They Are Coming for Alito and It Has Nothing to Do With Upside Down Flags

You are not going to like this, and most will say I’m nuts. However, with more than a dozen years of crazy “right-wing conspiracy theories” proven out in real time, I hope the long-time readers will adjust their perspectives and affairs accordingly.

The IC is coming after Judge Sam Alito, but not because of his non pretending, general J6 disdain, solid grasp on the fraud that is Joe Biden, or his wife having an upside-down flag (although the non-pretending aspect is very troubling for them). No, the IC has been coming for Justice Alito since Chief Justice John Robert’s internal court counselor’s lead office staff, Sheldon Snook, the husband of Mary McCord, leaked the Alito decision [Dobbs Decision] overturning Roe and sending the abortion issue back to the states.

The Sheldon Snook leak, hidden by Justice Roberts due to the origination from his office, is the structural compromise within the court that gives the IC leverage over the third branch of government. In a strange situation, Judge Alito appears to be holding the line and forcing the IC to come out of the shadows after him. My hunch is he’s just had enough.

There was a recent decision by the Supreme Court to validate the funding mechanism for the Consumer Financial Protection Bureau (CFPB), a racketeering operation of government created by Elizabeth Warren {GO DEEP – AMY HOWE} {GO DEEP – Background}.

The CFPB is supposed to protect consumers from predatory financial systems. That was the selling point. However, the CFPB is paid by (read “funded by”) the Federal Reserve to protect the interests of the U.S. dollar reserve system; that’s the deep state motive (you’ll see why later). The other motive is the CFPB blackmailing the financial sector to support Democrat operations and policies – or else [we’re not supposed to talk about that part].

What few people paid attention to recently, including Amy Howe of SCOTUS blog, was…. the 7-2 decision not only approved the funding mechanism as constitutional (it’s not), but the high court also reversed itself on the 2020 decision about the constitutionality of the CFPB itself. Why reverse itself in only four short years? That’s where you need to see the leverage and insert John Roberts hiding the Sheldon Snook leak.

2017 SCOTUS had issues with the CFPB’s constitutional structure. 2020 SCOTUS still has issues with the CFPB’s constitutional structure. 2024 SCOTUS suddenly says ‘all good’ to CFPB funding and constitutional structure. What changed? Court is compromised by hiding the Dobbs leak.

However, Justice Alito…. same justice who wrote the Dobbs decision…. wrote the dissenting opinion on the CFPB construct (joined by Gorsuch).

AMY HOWE – In his dissenting opinion, Alito rejected Thomas’ recounting of history, arguing that the drafters of the Constitution “would be shocked, even horrified, by” the CFPB’s funding scheme. Offering his own detailed version of history, Alito concluded that “centuries of historical practice show that the Appropriations Clause demands legislative control over the source and disposition of the money used to finance Government operations and projects.”

But the CFPB’s “unprecedented combination of funding features,” Alito wrote, “affords it the very kind of financial independence that the Appropriations Clause was designed to prevent. It is not an exaggeration to say that the CFPB enjoys a degree of financial autonomy that a Stuart king would envy.”

And that autonomy, Alito continued, “has real-world consequences.” Alito noted several “major” changes to consumer protection law that the CFPB has recently announced, including guidance indicating that financial institutions should not deny credit to consumers based on their immigration status, as well as a proposed rulemaking to cap overdraft fees and remove medical bills from credit reports. “These may or may not be wise policies,” Alito concluded, “but Congress did not specifically authorize any of them, and if the CFPB’s financing scheme is sustained, Congress cannot control or monitor the CFPB’s use of funds to implement such changes.” (MORE)

Alito is correct, but that’s not the core issue.

The CFPB is funded by the federal reserve, and will be a key player in the implementation of the dollar-based Central Bank Digital Currency (D-BCBDC). Likely, the CFPB will be the authorizing agency for the major banks that will facilitate digital currency transactions; this puts the CFPB in the position of power with the mechanics of central control. This is why Senator Elizabeth Warren is the key player in both the CFPB (she created it) and the currently ongoing legislation against crypto currency.

The D-B CBDC is almost certainly going to happen. Too much blood and treasure (NATO push + Ukraine use) has been shed to construct the financial walls that support it (Russian sanctions). Additionally, the issues are too complex for the average person to engage in opposition.

In related news, just as Australia was the tip of the spear in the COVID-19 vaccination enforcement effort, so too is the nation down-under the leading organizer of the digital identity that forms the baseline for the digital currency distribution model.

AUSTRALIA – […] The Digital ID Bill 2024 and Digital ID (Transitional and Consequential Provisions) Bill 2024 passed through the House of Representatives on the evening of 16 May in what the Department of Finance is calling a “milestone for the program”.

“This provides certainty for the expansion of the Australian government digital ID system and for providers and services to apply to join the government’s system. An economy-wide digital ID system will provide many benefits to Australians by improving privacy and security when interacting online,” the department said in a statement.

“It will also strengthen the voluntary Accreditation Scheme for digital ID service providers that wish to demonstrate compliance with best practice privacy, security, proofing and authentication standards, providing Australians with more choice of secure and trusted providers.”

