Kevin O’Leary Explains to Stunned CNN Audience Why New York Case Against President Trump Is Nonsense

Everything about the case in New York City against the Trump Organization business operations is ridiculous. There are no victims. There was no fraud. All of the lenders did their own due diligence. All of the loans were paid back without issue, and the statement of financial condition was factual and accurate. There were no defaults or banking interests adversely impacted. There are no victims of what the State calls “fraud.”

New York Attorney General Latisha James campaigned for office with promises to target the Trump Organization and Donald Trump himself. This is malicious Lawfare in the extreme. Additionally, the statute being used as the predicate for the case is a consumer fraud statute, intended to protect borrowers from predatory lenders. In the four corners of this case, Trump is the borrower, and the banks were the lenders. New York is flipping the statute to claim the borrower defrauded the lenders, despite the lenders denying there was any fraud and there was no harm. The entire case is ridiculous.

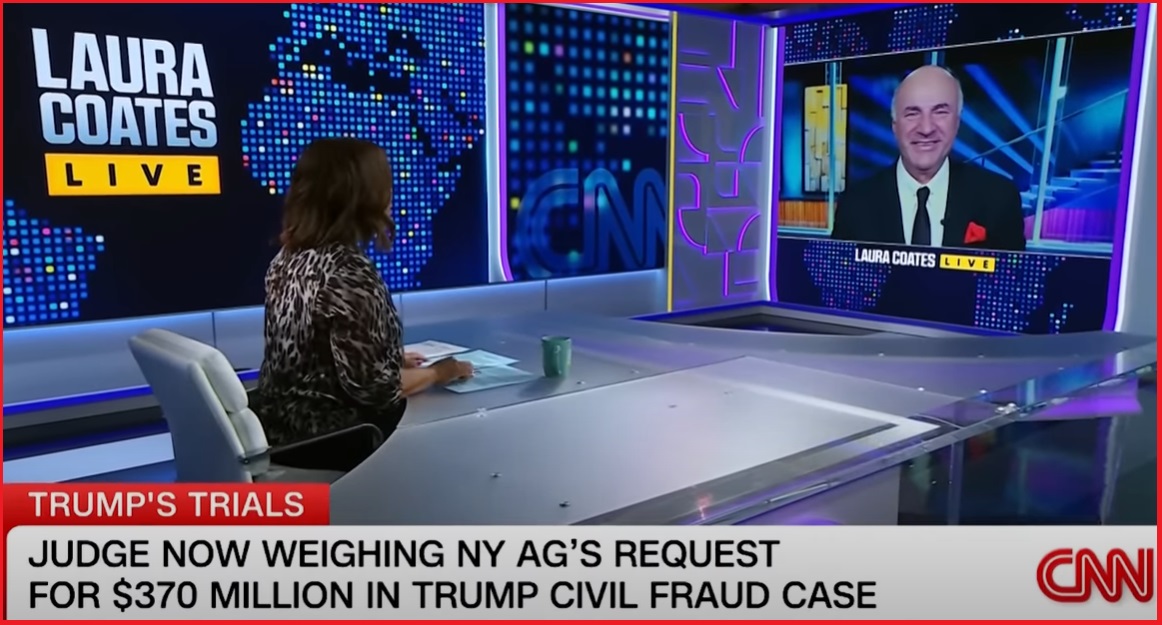

Appearing on CNN, O’Leary Ventures Chairman Kevin O’Leary outlines, to a perplexed Laura Coates, why Donald Trump’s civil fraud trial in New York is political nonsense. WATCH (prompted):

TRANSCRIPT – O’LEARY: Well, let’s leave out Trump for a minute, and let’s leave out politics, and just talk about what happens in real estate development anywhere. So, if you’re a developer and you’ve got a building on the block, anywhere in America, and it’s worth, let’s say, $500 million, and you want to build a building right beside it, you go to the bank and say, “This building is worth $500 million. I’d like to borrow a construction finance loan against this asset, and I want you to tell me it’s worth $500 million too.”

And the bank negotiates with you, and says, “Well no, we think it’s worth $400 million,” and you fight it out. You are always trying to show your assets in the brightest light with the sunshine you can possibly determine for them. You want them to be worth the very most because you’re only going to get a 40 to 50 percent loan to value, as it’s called. Then you borrow that money, in the case of a $500 million asset, maybe you get $250 million, and you build the new building with a construction finance loan. So that’s what this case is all about.

And by the way, forget about Trump, every single real estate developer everywhere on earth does this. They always talk about their asset being worth a lot and the bank says no. That’s just the way it is. So in this case, what I’m trying to figure out, and I’m not pro or con, or I don’t care about the politics, who lost money? Nobody. The bank got paid back the construction finance loan, and a new building was built. If you’re going to sue this case and win, you’ve gotta sue every real estate developer everywhere. This is all they do. This is what they do all day long every day. So I don’t think this thing will ever survive appeal regardless of what the fine is. This doesn’t even make sense.

Now look, I understand Trump has a lot of problems in other indictments and everything else, but if you’re a real estate developer, you’re watching this and saying, “What is this? This is ridiculous.”

Post a Comment