Showdown Over Student Loan Forgiveness Hits Supreme Court Tomorrow (Today)

Showdown Over Student Loan Forgiveness Hits Supreme Court Tomorrow (Today)

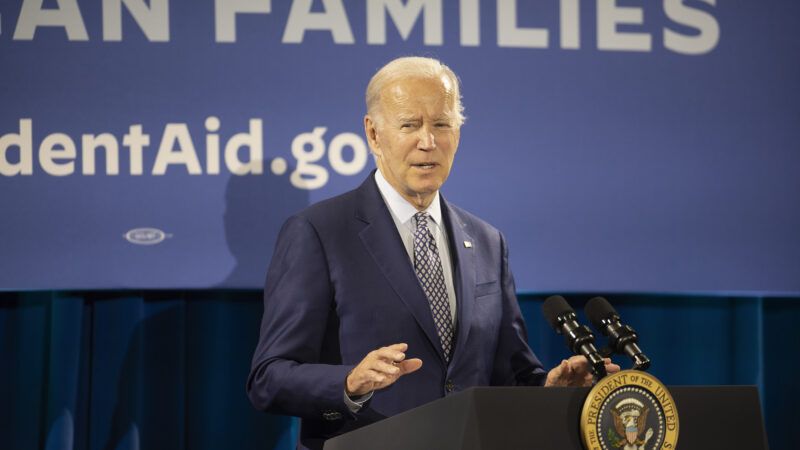

(Adolphe Pierre-Louis/ZUMAPRESS/Newscom)

Challenge to Biden's student debt plan hits Supreme Court tomorrow. On Tuesday, the Supreme Court will hear two lawsuits challenging President Joe Biden's plan to erase a huge chunk of student loan debt.

Biden's debt forgiveness plan, announced last August, applies to anyone with an income under $125,000 and allows for the cancellation of up to $10,000 in student loan debt for all borrowers and up to $20,000 for those with Pell Grants. Biden justified this giant flex of executive power by citing COVID-19.

Specifically, the Biden administration argues that the Higher Education Relief Opportunities for Students (HEROES) Act of 2003—which "permits the Secretary of Education to waive or modify Federal student financial assistance program requirements to help students and their families or academic institutions affected by a war, other military operation, or national emergency"—could be invoked in the summer of 2022 because of the coronavirus pandemic. (Never mind that Biden also said around the same time that the pandemic was "over.")

"The HEROES Act was designed to let the executive branch ameliorate the student loan situations of service members fighting the war on terror," wrote Reason's Eric Boehm last summer. But Biden twisted that to accomplish something Democrats have long wanted to do but have been unable to accomplish through the proper legislative channels.

The administration's move quickly provoked a spate of lawsuits, which have since been winding their way through the federal court system. As part of this process, a federal appeals court issued a temporary injunction against the debt forgiveness.

The Supreme Court has agreed to hear two of the challenges. One suit was filed by the attorneys general of six states (Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina), who argue "that the debt-relief plan will harm state revenues and agencies that hold student loans," reports Inside Higher Ed. The other suit was brought by two Texans who "challenged the debt-relief plan because they wouldn't benefit from all the provisions and didn't have the chance to comment on the proposal."

More from Inside Higher Ed:

The plaintiffs argue in the lawsuits that the Higher Education Relief Opportunities for Students Act of 2003 does not authorize the debt-relief plan—an argument that one federal judge has already agreed with….The Biden administration has said the law clearly authorizes the program and that relief is necessary to ensure those affected by the pandemic aren't in a worse position financially once student loan payments resume. Payments are currently paused through the end of June, or 60 days after the lawsuits are resolved, whichever comes first.

The plaintiffs also want the justices to apply the major-questions doctrine to the case, which says in part that agencies need clear congressional authorization when carrying out policies that have economic and political significance. The court recently used the doctrine to strike down the Environmental Protection Agency's Clean Power Plan last year.

Conservative legal experts and the plaintiffs say in filings that the lawsuits are ideal for the major-questions doctrine because of the scale of the debt-relief program and what it would mean for executive power.

"What we have to remember is that the court certainly knows its decision here is never just going to be confined to this one instance," said Jack Fitzhenry, senior legal policy analyst at the conservative think tank the Heritage Foundation. "As large and important as the question of student loan cancellation is, the kind of law that they set for what future presidents can do and what future secretaries can do—that's going to have enormous impacts on how policy preferences are pursued by this administration and future administration."

The Supreme Court arguments will also examine the question of standing. Last October, the U.S. District Court for the Eastern District of Missouri ruled that the six states challenging Biden's loan plan did not have standing to do so. In November, however, a three-judge panel of the U.S. Court of Appeals for the Eighth Circuit unanimously concluded that at least some of the states did.

That same month, another federal court—this one hearing the challenge by the two Texas residents—ruled Biden's plan unconstitutional. "In this country, we are not ruled by an all-powerful executive with a pen and a phone," U.S. District Judge Mark T. Pittman wrote in his decision. "Instead, we are ruled by a Constitution that provides for three distinct and independent branches of government."

And a few days later, the U.S. Court of Appeals for the Eighth Circuit granted an emergency motion for a nationwide injunction on implementing the student loan plan. Which brings us to tomorrow's showdown in the Supreme Court.

George Mason University law professor Ilya Somin has more on the question of standing here and more on the broader issues at stake here. "The administration's ultra-broad interpretation of the HEROES Act runs afoul of the Supreme Court's recent rulings on the 'major questions' doctrine," writes Somin. He adds that "Biden's loan-forgiveness plan is not the first time a president has tried to leverage emergency powers to raid the federal treasury for purposes denied by Congress. In 2019, Trump used a dubious emergency declaration to try to divert funds to build his border wall, despite the fact Congress had repeatedly refused to authorize any such expenditure."

"As with Trump, the use of emergency powers here is a pretext for achieving an unrelated policy objective rejected by Congress," Somin adds.

Post a Comment