Biden Announces Ban on Russian Oil Imports, Simultaneous With US Gasoline Prices Hitting Record High

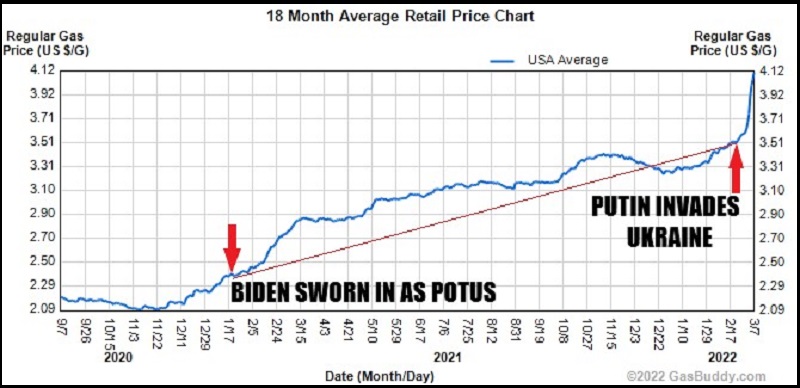

Gasoline is now at the highest price ever recorded. The average cost of a retail gallon of unleaded gasoline hit $4.173, according to the American Automobile Association, with many regions now far exceeding that price. It is not uncommon to see $5/gal gasoline in many areas.

Against this backdrop, Joe Biden announced today that his administration is banning the import of oil, liquified natural gas (LNG) and coal from Russia. [We do not import LNG or coal from Russia, so that political point is moot.] You can read the executive order HERE.

The executive order also bans any U.S. entity from investing or facilitating the investment of Russian energy development. That section explains why there were earlier reports of Oil companies withdrawing from Russia. They were obviously given a heads up.

The way the order is currently written, and a lot of it has to do with extremely generous interpretations by the U.S. Treasury Dept., it would appear that any energy company currently operating in the U.S. cannot simultaneously be operating in Russia (or be part of the subsidizing and insurance network that supports energy development in Russia). The Treasury interpretations here are fraught with complexity.

The part that matters is boiled down in this section:

(i) the importation into the United States of the following products of Russian Federation origin: crude oil; petroleum; petroleum fuels, oils, and products of their distillation; liquefied natural gas; coal; and coal products;

(ii) new investment in the energy sector in the Russian Federation by a United States person, wherever located; and

(iii) any approval, financing, facilitation, or guarantee by a United States person, wherever located, of a transaction by a foreign person where the transaction by that foreign person would be prohibited by this section if performed by a United States person or within the United States.

(b) The prohibitions in subsection (a) of this section apply except to the extent provided by statutes, or in regulations, orders, directives, or licenses that may be issued pursuant to this order, and notwithstanding any contract entered into or license or permit granted prior to the date of this order. (LINK)

The European Union cannot cut themselves off from Russian oil and natural gas. Europe relies on imports for 90% of its gas and 97% of its oil products. Russia supplies 40% of Europe’s gas and a quarter of its oil. {source} Essentially, China and the EU will continue to be the largest purchasers of Russian energy.

The White House is looking to replace Russian oil by purchasing from Venezuela, Iran and, to a lesser extent, Saudi Arabia. In some ways, you can look at this oil purchase shift as a continuation of President Obama’s intent to exfiltrate American wealth. Iran and Venezuela become the favored nations again, as they were in the Obama-Biden administration 2009-2017.

Ideologues who have always operated in the background of Biden are working on the same program to consign the U.S. economy as a permanent “service driven economy.” The difference now is the rapid speed of their policy outcomes, because Biden is disposable.

Biden-Obama, and all that come with them, are working through an ideological plan. All of these consequences and outcomes are features, not flaws.

$7/gal gas is likely this summer (if not sooner), that’s around $180 to $200 barrel oil price.

$10/gal gas appears to be their ‘Build Back Better‘ target price with oil around $250/barrel.

The Russia-Ukraine ‘crisis’ just helps them justify and speed up the process they already had underway. I would argue the speed of their action is driven by their concern of a mid-term election outcome that might impede the bigger objective.

Post a Comment