Consumer Spending: Significant Sales Drops in Dept Stores, Electronics and Home Improvement

Always keep in mind that retails sales from the Dept of Commerce [DATA HERE pdf] are always calculated in dollars. Inflation can artificially skewer retail sales if prices increase, and yet consumer purchases decline at a rate lower than the increase in price. Fewer units sold at higher prices can give the false impression of increased sales.

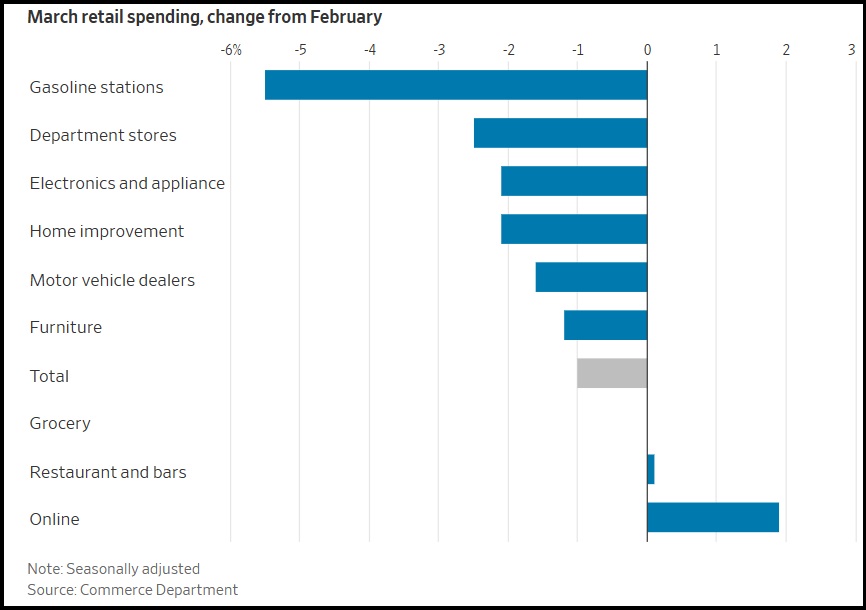

During an inflationary environment, when prices increase yet retail sales drop, there are substantially fewer units being purchased. Overall purchases at stores, restaurants and online declined a seasonally adjusted 1% in March from the prior month.

During an inflationary environment, when prices increase yet retail sales drop, there are substantially fewer units being purchased. Overall purchases at stores, restaurants and online declined a seasonally adjusted 1% in March from the prior month.

During the time measured gasoline was less expensive, so that led the drop in fuel sales; however, drops in dept stores (-2.5%), General Merchandise (-3.0%), electronics (-2.1%), and building supplies (-2.1%), shows another broad-based pullback of Main Street consumer spending. (pdf here)

These outcomes are in general alignment with what many people have shared via regional ground reports. Grocery store sales are flat despite major increases in grocery store prices (+10 to +20%). People are buying fewer grocery store units and making their food budget stretch as far as possible.

Durable goods are not considered essential, and sales of cars, electronics and department store products are much lower.

I am actually a little (pleasantly) surprised to see restaurant sales holding (+0.1%), despite the massive increase in fresh food costs. I thought people would eat out less, but the total decline in restaurant foot traffic seems to be in the single digits. I guess people can afford it more than I anticipated.

(Via Wall Street Journal) – […] The retail-sales report mainly captures spending on goods rather than most services such as travel, rent and utilities, offering only a partial picture of spending. The Commerce Department will release more complete figures later this month.

Spending on air travel was robust in March but outlays on other services like hotels declined, transaction data from Bank of America credit and debit cards showed. And the cost of shelter has increased faster than the overall rate of inflation, federal data show.

Some Americans have had to make adjustments to allow them to keep spending.

Recent data suggest many consumers are more cautious about purchases of goods they often have to borrow money to buy. In March, spending declined in big-ticket categories including vehicle sales, electronics, furniture, and at home-improvement and department stores.

“The current challenges in the used auto industry are well documented,” CarMax Inc. Chief Executive Bill Nash said on a call with analysts this week, “with affordability pressured by broad inflation, climbing interest rates, tightening lending standards and prolonged low consumer confidence.” (more)

Post a Comment