World’s Second Largest Appliance Manufacturer Announces Earnings Collapse and Inventory Buildup as Consumer Sales Plummet

Mid-August CTH noted, “amid all of the headline warnings about inflation and prices of essential products, CTH notes that if we are to continue waiting about six months, we would see a massive backlog of unsold goods and as a consequence the prices of non-essential durable goods would begin a rapid decline. That exact scenario is about to unfold.” {link}

Today the world’s second largest appliance manufacturer, Electrolux, announced a collapse of corporate earnings -the result of the western alliance economic contraction- leading to major cost cutting and future incentive programs. [Announcement Link, emphasis mine]

Today the world’s second largest appliance manufacturer, Electrolux, announced a collapse of corporate earnings -the result of the western alliance economic contraction- leading to major cost cutting and future incentive programs. [Announcement Link, emphasis mine]

(Electrolux) – […] Market demand for core appliances in Europe and the US so far in the third quarter is estimated to have decreased at a significantly accelerated pace compared with the second quarter, driven by the impact of high inflation on consumer durables purchases and low consumer confidence. High retailer inventory levels have amplified the impact of the slowdown in consumer demand.

In combination with supply chain imbalances resulting in significant production inefficiencies and increased costs, the third quarter earnings for the Group are expected to decline significantly compared to the second quarter 2022 also excluding the one-time cost to exit the Russia market. This has been driven mainly by Europe and North America. Business Area North America is expected to report an operating loss in the third quarter exceeding the loss in the second quarter.

Since market demand for 2023 is expected to continue to be weak in both regions, the Board has today decided to initiate a Group-wide cost reduction program addressing both variable and structural costs. The program, which starts immediately, will focus on reducing variable costs, with special attention to eliminating cost inefficiencies in our supply chain and production. The structural cost reductions will primarily take place in Europe and North America. (more)

Keep in mind, this is not necessarily a collapse of total global economic activity; what we are seeing is a collapse of western nation economic activity that is impacting the rest of the world. A great economic fracturing is taking place as the western nations intentionally shrink their economy. The supplier nations are feeling the consequences.

Keep in mind, South Korean factory output is now negative (electronics etc). European factory output is now negative (industrial equipment). Japanese factory output has dropped dramatically, and U.S. factory output has stalled. All of these issues overlay the statements by Maersk that shipping is not needed.

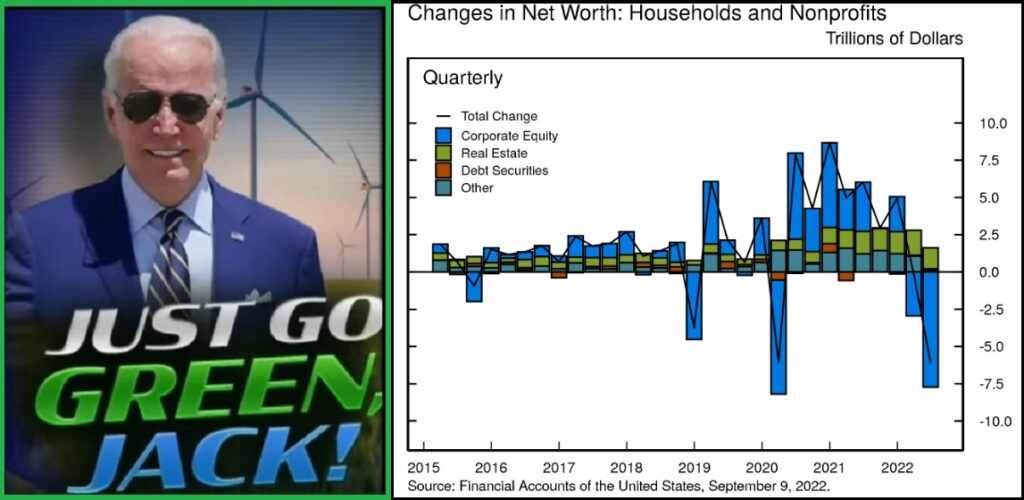

The western economies are contracting in response to the collective energy policies of the Build Back Better climate change agenda, and the high cost of energy that comes from stopping energy production.

Energy production in western nations has been slowed or stopped (Build Back Better). Western nation inflation is being driven by higher energy costs as a result of less energy products being produced, oil, coal, gas. Western banking groups have raised interest rates to slow down the economic engines to meet the drop in energy production.

All of this is being done with intent, purpose and control. This is a managed decline.

Post a Comment