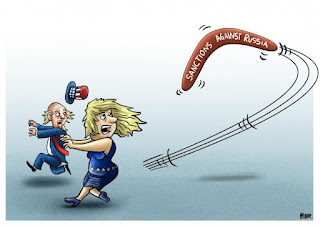

Sanctions Regime Boomerangs on the West

After one year, 10 increasingly stringent rounds, and over 14,500 specific sanctions imposed on Russian individuals, companies, and institutions, the U.S. led sanctions regime appears to be hurting Western economic and geostrategic interests as much or more than the Russian target.

Last month I explored in American Greatness the question of whether and how the sanctions regime—one year on—is impacting Russia’s economy and trading relationships. The conclusion was yes, but not as the West desires, and that “economic sanctions are . . . giving Western leaders a lot of virtue signaling and public relations opportunities, but with little tangible result.”

But what of the costs and consequences Russian sanctions have imposed—not on their intended target but rather—on the UnitedStates and its Western allies, particularly those in the European Union?

Western and especially European economic interests have been negatively impacted by the sanctions regime. The value of EU imports from Russia fell by 51 percent in 2022, while EU exports to Russia dropped by 48 percent. In 2021, the United States exported $17.3 billion of goods and services to Russia; in 2022 this figure dropped by 90 percent to $1.7 billion. Canada’s exports to Russia fell 84 percent from $928 million to $153 million. So add $18 billion in direct costs to North American industry, not to mention the $100 billion of indirect costs through support of the Ukrainian war, a profitable benefit to defense contractors and a liability to taxpayers.

China has won massively. China’s trade with Russia topped $190 billion in 2022, a 35 percent increase from 2021. Russia’s relationship with China is lopsided, to be sure. While Russia represents only three percent of China’s trade, Russia is now wholly dependent on China as its largest trading partner. This itself is fundamentally detrimental and dangerous to U.S. and Western interests.

Energy

In the first round of sanctions in March 2022, the United States banned Russian oil, liquified natural gas (LNG), and coal. The European Union—negotiating amongst 27 members—followed suit in stop-start stages over multiple rounds, with sanctions covering crude, diesel, and other refined oil products, coal, and LNG, but not natural gas. These sanctions have had a direct and consequential impact on European and American energy markets, while Russia has simply found other homes for its products. To be sure, energy is driving global inflation, especially in Europe. Energy touches all sectors, from food to transportation to downstream electricity generation. A few examples follow.

The price of Europe Brent spot crude topped out at nearly $123 per barrel in June 2022, and averaged $101 per barrel for the full-year 2022, before settling back down to $83 per barrel in February 2023. Nonetheless, this latest price represents an over 50 percent increase from the $55 per barrel of January 2021. Similarly, natural gas prices rose tenfold in European markets, from $7.3 to $70 per million metric BTU. There has been much rejoicing as natural gas prices fell back to $16.7 in February 2023. But let us not fool ourselves. This still represents a 129 percent price increase in the two years from January 2021.

Following the announcement in April 2022 of sanctions on Russian coal, the price of thermal coal (used for power generation) surged to over $450 per ton in the third quarter of 2022, a nearly sevenfold increase from January 2021. The EU was forced in September 2022 to ease sanctions on Russian coal in order to keep the lights on. While down from 2022 highs, coal prices remain 150 percent above January 2021 levels.

As a general rule, as goes oil, gas, and coal prices, so goes electricity. In many European countries, the cost of wholesale electricity has increased by 400 percent to 500 percent or more in the two-year period ending December 2022. For example, wholesale electricity prices were up 459 percent in France, 489 percent in Germany, and 687 percent in Sweden.

The United States was not spared: there has been a doubling or tripling of wholesale prices (depending on region) over the same period. The retail cost of electricity rose by 14.3 percent in the United States in 2022. In populous urban areas it is worse, as the U.S. city average cost of electricity is up by 16.2 percent over the same period. Either measure is well more than double the aggregate CPI figure as a whole. If, like tens of millions of Americans, one happens to live in a large city in the Northeast, the average price increase was 22.8 percent in 2022.

While the United States and Europe paid substantially higher prices, Russia found new buyers for its products. According to Russian energy minister Nikolai Shulginov on March 28, 2023, Russia “completely redirect[ed] the entire volume of exports that fell due to the embargo—there was no decrease in sales” but rather an increase in exports in 2022.

China and India now account for over 50 percent of Russia’s crude oil export. Russia overtook Saudi Arabia to become India’s second largest supplier of oil in 2022. Russia is now the number two supplier of crude to China, having delivered 79.8 million tons through November 2022. Russia supplanted the United States by picking up marginal LNG sales to China.

U.S. oil companies could and should have been the ones delivering more oil and gas to a Chinese economy now reopening to the world after two years of brutal lockdowns. But instead, U.S. exports of crude to China have fallen by 12 percent since 2020. Just as the stickers of Joe Biden posted on gas pumps read, “I did that!” in response to $5 per gallon gas prices, the same can be said of the Biden Administration’s strengthening of Russia’s ties with China.

The EU has been unable to fulfill its intention to cordon off imports from Russia. While the value of EU imports from Russia fell by half in 2022, including 40 percent less Russian natural gas, by the end of the year imports were growing again. While Europe has lost through rising costs, the United States and its energy sector has been the biggest beneficiary of both sanctions and of the sabotage of Nord Stream. The United States has now replaced Russia as the leading supplier of both gas and oil to Europe.

Nonetheless, in 2022 Russia increased its direct sales of LNG to Europe and China by 37.5 percent and 29 percent, respectively, and then sold the LNG back to Europe at a large markup. European nations will now pay China in yuan rather than U.S. dollars, another example of the “death by a thousand cuts” to U.S. monetary hegemony.

