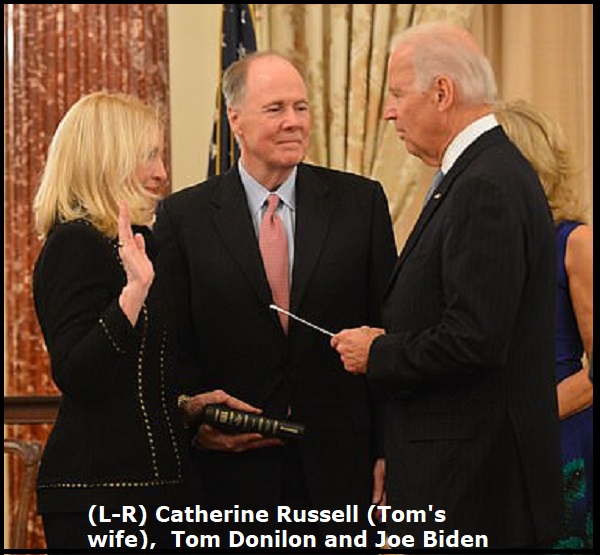

Absolutely Stunning DC Corruption – State Dept Appoints Blackrock Tom Donilon to U.S. Foreign Policy Board

The conflict of interest is simply off-the-proverbial charts here. Tom Donilon is a deep DC swamp operator and has been for his entire career. Donilon is connected to every tentacle of the Obama and Biden administrations. Donilon is also the Chairman of the BlackRock Investment Institute.

We have written about the conflicts {Go Deep Here} and {Go Deep Here}, but this move by Secretary of State Anthony Blinken is stunningly fraught with serious conflicts of interest.

We have written about the conflicts {Go Deep Here} and {Go Deep Here}, but this move by Secretary of State Anthony Blinken is stunningly fraught with serious conflicts of interest.

Tom Donilon’s literal job description at Blackrock is to “leverage the firm’s expertise and generate proprietary research to provide insights on the global economy, markets, geopolitics and long-term asset allocation,” and the State Dept has just appointed him as Co-Chair of the U.S. foreign policy advisory board.

Specifically, the Biden administration has just put Blackrock Investment Institute Chairman Tom Donilon in charge of U.S-China policy.

How in the proverbial hell can this be permitted? That’s way beyond a rhetorical question. The Dept of State has selected a team of Wall Street control agents to guide global U.S. policy.

(STATE DEPT) – Today, Secretary Blinken announced his selections for the U.S. Department of State’s Foreign Affairs Policy Board.

Since its establishment in 2011, the Board has provided independent advice on the conduct of U.S. foreign policy and diplomacy, consistent with each Secretary of State and administration’s evolving priorities for it.

Secretary Blinken has sought to build a diverse board that could advance the Department’s efforts to better root American diplomacy in the needs and aspirations of the American people. With expertise at the intersection of foreign and domestic policy, the Board will focus on the issues of increasing importance to the lives and livelihoods of Americans in the decade ahead, including cybersecurity and emerging technologies, climate and energy, international economics, global health, and strategic competition with the People’s Republic of China. (read more)

Tom Donilon has been appointed Co-Chair of this foreign policy group.

