Biden blame game continues as inflation soars

Biden blame game continues as inflation soars

It’s past time for Biden to embrace economic reality

'Kennedy' party panel reacts to President Biden's 'economic blunders' as inflation hit 8.3% in April.

Wednesday’s Consumer Price Index release serves as yet another stark reminder that inflation remains out of control. The CPI continued to barrel ahead rising 8.3 percent in April—a 40-year-high but for last month’s 8.5 percent increase. The Dow Jones estimate was for an 8.1 percent increase.

In yet another piece of bad economic news released on Thursday, the Produce Price Index increased by 11% in April – above expectations for a fall to 10.7%. The PPI reflects wholesale prices which, of course, eventually make their way to retail prices and consumers’ wallets.

In even worse news for American workers, real wage growth simply is not keeping up with inflation. As a direct consequence of President Joe Biden’s reckless economic policies, Americans are still facing overstretched budgets and lower real wages.

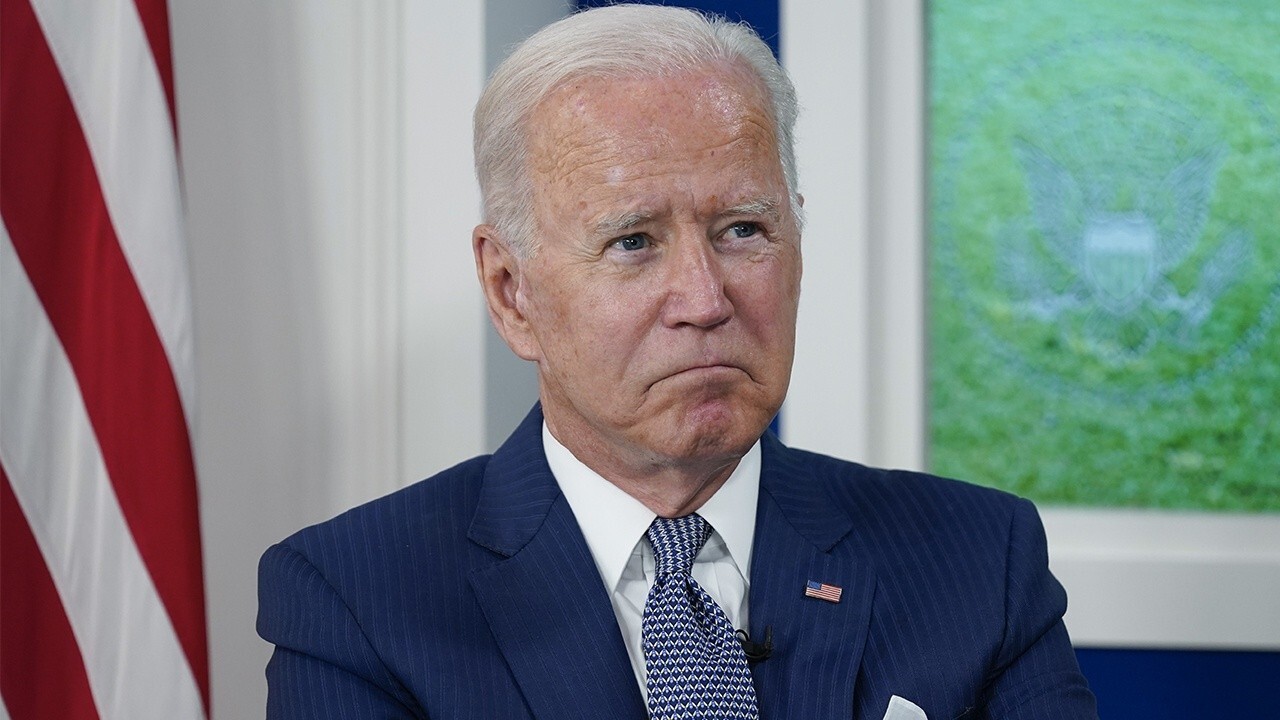

WASHINGTON, DC - MAY 10: U.S. President Joe Biden speaks about inflation and the economy in the South Court Auditorium on the White House campus May 10, 2022 in Washington, DC. Biden stated that tackling the rising prices is his top domestic priority(Getty Images / Getty Images)

Amidst this economic chaos, Biden is as out of touch as ever.

Let’s start with the Biden blame game. At every turn, Biden has blamed others for the inflation his policies created. One of his popular targets is the oil industry. Biden accuses oil companies of price gouging, but it is really a combination of increased demand and reduced supply that is setting oil prices, not oil companies.

