Minneapolis Fed President Admits Goal is to Shrink Economy to Meet Decreased Energy Supplies

This video interview segment was sent to me today along with a “wow, you were right” message. Apparently, the interview took place a few weeks ago (it’s new to me), but the admissions within it are quite remarkable.

The CNBC discussion surrounds inflation and the federal reserve raising interest rates. Minneapolis Fed President Neel Kashkari is talking about the jobs report, inflation and the intention of the federal reserve to continue raising interest rates until they achieve 2% inflation, regardless of consequence. Kashkari doesn’t hedge on the latter issue of consequence; he affirms with absolute guarantee the fed will keep raising rates until the economy shrinks enough such that 2% inflation is achieved. However, watch what happens when Joe Kernan takes that outlook and overlays “supply side” energy policy. WATCH (10:22 prompted):

The issue is quite simple, really. When additional oil, coal and natural gas development is blocked as an outcome of policy, energy prices jump massively. We are seeing 2022/2023 price increases in electricity, home heating, fuel, gasoline, natural gas and other total energy price outcomes in the 60%+ range.

As a direct outcome of energy policy, all of the downstream products and services have massive upward supply side price pressure. When the input prices are driving upward of 60%, the downstream prices increase accordingly. Farming costs, fertilizer, feeding, transportation costs, food at retail and wholesale, and just about every petroleum-based product, which is almost everything, increases in price accordingly.

If supply side energy price increases are pushing +60%, and the Fed will only accept a 2% inflation output result, the only method of achieving the desired result is to shrink energy demand. This is the goal of the current Fed monetary policy. In this interview Kashkari admits the dynamic for the first time in public.

Prior to this interview, the Fed was being too-cute-by-half as they talked about targeting the ‘demand side’ through increased rates. The demand they were targeting is the energy demand, but people (mostly in the financial and business world) were not willing to accept that Federal Reserve monetary policy would intentionally try to shrink the economy.

When overall energy price increases are driving upward of 60%, it is going to take a major amount of economic contraction to drop energy demand to meet the diminished energy supply. CTH has been warning about this ultimate objective for over two years. It’s a simple economic situation.

+60% price on the supply side, with a goal of +2% on the downstream demand side, equals a major amount of activity needing to be removed. Essentially energy use needs to drop by half.

You can put everyone in an electric car and still not even come close to dropping energy demand 50%. You cannot “energy efficient” your way to a 50% drop in demand; there just isn’t enough waste in the system, especially when people are already paying close attention to energy use because it costs so much.

This “transition to the new green economy” is a whole of society shift.

This “transition to the new green economy”, is a multi-generational shift.

The transition includes putting people in smaller houses, stopping their travel, stopping their purchasing of new goods, taking down entire industries and limiting human activity on a massive scale.

Something akin to the COVID-19 lockdown period would be needed, only this level of diminished economic activity would be permanent.

It makes you wonder if the COVID-19 lockdown was the test to see how much energy use would drop if everyone was stopped in place. And yes, during the COVID lockdowns, human activity did stop, economic activity did stop, and energy use did drop by the nearly amount we are talking about.

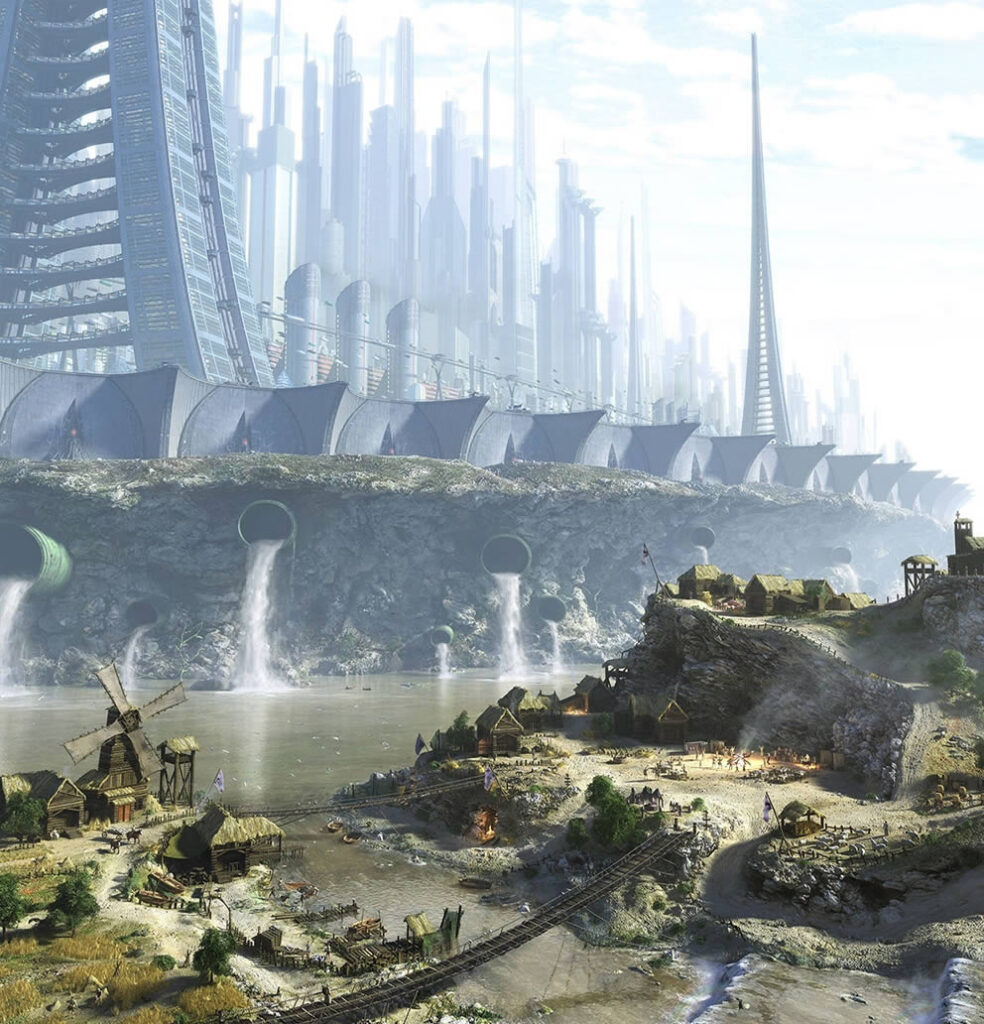

When you accept what Minneapolis Fed President Neel Kashkari is openly admitting in that interview segment, particularly as he is asked about the massive supply side costs and how that overlays, then you realize how prescient the image is below.

This image is the exact future you see flowing from the “radical transformation,” or what is also called “managing the transition“…

At the end of the transition, you have two social societies. One social system is a massive assembly of human activity all in close proximity. The alternative social system consists of those who do not wish to be jammed into Build Back Better cities yet forced to sustain themselves because the energy production and delivery resources in the larger geography have been stopped.

Now you know why I asked the question, “where would you live” over a decade ago.

Post a Comment