Ukraine crisis: Russian oil and gas turn to Asia

Indian Prime Minister Narendra Modi has said that protecting the country's energy security is vital and there should be no restrictions on energy supply.

India has been buying increasing amounts of cheaper Russian oil, and China's imports of Russian oil have also grown in the aftermath of Russia's invasion of Ukraine.

How much Russian oil is going to Asia?

India and China are currently the largest single buyers of Russian crude oil.

India's imports of Russian oil have rocketed from a very low base at the start of the year reaching a peak in June and July and largely maintaining these levels through to October.

China's purchases of Russian oil have fluctuated this year, falling in February at the start of Russia's invasion of Ukraine, but then rising significantly in the following months.

Russia has been selling oil at a discounted rate since March this year after the Ukraine invasion.

In March, combined oil imports by China and India from Russia overtook those from the 27 EU member states.

Other countries have also taken advantage of discounted Russian crude like Sri Lanka, which has been grappling with a severe economic crisis.

Cheaper oil is driving the flow to Asia

Following its invasion of Ukraine, Russia had fewer buyers for its Ural crude oil, with some foreign governments and companies deciding to shun its energy exports, and its price started to fall.

At one point Russian Urals crude was more than $30 a barrel cheaper than Brent crude (the global benchmark). By the end of September it was around $20 a barrel cheaper.

The US government had been critical of these purchases, although it's now made clear that it accepts that India can continue to buy discounted Russian oil.

The G7 countries - the UK, US, France, Germany, Japan, Italy and Canada - have proposed a plan to cap the price of Russian oil to minimise revenue generated from it.

But it's not yet clear what impact it could have on countries like India and China that are already buying Russian oil at a discount.

Moscow has said will stop selling to countries that join this attempt to impose price caps on its crude exports.

Also, in December, the EU is due stop imports of Russian oil by sea completely as part of measures taken against Russia after its invasion of Ukraine.

What's the impact of sanctions against Russia?

Although the price of Russian crude oil is attractive, India's refineries are facing a challenge trying to finance purchases, because sanctions on Russian banks are affecting payment transactions.

One of the options India is looking at is a system based on local currencies, where Indian exporters to Russia get paid in roubles instead of dollars or euros and imports are paid for in rupees.

China's state-owned oil enterprises are increasingly using the Chinese renminbi rather than the US dollar to finance oil purchases from abroad.

What's happening to gas exports from Russia?

Nearly 50% of India's total gas requirements come from abroad - but mostly from the Gulf States, with very little from Russia.

"Deliveries of Russian LNG (liquefied natural gas) to India are rare" says Antonio Peciccia, a commodity industry expert with Argus media. "We believe five cargoes so far this year, down from seven a year earlier".

China imports most of its gas via pipeline from central Asia. Currently, Turkmenistan is the largest supplier.

Once a new pipeline, known as Power of Siberia, is completed later this decade, Russia may well take over as China's biggest supplier of gas.

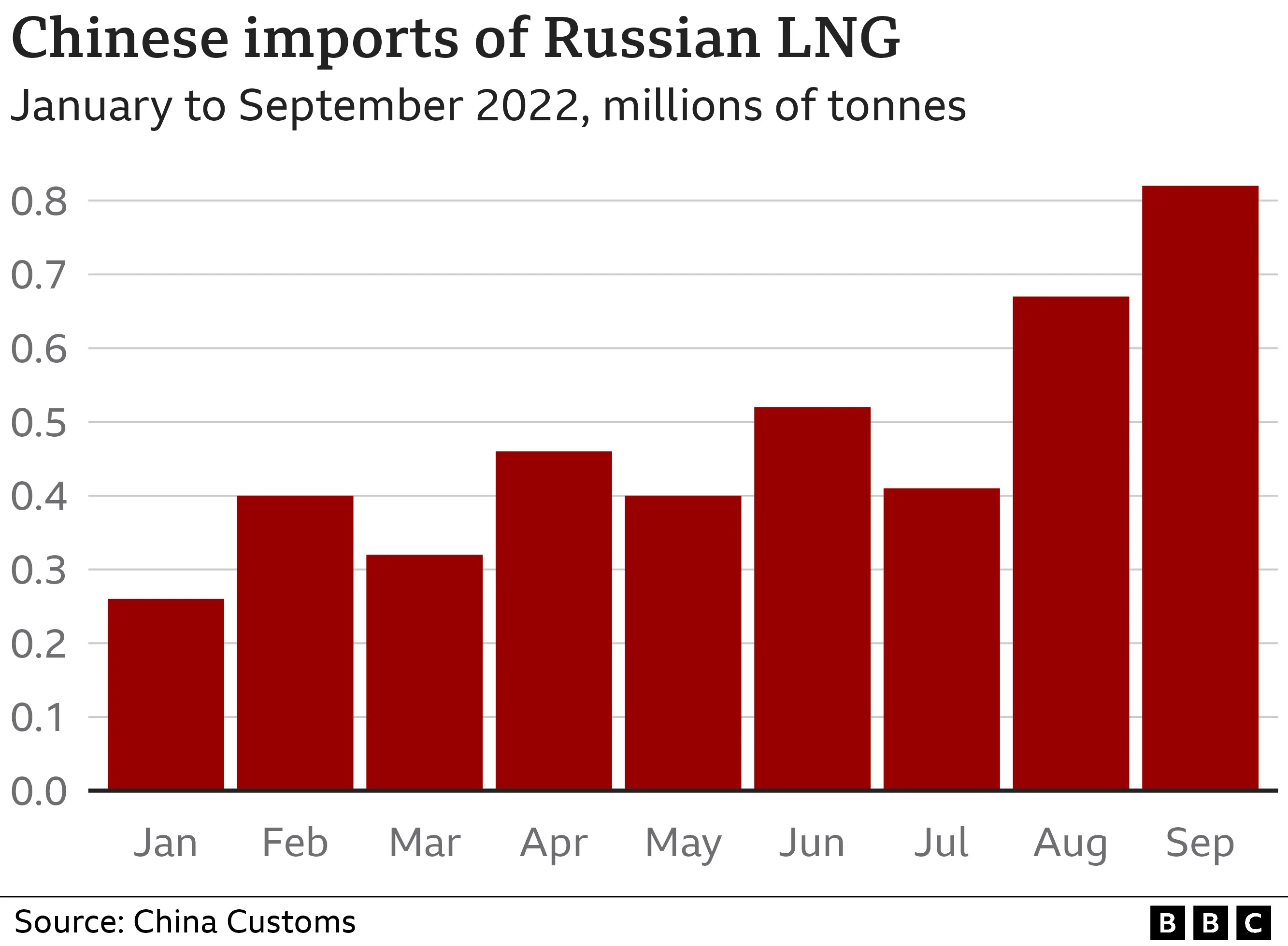

And there's been a noticeable increase this year in liquefied natural gas (LNG) imports from Russia, although most of China's LNG still comes from other countries.

China has signed new deals to transport Russian LNG via the Arctic.

In September, Russia's Gazprom and the China National Petroleum Corporation agreed to use Russian roubles and yuan instead of dollars to make payments for Russian gas.

Post a Comment