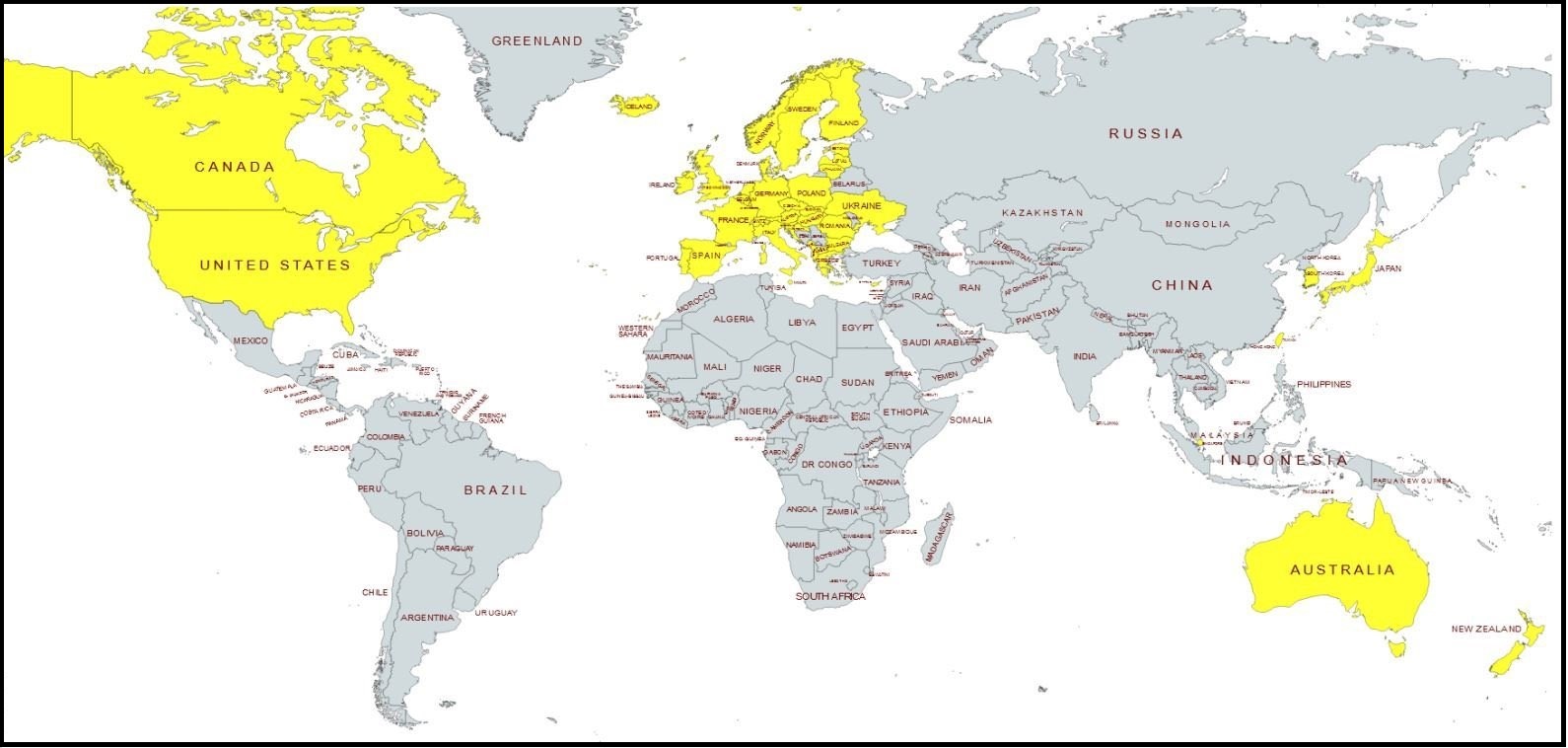

(JUNE 2021) BlackRock, Inc. (together with its subsidiaries) is a massive publicly traded multinational investment firm with over $8.68 trillion in assets under management [December 31, 2020 financial statement] in more than 100 countries across the globe.

