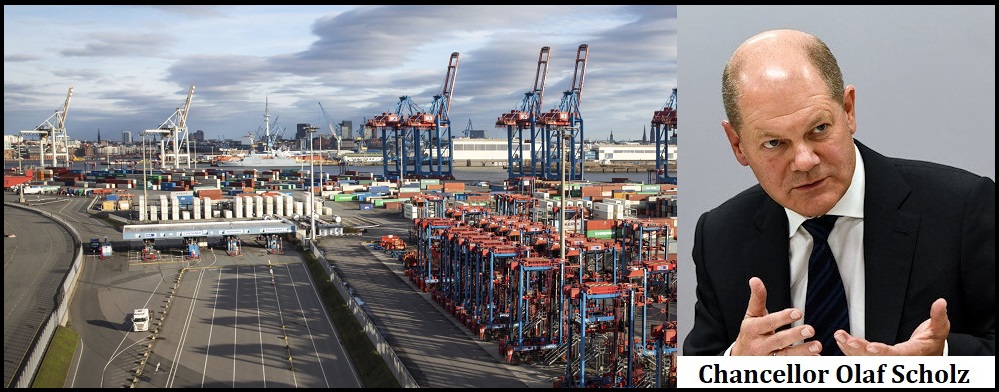

Into this downward spiral of negative economic events within Germany, now comes the problem of President Trump eager to eliminate the Marshal Plan of one-way tariffs and start dealing with the trade inequities. The German industrial manufacturing companies who make up the majority of the economic output are concerned, very concerned.

Within the discussion suddenly something appears that all Western financial pundits have yet to accept. Leo Barincou, a senior economist at Oxford Economics in Paris says:

[…] limited tariffs on selected products, such as cars, chemicals and agricultural products, may not be too much of a problem, Barincou says. A rising dollar, and hence a falling value of the euro, would offset some of the harm caused by the tariffs. “At a macro level, the impact would be limited,” he says. (read more)

Yep, here we go again.

We saw this play out in 2017 through 2019. China first responded to tariffs by subsidizing their targeted industries and later devaluing their currency. We began importing deflation because Chinese products arrived with lower, subsidized, prices, and we paid for them with higher value dollars.

The downside for the rest of the world was China pulling back from purchases of large industrial products from Europe. This made the EU furious at Trump, and subsequently the EU central banks lowered the euro as an offset. For Americans we started importing deflation from Asia and Europe. Everything was arriving at a lower price and being paid using higher value dollars.

I find it a little humorous that Germany openly admits they will offset Trump tariffs, devalue their currency, and ship goods without tax impacts. Meanwhile the gaslighting U.S. financial pundits will keep pretending this is not happening.

The names have changed, but the cause & effect outcomes remain the same.

Post a Comment