Meanwhile, The Petrodollar Just Got Smaller as The First LNG Shipment Between UAE and France Is Traded in Yuan

Two major energy trade developments yesterday highlight how the Western Alliance is quickly losing a grip on the world energy market, as an alliance between China, Russia, Iran and the Middle East Gulf Cooperation Council starts to take shape with actual trade exchanges that are not in dollars.

Last year, in response to big panda’s own interest and seeking to exploit two western alliance self-created weaknesses; (1) sanctions against Russia and (2) weakened investment in LNG production; China spearheaded the Shanghai Petroleum and Natural Gas Exchange.

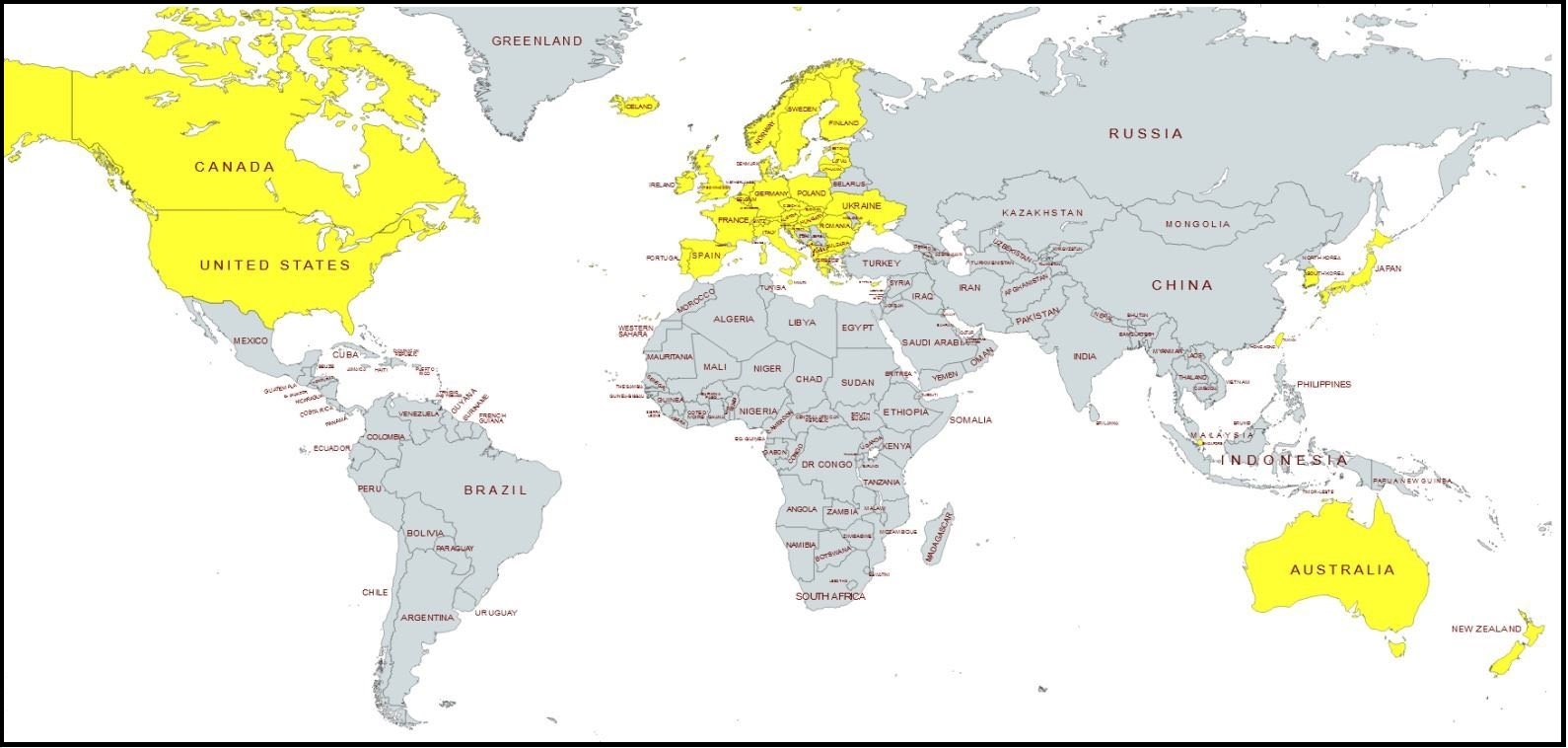

The exchange was aimed at group purchasing services for liquefied natural gas (LNG) though the use of the yuan to replace the dollar. Essentially, team Gray operating without the global trading system of team Yellow (map). The Shanghai exchange allows purchases of LNG portions by small and medium-sized buyers in yuan.

Yesterday, CHINESE national oil company CNOOC and France’s TotalEnergies have completed China’s first yuan-settled liquefied natural gas (LNG) trade through the Shanghai Petroleum and Natural Gas Exchange, the exchange said on Tuesday (Mar 28).

Approximately 65,000 tonnes of LNG imported from the UAE changed hands in the trade, it said in a statement. TotalEnergies confirmed to Reuters that the transaction involved LNG imported from the UAE but did not comment further. (read more)

This exchange between the UAE and France is taking place without dollars. If the process continues the dollar weakens. In the geopolitical world of currency valuations and trade, this might be considered the Archduke Ferdinand moment for the end of the petrodollar. The question will become, can they grow this process with OPEC+ support and begin eventually trading oil in yuan?

A second energy targeted development comes from a shipment of Russian diesel fuel into Mexico. The raw material was: (A) sold at an originating discount; and (B) presumably refined in Spain, making it exempt from the current energy embargo against Russia.

Post a Comment