Once the act comes into effect, the Australian Competition and Consumer Commission will be the digital ID regulator, with the Office of the Australian Information Commissioner regulating the privacy aspects of the new system. (read more)

As most will remember, the European Union has already constructed their digital identity via the mandated COVID-19 Passport process. For the key components, the EU is already digital id compliant thanks to COVID.

The Russian sanctions were not created to block the Russians. The Russian sanctions were created to wall-in the West.

The Russian sanctions were not created to block the Russians. The Russian sanctions were created to wall-in the West.

There are now networks of people who operate in various places that create proactive financial mechanisms for what you might call, “financial preppers.”

These people and groups set up bank accounts in foreign countries for you; they organize addresses (needed), phone numbers (needed), and create accounts that you can access that are outside the control of the dollar-based financial system. You can even get an official passport in the process.

These people also sell hardware [to support the phone numbers (really digital ids)] that is completely different from what exists behind the wall of the yellow zone.

How many Americans know that an iPhone-15 sold in the USA is completely different from an iPhone-15 sold outside the yellow zone? Meaning, the internal hardware is different. How many Americans know that?

How many Americans know that an iPhone-15 sold inside the USA has different originating software than an iPhone-15 sold outside the USA?

How many people know that when you purchase one of these “ghost phones”, the data network automatically identifies the disparity when the phone crosses into the yellow zone, and shortly thereafter the cellular network transmits a software update to bring the “ghost phone” into USA (yellow zone) compliance?

How many Americans know phone apps, and internal app functions, can exist on phones outside the yellow zone that do not exist inside the yellow zone?

Example: use a ghost phone, and you can access a digital wallet in Telegram; you can transmit funds to other Telegram users. However, use a USA compliant phone and you cannot. The function is there, but the service is, “not available in your area.”

Why?

It’s about control.

If you don’t update the software, the function exists inside the yellow zone. However, update the software, and the function disappears.

This happens.

Another real-life example was recently missed by many people when the story of the Apple Watch Series 9 was found to have violated patent technology and was banned for sale in the USA. {STORY}

To get into legal compliance, Apple transmitted a remote software update disabling the function of the patent technology in the USA. Again, for emphasis, only in the USA. Bring your non-compliant Series-9 into the range of a wifi network, and bingo – auto-compliance. I mention this story only to highlight a modern compliance capability that many people do not know exists.

In essence, your tech devices – and the capability therein – are different than an identical tech device sold outside the Western control zone.

♦ Technology is intertwined with Central Bank Digital Currencies. Tech companies are regulated by the U.S/Western government, and the tech companies have to comply. The regulatory compliance is part of the process of control. There are regulatory walls around us that most do not understand. The same regulatory principle applies to finance and banking. Hence, the origination motive of the yellow zone wall, built under the auspices of Russian sanctions.

Let me make one big point resoundingly clear. When the WESTERN Central Bank Digital Currency system begins, all forms of cryptocurrency will be blocked and made unlawful inside the Western zone – either by regulation or by legislation.

Let me repeat this. Cryptocurrency in all forms will be banned.

Crypto is not technically a currency; it is a barter based on trust. However, at a certain point (origination or end) crypto must have the ability to transfer into currency value. Dollars (or another currency) are needed to purchase BitCoin,…. or BitCoin eventually sold or exchanged for Dollars (or another currency). [BitCoin only used as a familiar type of crypto.] This process is where crypto gets blocked.

Ownership of Crypto may not be unlawful, but any effort to use Crypto as an alternate digital currency to exchange value will be unlawful once the dollar based CBDC is launched.

A fully implemented govt controlled central bank digital currency will not allow competition. Alternate digital currency will be banned.

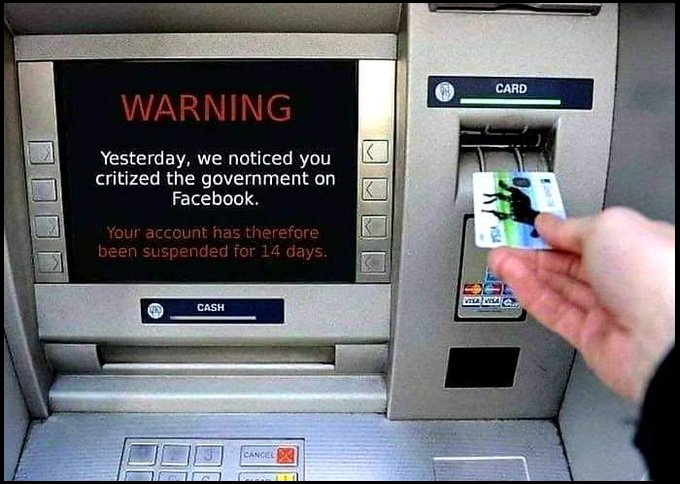

Ultimately, a dollar-based US-Central Bank Digital Currency, ie a “digital dollar,” is about control.

Every transaction has a unique digital fingerprint, and every digital dollar can be traced by the IRS to the digital id associated with it.

There is a BIG difference between electronic funds (current), and a digital dollar (future).

CFPB Background

CBDC Background

Post a Comment