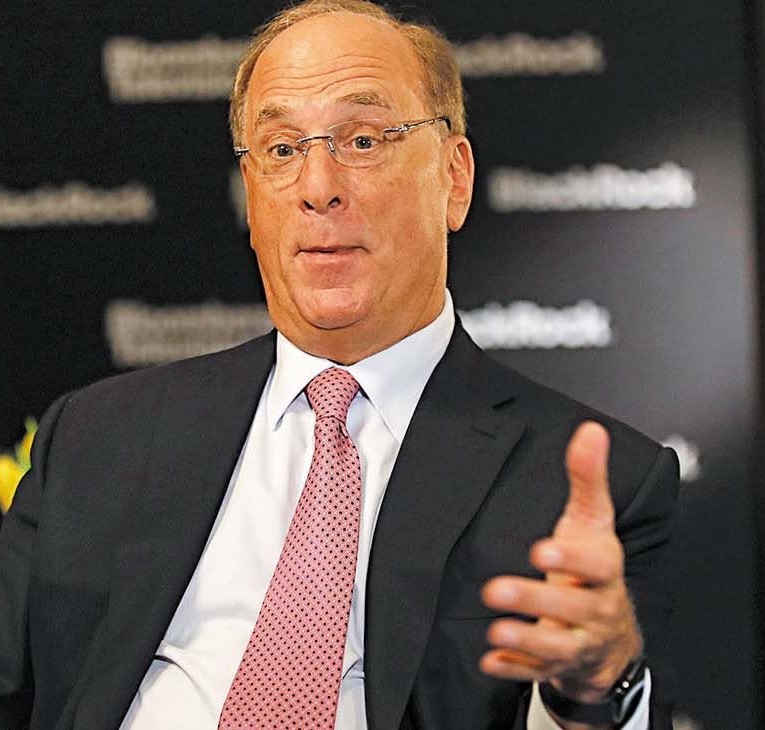

To say that Blackrock is invested in globalism, climate change and leftist politics, would be a severe understatement {See Here}. Larry Fink is the CEO and people like Cheryl Mills, Hillary Clinton’s attorney of record, are on the board.

Inside BlackRock there is a division called the BlackRock Investment Institute (BII) {See Here}.

Essentially the role of the BII is to tell BlackRock what is going to happen around the globe, and be the tip-of-the-spear in directing BlackRock where to invest money by predicting political events.

The Chairman of the BlackRock Investment Institute is Tom Donilon, President Obama’s former National Security Advisor (before Susan Rice), and a key advisor to Joe Biden throughout his career in politics.

You cannot get more deeply connected in the swamp financial schemes than Tom Donilon.

Donilon has been in/around government for 35+ years, deeply connected. Before joining the Obama administration Donilon was a registered lobbyist from 1999 through 2005 for O’Melvney & Myers. {Bio Here} Tom’s sole client was Fannie Mae. Fannie Mae is a government-backed private corporation that sells mortgages to investors.

Donilon took the lobbying gig because he was previously Executive Vice President for Law and Policy at Fannie Mae where he was responsible for Fannie Mae’s legal, regulatory, government affairs, and public policy issues. Tom Donilon’s BlackRock Biography reads like a who’s-who of connections to the swamp {READ HERE}

♦Tom Donilon’s brother, Mike Donilon is a Senior Advisor to Joe Biden {link} providing guidance on what policies should be implemented within the administration. Mike Donilon guides the focus of spending, budgets, regulation and white house policy from his position of Senior Advisor to the President.

♦Tom Donilon’s wife, Catherine Russell, is the White House Personnel Director {link}. In that position Donilon’s wife controls every hire in the Office of the Presidency.

♦Tom Donilon’s daughter, Sarah Donilon, who graduated college in 2019, now works on the White House National Security Council {link}

So let me just summarize this…. The Chairman of the BlackRock Investment Institute, the guy who tells the $8.7 trillion investment firm BlackRock where to put their money, has a brother who is the Senior Advisor to Joe Biden; has a wife who is the White House Personnel Director; and has a daughter who is now on the National Security Council.

Put another way… Tom Donilon’s literal job description for BlackRock is to: “leverage the firm’s expertise and generate proprietary research to provide insights on the global economy, markets, geopolitics and long-term asset allocation,” and his wife is in charge of White House personnel, his brother is Senior Advisor to the President, and his daughter is on the National Security Council. He has just been put in charge of U.S-China policy by the State Dept.

You seeing this?

Conflicts, insider trading, influence and insider information much?

So now the question becomes, WHY?