INFLATION SOARS 8.3 PERCENT IN APRIL, HOVERING NEAR 40-YEAR HIGH

Consider this little-known fact: when Biden released oil from the U.S. Strategic Petroleum Reserve, he did with our reserves exactly what oil companies do with their oil—he sold it in the open market in a "price competitive sale." The government doesn’t give its oil away for free, and it doesn’t sell it at cost. It sells at the market rate—just like the oil companies do. By Biden’s own standard, he’s been price gouging the American people.

If Biden really wanted to lower the cost of energy (and reduce the pain of inflation at the pump), rather than blaming oil companies for doing precisely what he’s been doing, he’d end his war on carbon fuels, encourage banks to lend to fossil fuel companies, reduce burdensome regulations, green-light pipeline projects, and fight to regain the energy independence our nation accomplished under President Trump. This really isn’t that tough. But sadly, he’s being held hostage by the green energy radicals in his party and high prices are here to stay.

So, what is Biden’s inflation solution? Well, while the Federal Reserve Bank is increasing interest rates to slow the economy—tamping down consumer demand amidst depleted supplies (the obvious cause of inflation)—Biden is still pushing for more spending. Seriously, you can’t make this stuff up.

Just last week, Biden said, "it’s time to grow the economy" and pitched, yet again, his historically massive tax-and-spend scheme. So, let’s look at how well that that worked out last year.

Former CKE Restaurants CEO Andy Puzder argues the U.S. is 'in for a tough time' as inflation threatens an economic slowdown.

The $1.9 trillion spending bonanza or so-called "Covid Relief" bill Democrats passed last March ignited the inflation a majority of Americans now cite as a "hardship." This is not something that’s seriously disputed outside of the White House.

Clinton/Obama economist Larry Summers called it "the "least responsible" economic policy in 40 years and former Obama economic advisor Steven Rattner called it "the original sin." Even Biden’s Secretary of the Treasury Janet Yellen recently said: "So, look, inflation is a matter of demand and supply, and the spending that was undertaken in the American Rescue Plan did feed demand." Enough said.

Ultimately, only 9 percent of this so-called COVID relief spending went toward fighting COVID—while month after month, inflation continued to soar.

The $1.9 trillion spending spree was replete with radical measures that defied Democrats’ spending rationale. Among these out-of-touch priorities were $50 million for "environmental justice," $350 billion for a blue state bailout, and funds to push CRT in schools.

GOP lawmaker pins inflation on Biden

Arkansas Rep. Bruce Westerman and former White House Council of Economic Advisers acting chairman Tomas Philipson weigh in on Biden's economy on 'The Evening Edit.'

It should come as no surprise then that "COVID relief" money has been a godsend for high-end recreational activities, and exotic building makeovers. In New York, $12 million was set aside by one county to renovate its minor league baseball stadium; in Iowa, $2 million to purchase a privately owned ski area; in Florida, $140 million for breaking ground on a high-end hotel with Atlantic Ocean views. And in case you were concerned, don’t worry—the money has been a "boon" for the pickleball court industry.

Now as many Americans have to choose between gas or groceries this type of lavish spending is egregious and illogical. Moreover, it certainly supports the notion that voters should reject Biden’s calls to foot the bill of his Build Back Broke agenda. Their money would further fuel inflation and, as Democrats’ dismal spending record shows, fund radical measures out of touch with their day-to-day needs.

It’s no wonder that a recent Gallup poll shows that Americans cite inflation as their top economic top concern. Pair this with another Gallup poll showing that only 40% of voters think Biden will do the right thing for the economy—a 17 point drop from last year—and Democrats sit even lower at just 38 percent voter confidence. Given what they accomplished in the past 16 months, that 38 percent feels overstated.

It’s past time for Biden to embrace economic reality. If he truly wants to halt inflation, Biden has two options: reduce demand, or increase supply.

Demand-reducing measures (such as higher interest rates) benefit no one and hurt the people who are creating that demand—working- and middle-class Americans.

The rational path forward would be to boost the economy’s supply-side. Even with demand high, if there is sufficient supply to meet that demand, inflation does not rise materially (recall 2018 and 19). But this would require cutting taxes, reducing regulations, focusing on domestic energy production and unleashing the American economy to do what it does best—lead the world.

I’m not holding my breath for Biden to implement logical economic policies. It was sky-high Democrat spending that got us into this mess, and, if history is any guide, Democrats will push for even more spending to get us out of it.

It didn’t work then, and it surely won’t work now. Keep this in mind come November.

Post a Comment