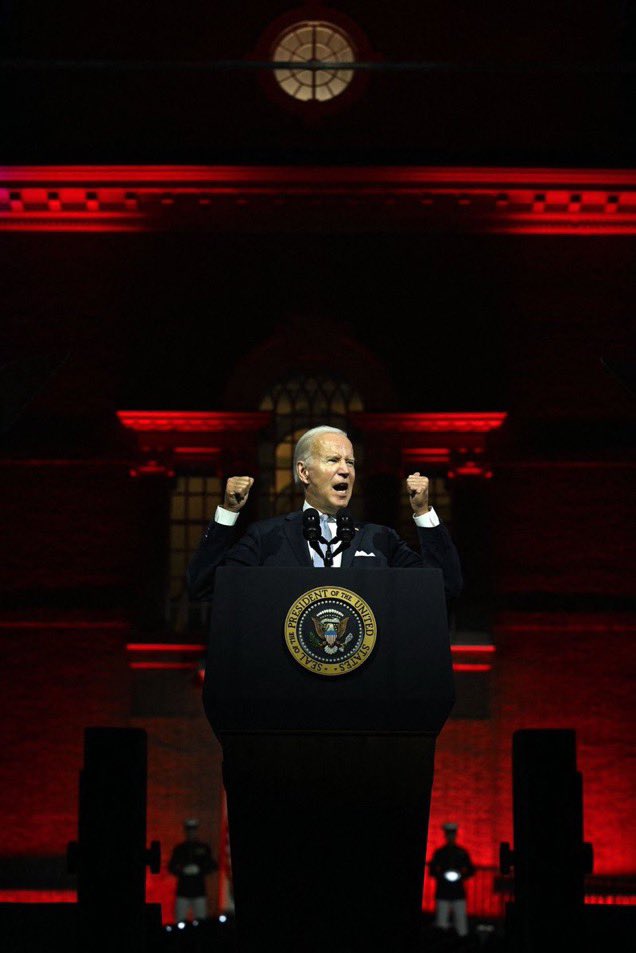

The Great Pretending – Denial of Truth Allows Easier Trespass

I was asked recently, what I considered to be the biggest problem of the current moment, and how would I describe it to my future self. My response was, we are living in an era of great pretending, and if you elevate yourself and pause its actually quite interesting to watch.

The pretending issue goes beyond politics, it’s everywhere. Sure, there was always an era where reality was skewed in favor of one position or another by various groups, people and leaders, where denying the obvious was always odd. However, this current state of our national and international disposition extends far beyond politics into almost everything.

The pretending issue goes beyond politics, it’s everywhere. Sure, there was always an era where reality was skewed in favor of one position or another by various groups, people and leaders, where denying the obvious was always odd. However, this current state of our national and international disposition extends far beyond politics into almost everything.