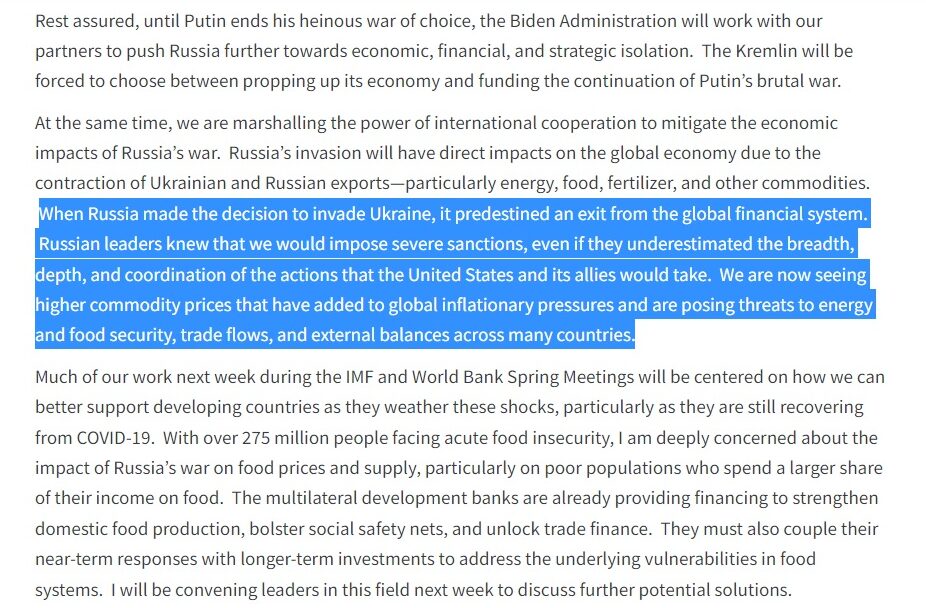

Here is the answer – March, 2022:

When CTH outlined the ‘Destination Handbasket’ framework {Go Deep}, we had no idea Blackrock CEO Larry Fink was essentially going to confirm the premise of our prediction. Keep in mind, any digital currency can only work if there is a digital identity attributed to it – what some have called a digital passport which then creates a crypto wallet.

I have based the framework, of what appears to be over the horizon, on a set of inevitable geopolitical outcomes if the current path is continued. The letter by Blackrock CEO Larry Fink [LINK] seems to affirm the strongest likelihood of a western-inspired digital currency eventually replacing the dollar.

NEW YORK, March 24 (Reuters) – BlackRock Inc’s (BLK.N) chief executive, Larry Fink, said on Thursday that the Russia-Ukraine war could end up accelerating digital currencies as a tool to settle international transactions, as the conflict upends the globalization drive of the last three decades.

In a letter to the shareholders of the world’s largest asset manager, Fink said the war will push countries to reassess currency dependencies, and that BlackRock was studying digital currencies and stablecoins due to increased client interest.

“A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption”, he said.

[…] In the letter on Thursday, the chairman and CEO of the $10 trillion asset manager said the Russia-Ukraine crisis had put an end to the globalization forces at work over the past 30 years.

[…] “While companies’ and consumers’ balance sheets are strong today, giving them more of a cushion to weather these difficulties, a large-scale reorientation of supply chains will inherently be inflationary,” said Fink.

He said central banks were dealing with a dilemma they had not faced in decades, having to choose between living with high inflation or slowing economic activity to contain price pressures. (read more)

You see that problem, that “dilemma” Fink mentions in the last paragraph above. That is what we have been talking about on these pages for more than two years. It is a dilemma western government created when they all joined together and followed the exact same financial path during the pandemic.

You see that problem, that “dilemma” Fink mentions in the last paragraph above. That is what we have been talking about on these pages for more than two years. It is a dilemma western government created when they all joined together and followed the exact same financial path during the pandemic.

