White House Introduces the Joe Biden “U.S. Central Bank Digital Currency”

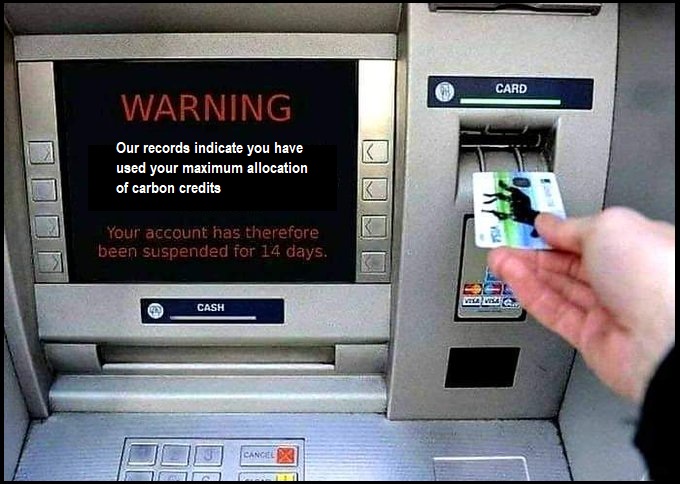

If you combine government use of energy policy, government regulation on individuals around that energy policy, and the self-interested need to control political opposition, you discover one of the most effective ways to control human activity is to control their finance.

Canadian Prime Minister Justin Trudeau gave us a great example of that when he weaponized the power of the Canadian government to target the protesting truckers and those who support them. You might remember Trudeau’s government locked down bank accounts, froze assets, denied loans, blocked mortgages and generally confiscated the wealth and incomes of his political opposition without any due process; all because the people were challenging his totalitarian COVID dictates. {Go Deep}

Canadian Prime Minister Justin Trudeau gave us a great example of that when he weaponized the power of the Canadian government to target the protesting truckers and those who support them. You might remember Trudeau’s government locked down bank accounts, froze assets, denied loans, blocked mortgages and generally confiscated the wealth and incomes of his political opposition without any due process; all because the people were challenging his totalitarian COVID dictates. {Go Deep}

Take those reference points as an overlay and now consider this undiscussed recent announcement from the Biden administration:

[White House] – President Biden often summarizes his vision for America in one word: Possibilities. A “digital dollar” may seem far-fetched, but modern technology could make it a real possibility.

A United States central bank digital currency (CBDC) would be a digital form of the U.S. dollar. While the U.S. has not yet decided whether it will pursue a CBDC, the U.S. has been closely examining the implications of, and options for, issuing a CBDC. If the U.S. pursued a CBDC, there could be many possible benefits, such as facilitating efficient and low-cost transactions, fostering greater access to the financial system, boosting economic growth, and supporting the continued centrality of the U.S. within the international financial system. However, a U.S. CBDC could also introduce a variety of risks, as it might affect everything ranging from the stability of the financial system to the protection of sensitive data.

Notably, these benefits and risks might vary significantly based on how the CBDC system is designed and deployed. That is why Executive Order 14067, Ensuring Responsible Development of Digital Assets, placed the highest urgency on research and development efforts into the potential design and deployment options of a U.S. CBDC. The Executive Order directed the Office of Science and Technology Policy (OSTP), in consultation with other Federal departments and agencies, to submit to the President a technical evaluation for a potential U.S. CBDC system.

Today, OSTP is publishing its report, Technical Evaluation for a U.S. Central Bank Digital Currency System, which lays out policy objectives for a potential U.S. CBDC system and analyzes key technical design choices for a U.S. CBDC system. The report also estimates the technical feasibility of building a CBDC minimum viable product and describes how a U.S. CBDC system might affect Federal operations. The report makes recommendations on how to prepare the Federal Government for a U.S. CBDC system. Importantly, the report does not make any assessments or recommendations about whether the U.S. should pursue a CBDC, nor does it make any decisions regarding particular design choices for a potential U.S. CBDC system. (read more)

When you read that full announcement, you realize they have already built the system.

When you read that full announcement, you realize they have already built the system.

If the system is built and they are now making policy recommendations for implementation, the question becomes ‘what’s the goal’?

