May Inflation Higher Than all Expectations at 8.6% - Energy, Gasoline, Food Prices Continue Climbing

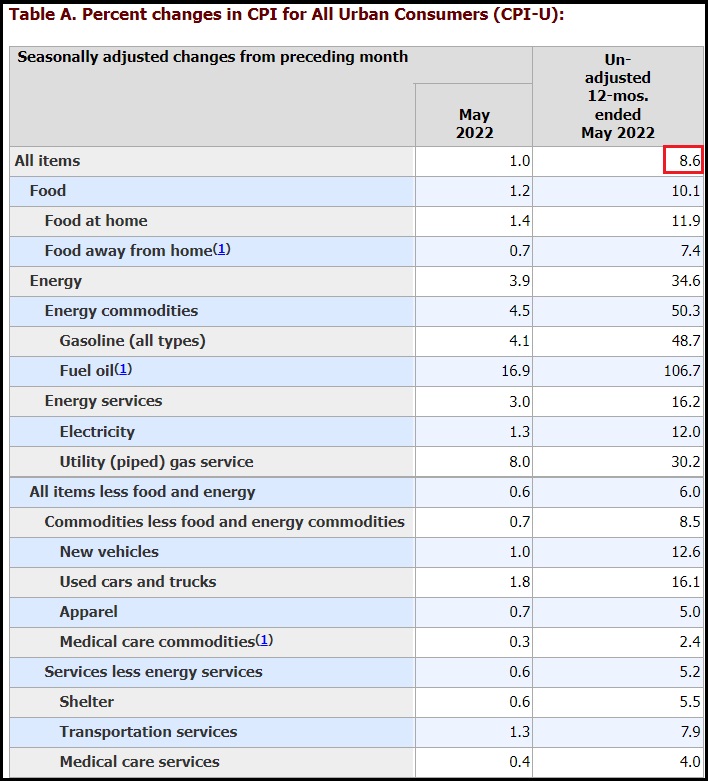

The Bureau of Labor and Statistics has released the May inflation report [DATA HERE] showing a 1.0% increase in the month of May, bringing the rate of inflation to 8.6 percent. The highest rate of inflation in over 40 years.

This month of inflation data is particularly important because it cycles through the May 2021 calendar comparison from last year when the first wave of massive inflation first triggered. The current year-over-year 8.6% rate of inflation now lands atop twelve months of massive increases in prices.

This month of inflation data is particularly important because it cycles through the May 2021 calendar comparison from last year when the first wave of massive inflation first triggered. The current year-over-year 8.6% rate of inflation now lands atop twelve months of massive increases in prices.

The data clearly shows how energy costs are the dominant factor hitting every aspect of consumer purchasing. Gasoline increased 4.1% for the month, 48.7% year-over-year. Fuel Oil increased 16.9% in May, 106.7% year over year.

The energy sector is crushing the ability of consumers to spend on anything else. Real wages declined in May 0.6% as paychecks are being eaten up by massive inflation. On an annual basis wages have declined by 4% year-over-year [BLS DATA].

Unfortunately, there is no forward optimism for any change in energy policy from the Joe Biden White House, that means energy costs will continue skyrocketing as the ideologues in control of the administration push their climate change Green New Deal policies.

Additionally, we still have the third wave of massive food price increases to look forward to later in the summer as the big increases in field costs start to reach the supermarket. Those food store increases will average around 20 to 30% more than current.

Table-2 gives you a great breakdown of the price increases in specific sectors within each of the larger categories. [SEE HERE] Eggs increased 5% in May, that’s a 60% annualized rate of inflation for eggs, which are already 32% more than last year. Chicken is exceeding 30% inflation and growing.

A CNBC media report is below, as Wall Street laments the Fed response. However, the Fed cannot do anything to stop this inflation because what’s needed is a total reversal of U.S. energy policy.

[CNBC] – ““It’s hard to look at May’s inflation data and not be disappointed,” said Morning Consult’s chief economist, John Leer. “We’re just not yet seeing any signs that we’re in the clear.”

Some of the biggest increases came in airfares (up 12.6% on the month), used cars and trucks (1.8%), and dairy products (2.9%). The vehicle costs had been considered a bellwether of the inflation surge and had been falling for the past three months, so the increase is a potentially ominous sign, as used vehicle prices are now up 16.1% over the past year. New vehicle prices rose 1% in May.

Friday’s numbers dented hopes that inflation may have peaked and adds to fears that the U.S. economy is nearing a recession.

The inflation report comes with the Federal Reserve in the early stages of a rate-hiking campaign to slow growth and bring down prices. May’s report likely solidifies the likelihood of multiple 50 basis point interest rate increases ahead.

“Obviously, nothing is good in this report,” said Julian Brigden, president of MI2 Partners, a global macroeconomic research firm. “There is nothing in there that’s going to give the Fed any cheer. … I struggle to see how the Fed can back off.”

With 75 basis points of interest rate rises already under its belt, markets widely expect the Fed to continue tightening policy through the year and possibly into 2023. The central bank’s benchmark short-term borrowing rate is currently anchored around 0.75% -1% and is expected to rise to 2.75%-3% by the end of the year, according to CME Group estimates. (read more)

We are in an abusive relationship with government…

Post a Comment