Inflation Plateau Continues During March, Real Wages Shrink Again, Future Energy Costs Start to Rise Again with Oil

In the latest round of statistics from the Bureau of Labor and Statistics (BLS) the March inflation data has been released [DATA HERE]. The Consumer Price Index (CPI) climbed 0.1% in March after advancing 0.4% in February. This puts the 12-month CPI outlook at 5% inflation. [See Modified Table A on Left]

A 4.6% decline in March gasoline prices was offset by higher rental and housing costs. That was the primary driver of the lowered inflationary data as gasoline is weighted heavier in the impact.

A 4.6% decline in March gasoline prices was offset by higher rental and housing costs. That was the primary driver of the lowered inflationary data as gasoline is weighted heavier in the impact.

However, that said, gasoline prices are already rising again after Saudi Arabia and other OPEC+ oil producers early this month announced further oil output cuts. This puts the April CPI data (starting to be assembled this week) on track to increase over March.

Overall, in the big picture the data shows the plateau of sorts as we described for this spring. This plateau will be followed by another bump as a result of current input costs and prior energy costs traveling through the supply chain.

Energy services, electricity and natural gas, are stable but higher than last year. The crop cycles carry those increased costs from field to fork. Consumers cannot avoid those food prices increasing. The more processing involved in the food sector, the higher the price increase.

Housing increases are another unavoidable cost and generally cycle with a lag within them. As leases expire, the new lease rates increase accordingly. The same is true for insurance rates. Both unavoidable sectors have a rolling lag that hits the consumer upon renewal.

On the wage side [DATA HERE] wages went up .03% but the work week declined 0.3%. Essentially nullifying earnings growth with fewer worked hours. With inflation at 0.1%, real wages declined .01%.

For the total 12-month cycle noted by the BLS data, “real average hourly earnings decreased 0.7 percent, seasonally adjusted, from March 2022 to March 2023. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 1.6-percent decrease in real average weekly earnings over this period.” For the year, wages continue to fall far short of inflation; meaning real wages are negative. Actual real wage growth has been negative for 24 consecutive months.

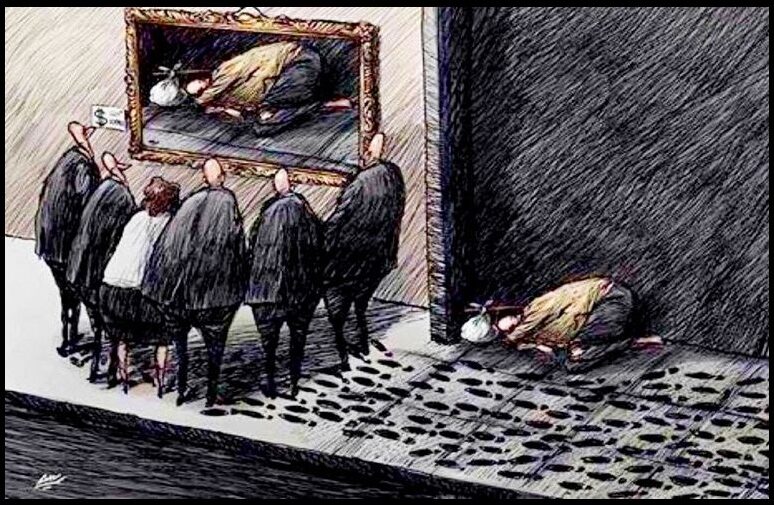

The main street economy is feeling all of these impacts. The paper economy (Wall St) is not feeling these impacts at the same level. The chasm between the haves and have-nots is widening.

Post a Comment