We do not have to look far for the explanation.

the World Government Summit 2022 took place on March 29 and 30 in Dubai, hosting more than 4,000 individuals from 190 countries including senior government officials, heads of international organizations, and global “experts.” The invited participants presented ideas and worldviews from within their various fields of specialty.

One presentation was from Dr. Pippa Malmgren, an American economist who served as special advisor on Economic Policy to President George W. Bush.

Her father, Harald Malmgren, served as a senior aide to US Presidents John F. Kennedy, Lyndon B. Johnson, Richard Nixon, and Gerald Ford. In this segment, Mrs. Malmgren says the quiet part out loud. Yes, they are no longer hiding the construct; indeed, as you will hear they are saying quite openly what the future will look like. WATCH (2 minutes):

[Full Source – 6 hours (internal segment at 18:30)]

Transcript – Dr. Malmgren: “What underpins a world order is always the financial system. I was very privileged. My father was an adviser to Nixon when they came off the gold standard in 71. And so, I was brought up with a kind of inside view of how very important the financial structure is to absolutely everything else.

And what we’re seeing in the world today, I think, is we are on the brink of a dramatic change where we are about to, and I’ll say this boldly, we’re about to abandon the traditional system of money and accounting and introduce a new one. And the new one. The new accounting is what we call blockchain.

It means digital, it means having a almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what’s going on. It also raises huge dangers in terms of the balance of power between states and citizens.

In my opinion, we’re going to need a digital constitution of human rights if we’re going to have digital money. But also this new money will be sovereign in nature. Most people think that digital money is crypto, and private. But what I see our superpowers introducing digital currency, the Chinese were the first the US is on the brink, I think of moving in the same direction the Europeans have committed to that as well.

And the question is, will that new system of digital money and digital accounting accommodate the competing needs of the citizens of all these locations, so that every human being has a chance to have a better life? Because that’s the only measure of whether a world order really serves!”

The entry into a digital currency, needs a digital identity.

The end goal of a digital currency is why western political leaders have not been worried about following the COVID-19 spending demands from the World Economic Forum. {Go Deep}

When the global trade currency does not need to be pegged to anything to determine value, it is completely fiat. This is the current problem with global trade and transactions taking place in U.S. dollars, which arbitrarily lifts the standard of life for Americans while providing no similar benefit to other nations. That view became the underlying motive for Osama Bin Laden to target the World Trade Center, twin towers. That view was/is also the perspective carried by Barack Obama, that lay behind his “fundamental change” statement.

A digital currency allows ultimate control on a global basis by a one world government, or western system of collective governments, that can assign value. No other mechanism will have as much control over the life of a person than a digital currency that will create a system of transactional credits and debits, perhaps also influenced by your social credit score.

The digital currency requires a digital identity in order for apportionment based on your value to society. This is essentially an extension of the Fabian mindset into the world of financial transactions and monetary evaluations. Fabians believed that some form of socioeconomic tribunal would be needed in order for each citizen to be quantified according to their “worth” to society. The Chinese social credit score is a variant of that same concept.

The phrase “you didn’t build that,” when espoused by former President Obama and current Senator Elizabeth Warren is also based on this collective worldview. Both believe that individuals do not succeed independently, but rather gain their ability to grow wealth by using the resources of the larger society, infrastructure, labor and education. The phrase “it takes a village” to raise a child, as espoused by Hillary Clinton is another variant of the same collective advocacy.

A digital currency and digital identity is not a conspiracy theory, these “global leaders” are explaining it to us out loud. However, I am concerned that most will not hear it, or understand it, until it is too late.

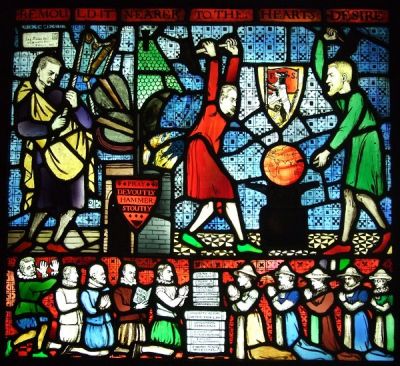

“Remold it nearer to the hearts desire”

or

“Build Back Better”

Same/Same

Post a Comment