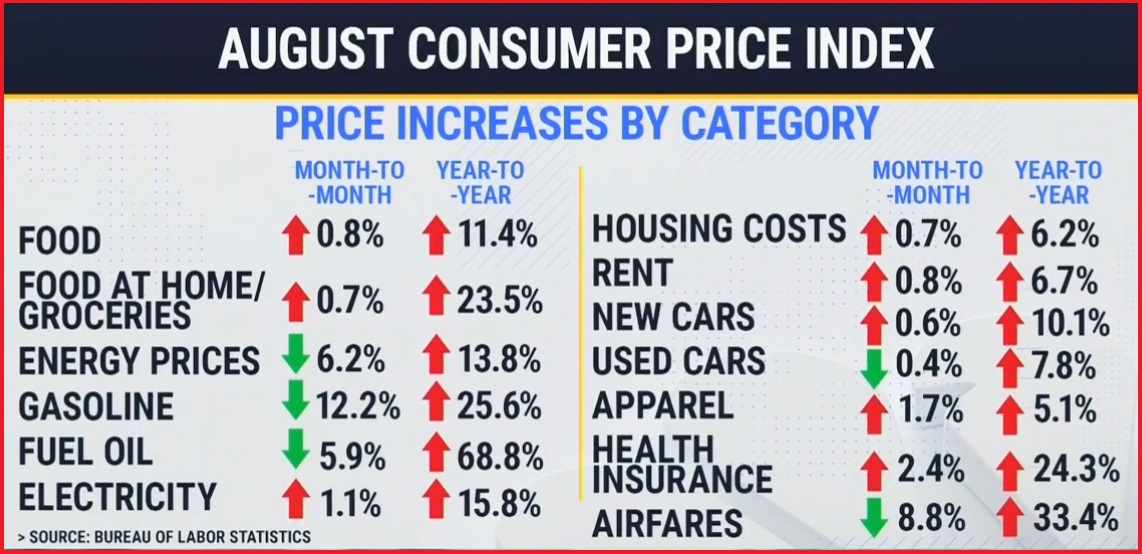

A person would ordinarily expect to see cultural or social pretending as an outcome of political correctness. Denying the underlying social construct behind the rules of the urban society has been the norm for several years. However, the pretending has become so pervasive it has recently extended into finance and economics; places where reality -actual outcomes- used to inoculate facts and figures against pretense.

It is no longer uncommon, heck, it’s become almost standard in this new era, to see CEO’s, CFO’s and even entire boards of directors, maintaining a standard of pretense. It is quite weird to see it happening.

Yes, this era -for a host of reasons- has made delusion somewhat of a norm.

In the social sphere, cultural norms now claim men can have babies, people can choose their gender, labels and pronouns, and everyone else bears the responsibility to conform to the delusion. While goofy, that part is somewhat a weird cultural phenomenon of this western era. If we were not pretending people like AOC would have no career opportunities.

In the political sphere, the axiom of politics being downstream from pop culture is perhaps the reason the infection of pretense has overwhelmed congress and the professional bureaucracies of government. The social pretending has metastasized from the federal level to the state level, and now we see efforts to counteract “wokeism” as a social priority for state and local leaders. It’s weird to see so much time and effort being exhausted on combatting social pretense at every level.

But the more stunning development comes in the sphere of economics, where factual outcomes of transactions are matters of simple accounting. A ledger of sales and profits would normally dictate whether a business was successful or failing, and in the bigger picture would show empirical evidence of the financial health of the community of customers who purchase goods and services.

Under all common norms of economics, if a business was operating at a higher cost than its income; or if the income was to shift or disappear quickly; people would seek to identify the underlying cause. However, in this era of great business pretending, an economic mass formation psychosis has led to complete denial of the obvious.

Accepting the state of the Main Street economy as it is – not as we would pretend it to be, CTH shared several months ago that quarterly profits would be far below expectations, and we would see revised projections from just about every business entity who engages in selling durable goods. People just are not buying stuff because the cost of living and buying energy, food, fuel and shelter, has become extraordinarily difficult. It isn’t rocket science to connect economic dots.

As expected, at a macro-level, topline sales for businesses have dropped or collapsed. Inventories of non-essential products are piling up. Consumers are stressed and/or hunkering down, and general economic activity has slowed dramatically.

None of what is happening is surprising. However, what is surprising is that businesses -while faced with empirical results that describe the situation- would continue pretending.

Yahoo Finance – […] The auto giant Ford warned of a whopping $1 billion profit hit late Monday in the form of higher parts costs, with the company blaming vendor inflation. Ford now sees third-quarter adjusted operating profits in the range of $1.4 billion to $1.7 billion, well below Wall Street estimates for $3 billion.

Somewhat oddly in the face of the major warning, Ford reiterated its full-year operating profit outlook of $11.5 billion to $12.5 billion.

The mood on Wall Street is that Ford’s warning is generally a shocker given relatively upbeat comments on demand and the bottom line when second-quarter earnings hit in late July. Now, the Street is scrambling to mark down profit and valuation estimates on the company.

“Vehicles in transit will be seen as transitory, but surprise inflation is always worrying,” said Evercore ISI analyst Chris McNally in a note to clients, adding that he sees Ford’s stock trading down to about $13 off the quarterly letdown. Citi’s Itay Michaeli also appeared stunned by Ford’s warning. (read more)

The great pretending continues…..

Post a Comment