Food and Agriculture

While Russian food and agricultural products were generally excluded from sanctions, food prices have suffered around the world from knock-on effects related to the cost of energy, transportation, insurance, and other inputs, as well as the inability to access sanctioned banks and payment networks to pay for technically unsanctioned products. According to the Food and Agriculture Organization of the United Nations, global food prices were up 51 percent in 2022 compared to the start of 2020 (before lockdowns). While having come down somewhat in 2023, the FAO Food Price Index remains up over 36 percent.

As a consequence of sanctions, which can include tariffs and quotas in addition to blocking payments and restrictions on transport, fertilizer prices have doubled since January 2021. Fertilizer is a key input to grains, cereals, and many other food commodities. Russia is the world’s leading exporter of fertilizers, representing over 15 percent of global exports in 2021. According to analysis from the IMF, every one percent increase in fertilizer prices translates into an 0.45 percent increase in food commodity prices, implying a 45 percent increase across the food commodity complex. The IMF notes that elevated prices typically persist for four or more quarters after a “fertilizer price shock” such as the one the world experienced in the second quarter of 2022, implying prices may remain elevated through 2023.

Watching global fertilizer prices spike by 30 percent in just two months, the U.S. government sought in July 2022 to make explicit exemptions for Russian fertilizer from its sanctions program. The EU persisted with sanctions, but the impact was so severe that by December 2022 the EU changed course and exempted maritime transportation of fertilizers (and related financial flows to fertilizer companies or the oligarchs who own them). Nonetheless, the EU now has the privilege of paying substantially more for these products.

Not wanting to be left out, the Canadian government imposed a 35 percent tariff on imported Russian fertilizer in early 2022. This translated into $34 million of additional costs borne by Canadian farmers that year. These farmers are now petitioning Ottawa to get this money refunded to them from government coffers.

Russia is finding willing buyers for confiscated Ukrainian grain, especially including Syria and other U.S. sanctioned nations, weakening the economic impact of sanctions while strengthening an alliance of the damned. Middle East expert Haid Haid writes, “Instead of reducing illicit activities, sanctions against Syria and Russia have apparently increased their cooperation.” Syria’s government acknowledges that it is paying (and thus Russia is receiving) a 35 percent premium to the non-sanctioned world’s market price, which is a small inconvenience compared to food riots in the streets of Damascus.

Shifting Global Alliances

Speaking of Syria, Saudi Arabia has agreed to reopen its embassy in Damascus after a 10-year hiatus. This follows closely on the heels of China’s brokering of a peace accord between two historically religious and regional adversaries, Sunni Saudi Arabia and Shiite Iran, potentially creating a regional powerhouse that leaves the United States out in the cold and endangers Israel in the process. Saudi’s pivot away from the United States towards China is noticeable not only here but in agreeing to accept yuan (goodnight, petrodollar era) as the settlement currency for oil purchases. Saudi Arabia is the leading exporter of crude to China, representing some 87.5 million tons in 2022, and as such understands where the bread is buttered.

Iran and Saudi Arabia are keen to participate in an expanded BRICS organization, which is increasingly becoming an anti-American alliance of sanctioned, bullied, or neglected nations seeking a new geopolitical order. Countries including Argentina, Egypt, Indonesia, Kazakhstan, Nigeria, Saudi Arabia, Senegal, Thailand, the United Arab Emirates, and others are considering, and in some cases formally applying for, BRICS+ membership.

Sanctions have accelerated a process that is explicitly designed to undermine U.S. dollar dominance and the power of U.S. financial, monetary, and trade sanctions.

Banking and Payments Networks

The U.S. Treasury boasts of having implemented over 2,500 sanctions, including on “Russian banks representing over 80 percent of total Russian banking sector assets.” Treasury asserts that “sanctions and export controls have caused Russia’s financial sector losses of hundreds of billions of dollars.” What Treasury fails to note is that 1) these losses primarily derive from foreign currency reserves held by Russian banks in a period that saw the ruble appreciate nearly 10 percent against the dollar (and thus caused these reserves to depreciate in accounting terms), 2) profits recovered in the second half of the year and the sector earned a profit in full year 2022, 3) banks were earning an average 29 percent return on capital by January 2023, and 4) Russian banking sector assets grew by 16 percent in 2022.

The U.S. dollar’s share of global transactions and foreign exchange reserves has been falling for years, but the weaponization of the U.S. dollar has accelerated the process. According to Reuters, trading of the yuan-ruble pair increased 80 fold since the start of Russia’s special military operation, equating to $1.25 billion per day by October. Nearly all this volume has come at the cost of U.S. dollar and euro exchange transactions.

The increasing ties between Russian and Chinese banking and monetary systems are a product of sanctions. The relationship was formed a full decade ago in the aftermath of the sanctions imposed on Russia by the United States following Russia’s annexure of the Crimea. Over the course of the decade, the technical aspects and financial systems plumbing required to make the network a practical reality have been nearly fully implemented. Excluding Russia from SWIFT in 2022 only served to hasten the transition.

In conclusion, Russian sanctions are boomeranging on the West. They are fueling inflation, grossly distorting global energy markets, increasing food insecurity worldwide, and harming both Europe’s economy and energy security. Sanctions are accelerating the process of undermining the U.S. dollar dominated global financial system, and encouraging development of new, anti-American alliances with former allied or neutral nations. Sanctions are inadvertently pushing Russia, a nation that has potential to be a U.S. ally or at least a neutral and buffer nation-state, into the hands of our most formidable potential adversary. While an objective analysis would indicate that the Dragon will eventually devour the Bear, for the moment the Bear has no choice but to run into the Dragon’s welcoming arms. This was not an inevitable or necessary outcome.

Post a Comment