Sketchy Economic Data About to Surface, White House Proactively Seeds MSM Narrative

For those who have been following closely, the economic data releases over the past several months have been almost impossible to reconcile from a Main Street perspective. Additionally, the scale of inflation is skewing everything that stems from dollar valuation.

CTH is certain the fourth quarter GDP statistic (+6.9%) is useless and was an outcome of several flawed metrics: (1) the import data was misrepresented and not accurately deducted (supply chain issue); (2) the value of building inventories was over calculated as an outcome of inflation; and (3) the value of all economic activity was subsequently skewed because the economic outputs (goods and services) were recorded at higher prices.

It has been our estimation that Main Street economic activity was substantially less than the data discussed by financial pundits.

Our review also sees the employment situation on Main Street as considerably less optimistic than claimed. Bolstering that point, in a very weird and structured preview from the White House, spokesperson Jen Psaki made an odd statement today. WATCH (14:35 prompted):

Psaki is prepositioning a narrative that employment data in January will be lower than expectations, perhaps considerably lower, as a result of “workers calling out sick” from COVID, ie. the omicron variant, during the time when employment polling was conducted. That is a very unusual proactive narrative.

Those talking points would not get into the briefing material if there wasn’t a person highly concerned in the economic circle to put them there. Quite frankly, this is a talking point the White House spokesperson would never have in their briefing book if there wasn’t an advanced notification of their need for it.

Someone knows something.

Given the nature of how heavily manipulated the government institutions are, there’s a strong likelihood the Bureau of Labor and Statistics have been surprised by their employment polling results. That internal tremor, a concern amid the political tribe, is then conveyed to someone, who then relays the warning to the White House economic team…. and that’s how Psaki gets the briefing material.

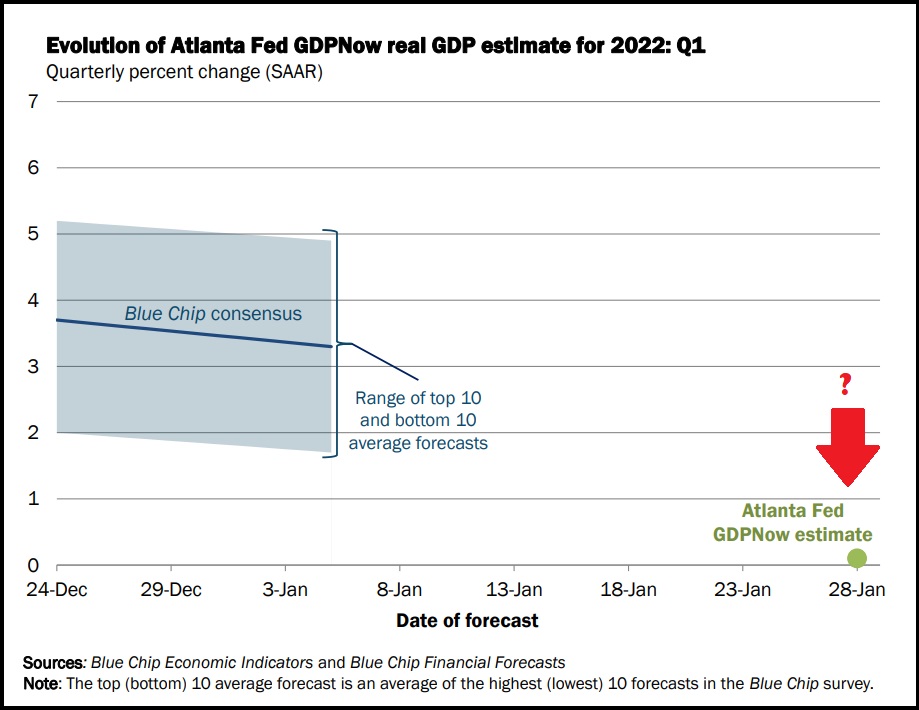

In the background of this unusually proactive economic and employment notation, the Atlanta FED recently released their forward-looking estimation [DATA HERE] of the first quarter GDP. Keeping in mind the official 4th quarter result was +6.9%, the Atlanta Fed is saying the first quarter of 2022 looks like 0.1%.

[DATA SOURCE – Graphic Source]

The economy of the United States doesn’t go, heck, cannot go, from 7% to ZERO in one quarter without some massive dynamic, like closing down the economy…..

Unless….

Unless, the 6.9% was manufactured horsepucky from the outset.

The economy doesn’t go from 6.9% growth in December to ZERO growth a few days later without something substantive happening in the background. My guess is the inventory buildup, cited by the Bureau of Economic Analysis in December, was the result of a massive drop in demand that took place in the three previous months.

The inventory and inflation driven inventory evaluation that helped inflate the metric of the Gross Domestic Product, was not the result of the supply chain coming back to normal. I will bet a donut the inventory buildup was specifically because demand collapsed.

My view of that situation is supported by the historic drop in productivity that was noted in the last half of 2021. The federal spending, and the federal subsidies for businesses and corporations to retain employees, ran past the period where payrolls would have naturally contracted due to the drop in demand.

If I am correct, the employment situation was artificially influenced, because interventionist COVID spending/bailouts allowed payrolls to be covered, and employees to remain on the payroll register, during a time when they should have been dropped if natural sales/profits were responsible for filling the payroll accounts of companies. This would explain the macro drop in productivity while macro employment was retained.

The natural outcome of that viewpoint is…. When the federal deposits into the private sector payroll accounts dry up, employers eventually drop employees.

That rather dramatic scenario is enough to trigger the BLS to freak out when they did the payroll polling.

Just a hunch… We’ll find out on Friday.

Post a Comment