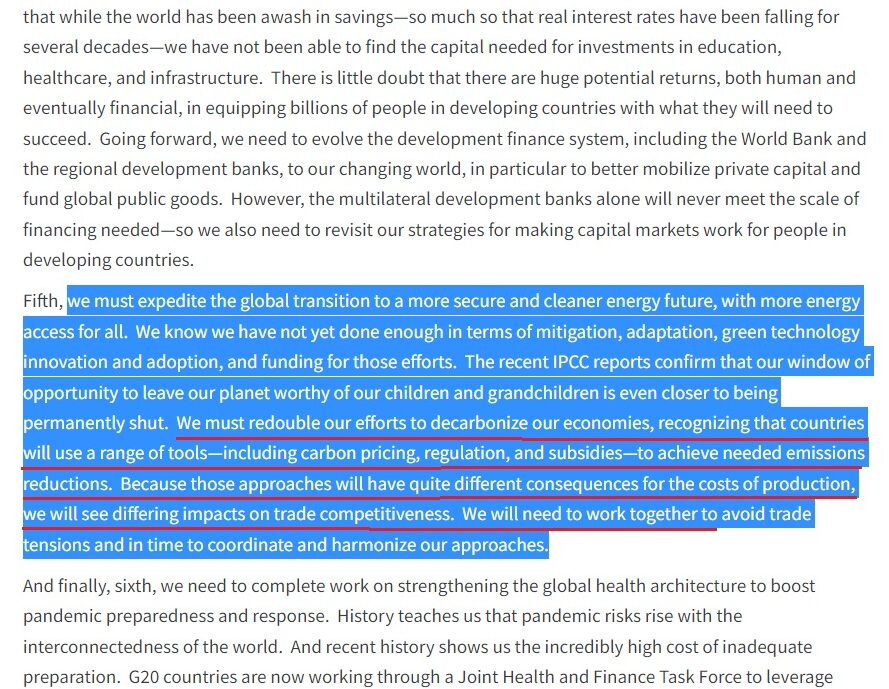

When western governments used the justification of the global pandemic to shut down their economies, enforce lockdowns and all of the subsequent rules, restrictions and economic pains as a direct result of those decisions, they put us on a crisis path that was always going to bring us to this “dilemma.” Quite frankly, I do not see that unity of action as accidental, nor do I see it as organic.

All of the western leaders followed the same monetary and financial policy that was being advanced by the World Economic Forum. They all spent like crazy, and provided tens-of-trillions in bailouts, subsidies and cash payments to cover the economic losses created by their COVID lockdowns. They all did exactly the same thing, and that collective action is why we have ‘global inflation.’

Perversely, while inflation crushes the working class, global inflation works to their benefit by lowering the cost of the debt the politicians created, which the central bands and federal reserve facilitated. We the citizens are suffering under inflation, but the governments that created the inflation actually benefit from it.

I will say with great deliberateness, these western governments want inflation. Sure, it provides a political challenge for those who need to get reelected by voters, but in the bigger of big pictures, they need inflation. Think about it in very simple terms. If they did not want inflation, those same central banks and federal reserve policy makers would have raised interest rates six to eight months ago.

None of what is happening in supply chains and inflation is a surprise to them; they might pretend not to know, but these are not stupid people. This is by design. Media covers for them because, well, I’ll accept the PR firms for the regimes are idiots. However, the people who constructed these policies to take advantage of COVID-19 are not dummies. They knew what all that intervention, manipulation and govt spending would lead to.

Where we are going now is a self-fulfilling prophecy, a destination that is a result of specific action the guided policymakers have taken.

The World Government Summit 2022 took place on March 29 and 30 in Dubai, hosting more than 4,000 individuals from 190 countries including senior government officials, heads of international organizations, and global “experts.” The invited participants presented ideas and worldviews from within their various fields of specialty.

One presentation that needs to be highlighted was from Dr. Pippa Malmgren, an American economist who served as special advisor on Economic Policy to President George W. Bush.

