Following Boost of $80 Billion from Congress, Treasury Secretary Tells IRS Enforcement to Prepare for New Technology Era

When congress approved $80 billion in new funding for the Internal Revenue Service (IRS) enforcement division, the intellectually honest crowd knew this was not just about hiring more IRS agents. Indeed, the personnel side of the spending will almost certainly pale in comparison to the IRS creating new technological enforcement mechanisms to track electronic payment systems. Ultimately, it’s just an obvious evolution in IRS monitoring and surveillance.

Yesterday, Treasury Secretary Janet Yellen seemed to outline exactly that when she sent the IRS a memo instructing them to develop an action plan within six months for how to improve the technology needed to expand enforcement {link}. What we are likely to experience is the next phase in the public-private partnership, this time focused almost exclusively on electronic payment systems, income and earnings.

Yesterday, Treasury Secretary Janet Yellen seemed to outline exactly that when she sent the IRS a memo instructing them to develop an action plan within six months for how to improve the technology needed to expand enforcement {link}. What we are likely to experience is the next phase in the public-private partnership, this time focused almost exclusively on electronic payment systems, income and earnings.

On August 10th, after reviewing the legislative language, CTH said, “I predict (in phase one) the IRS will soon create an office of “digital income verification and audits” or DIVA. This agency will be used to confiscate and remove access to on-line funds. In phase two they trigger the ‘climate change’ control mechanisms.” {link} It’s not that much of a prediction as it is just an acceptance of this ongoing big government continuum.

An IRS enforcement agency specifically focused on “Digital Income Verification and Audits” (DIVA), is a transparent mechanism following the basic principles of the government partnership with big tech social media. The IRS version will be a collaboration, and/or monitoring system, between the Treasury Dept and processors of on-line funds like PayPal or GiveSendGo, etc. Just like social media, the payment processing systems will eventually be merged with government systems.

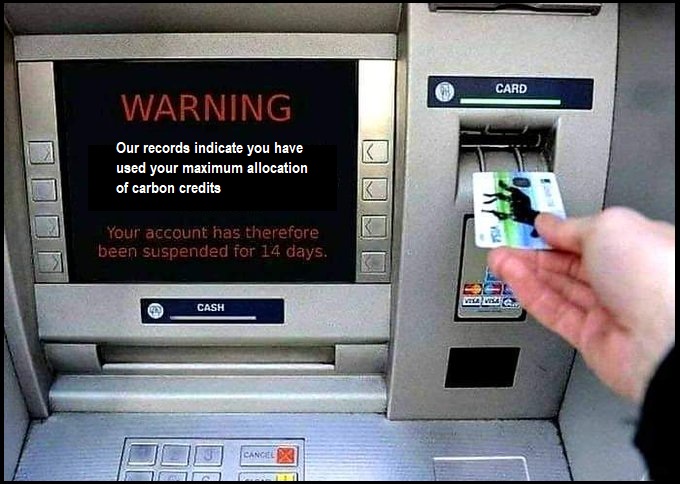

Once this technological system is built, legal and regulatory framework constructed, real time monitoring of on-line currency flow will be possible. Once that phase is fully executed, then phase-2 becomes possible. Phase two would likely involve the control or blocking of any transaction deemed against the regulations of the governing authority.

Example: If you used your debit card to purchase too much gasoline (fossil fuel) or meat (regulated food product), the carbon credit program attached to phase-2 could suspend your ability to make purchases.

The first step in the process is to have a surveillance system in place to view all monetary exchanges and payment processes that happen on-line. Thus, Secretary Yellen is asking the compliance division of the IRS for an action plan within six months to outline the IRS technology needed.

WASHINGTON (AP) — Now that President Joe Biden signed Democrats’ expansive climate, tax and health care bill into law, Treasury Secretary Janet Yellen has directed the IRS to develop a plan within six months outlining how the tax agency will overhaul its technology, customer service and hiring processes.

In part, the improvements are meant to “end the two-tiered tax system, where most Americans pay what they owe, but those at the top of the distribution often do not,” Yellen said in a Tuesday memo to IRS Commissioner Chuck Rettig, whose term ends in three months.

Yellen’s memo, obtained by The Associated Press, outlines the importance of modernizing IRS computer systems and ensuring the agency has an adequately-staffed workforce now that the tax collector is set to receive nearly $80 billion over the next 10 years. That funding is needed for more than technology. At least 50,000 IRS employees are expected to retire over the next five years.

[…] Yellen last week sent instructions to IRS leadership not to increase audit rates on Americans making under $400,000 a year annually.

“Instead, enforcement resources will focus on high-end noncompliance,” she said in her Aug. 11 guidance. “There, sustained, multi-year funding is so critical to the agency’s ability to make the investments needed to pursue a robust attack on the tax gap.” (read more)

That’s a parseltongue phrase if I have ever seen one. “Do not increase audit rates,” simply means if 75% of current audits are targeting the middle class within the current IRS budget, make sure only 75% of new audits target the middle class with the doubled budget. The number of audits doubles, but the rate of the audit in comparison to the IRS targeting remains the same.

Keep in mind, from their reference point it’s not your money, it’s theirs. That is why left-wing government officials use phrases like “spending in the tax code” to explain allowing people to keep their own income.

Post a Comment