Fertilizer Prices Continue Rising, Increasing Fears of Global Grain Costs and Shortages

As CTH has noted since last October the rapid increases in fertilizer costs could potentially create a major issue for global food supplies later this summer. As the farming costs continue escalating, including fertilizer and diesel fuel prices, this will eventually lead to major price increases on the harvests. Field to fork inflation is looking increasingly severe later this year; what we have called the third wave of inflation.

Beyond prices, a primary impact in the U.S. market, concerns are now escalating about grain shortages {SEE HERE} and lower European crop yields which will lead to less food products on a global basis. According to information shared by ZeroHedge, “We think it will take at least 2-3 years to replenish global grains stocks,” Illinois-based CF Industries Holdings Inc.’s president and chief executive officer Tony Will said in a statement in Wednesday’s earnings report.”

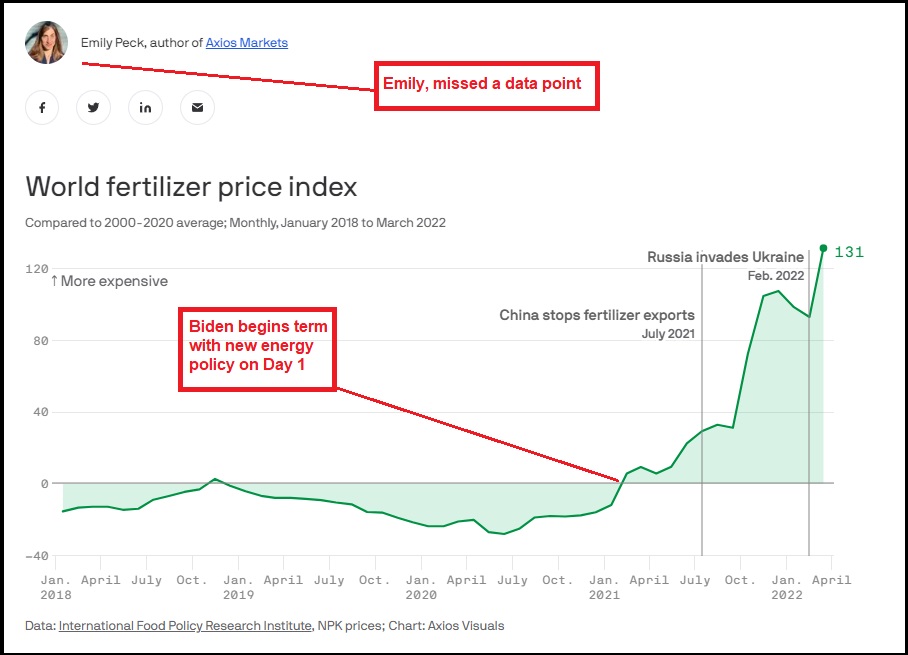

Axios is reporting on the continued escalation of fertilizer prices; however, they conveniently and purposefully avoid noting the origin of the problem in North America is directly the result of Joe Biden’s immediate energy policies that drove up the costs of natural gas (a critical component):

AXIOS – “Skyrocketing fertilizer costs — like those made from nitrogen, phosphorus and potassium (NPK) — are driving up food prices and, worse, threatening food security around the globe.

State of play: Prices for NPK were up 125% in January from a year before, and rose another 17% from the beginning of the year to March, according to data compiled by the International Food Policy Research Institute (IFPRI).

- The looming European ban on Russian natural gas (a critical component in manufacturing some fertilizers) could worsen the situation.

- “We’re in a dire situation right now,” said Svein Tore Holsether, the CEO of fertilizer maker Yara International, at a seminar hosted by IFPRI this week.

- If farmers use less fertilizer, they can’t produce as many crops — and that raises the specter of “malnutrition, political unrest and, ultimately, the otherwise avoidable loss of human life,” Bloomberg reported.

The big picture: Prices for these heavily traded raw materials were already rising in 2021, because of a myriad of factors: Hurricane Ida in the U.S., an upsurge in demand after the pandemic, supply chain issues, and rising natural gas prices that predated the war in Ukraine. (more)

It is clear to see the lower price of fertilizer when President Trump triggered U.S. energy independence through his use all resources method of energy development. Oil and natural gas prices dropped significantly as a part of the Trump energy policy which was directly connected to the his overall U.S. America-First economic policy.

We went from Trump inspired energy independence, low gasoline prices and the stable export of liquified natural gas (LNG) – to energy dependence, high gasoline prices and extreme increases in natural gas prices as a direct result of Joe Biden energy policy.

The downstream consequences of energy policy are extremely severe. Higher energy costs, higher petroleum costs, higher transportation costs and higher raw material costs drive inflation on all manufactured goods, including farm products.

The energy policy is not a mistake. These economic outcomes are a direct result of Joe Biden executing his Green New Deal / Build Back Better energy policy. Shortages of food are an outcome of chasing the climate change unicorn energy policy.

Yes, there is a direct connection between climate change energy policy and people starving around the world as a result of it.

Post a Comment