Her father, Harald Malmgren, served as a senior aide to US Presidents John F. Kennedy, Lyndon B. Johnson, Richard Nixon, and Gerald Ford. In this segment, Mrs. Malmgren says the quiet part out loud. Yes, they are no longer hiding the construct; indeed, as you will hear they are saying quite openly what the future will look like. WATCH (2 minutes):

[Full Source – 6 hours (internal segment at 18:30)]

Transcript – Dr. Malmgren: “What underpins a world order is always the financial system. I was very privileged. My father was an adviser to Nixon when they came off the gold standard in 71. And so, I was brought up with a kind of inside view of how very important the financial structure is to absolutely everything else.

And what we’re seeing in the world today, I think, is we are on the brink of a dramatic change where we are about to, and I’ll say this boldly, we’re about to abandon the traditional system of money and accounting and introduce a new one. And the new one. The new accounting is what we call blockchain.

It means digital, it means having a almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what’s going on. It also raises huge dangers in terms of the balance of power between states and citizens.

In my opinion, we’re going to need a digital constitution of human rights if we’re going to have digital money. But also this new money will be sovereign in nature. Most people think that digital money is crypto, and private. But what I see our superpowers introducing digital currency, the Chinese were the first the US is on the brink, I think of moving in the same direction the Europeans have committed to that as well.

And the question is, will that new system of digital money and digital accounting accommodate the competing needs of the citizens of all these locations, so that every human being has a chance to have a better life? Because that’s the only measure of whether a world order really serves!”

The entry into a digital currency, needs a digital identity.

The end goal of a digital currency is why western political leaders have not been worried about following the COVID-19 spending demands from the World Economic Forum. {Go Deep}

When the global trade currency does not need to be pegged to anything to determine value, it is completely fiat. This is the current problem with global trade and transactions taking place in U.S. dollars, which arbitrarily lifts the standard of life for Americans while providing no similar benefit to other nations. That view became the underlying motive for Osama Bin Laden to target the World Trade Center, twin towers. That view was/is also the perspective carried by Barack Obama, that lay behind his “fundamental change” statement.

A digital currency allows ultimate control on a global basis by a one world government, or western system of collective governments, that can assign value. No other mechanism will have as much control over the life of a person than a digital currency that will create a system of transactional credits and debits, perhaps also influenced by your social credit score.

The digital currency requires a digital identity in order for apportionment based on your value to society. This is essentially an extension of the Fabian mindset into the world of financial transactions and monetary evaluations. Fabians believed that some form of socioeconomic tribunal would be needed in order for each citizen to be quantified according to their “worth” to society. The Chinese social credit score is a variant of that same concept.

The phrase “you didn’t build that,” when espoused by former President Obama and current Senator Elizabeth Warren is also based on this collective worldview. Both believe that individuals do not succeed independently, but rather gain their ability to grow wealth by using the resources of the larger society, infrastructure, labor and education. The phrase “it takes a village” to raise a child, as espoused by Hillary Clinton is another variant of the same collective advocacy.

A digital currency and digital identity is not a conspiracy theory, these “global leaders” are explaining it to us out loud. However, I am concerned that most will not hear it, or understand it, until it is too late.

Yes, in hindsight, all of it does seem planned to a long-term eventual conclusion. However, I’m not going to make that specific affirmation just yet; there are still strong elements of ‘not letting a crisis go to waste’ as the leading driver. Did these governing bodies create the underlying crisis? We can debate that, but the point is essentially moot. We are where we are.

The vaccination protocol created the Vax-Passport. That has opened the door to the digital identity, “digital id.” Any government created digital currency is going to need a digital id from the outset.

There are a lot of people asking where this is going, and what can be done to stop it. I’m pretty certain we have accurately identified “Where This is Going,” and I’m a lot more confident now about that aspect than I was even just 24 hours ago. However, knowing that, now we need to look closer at what they would do to stop us from disrupting it.

(U.S. Treasury Dept SOURCE LINK)

Post a Comment