Kraft Heinz Announce Next Wave of Fulfillment Price Increases Up to 30 Percent

Last year, when CTH discussed the original Kraft-Heinz wholesale notification for January 2022, we warned it was only the first round. The reason for waves of price increases is specifically, because each of the processed food categories is impacted differently depending on the amount of processing involved. Each category is different.

This understanding is why we warned everyone in October of last year to make as much preparation as possible for waves of food inflation. The original notification for contracted terms in 30, 60 and 90 days was +20%. Meaning this month, on those group and sectors, prices to retailers went up by 20%, and you are seeing that in the supermarket now.

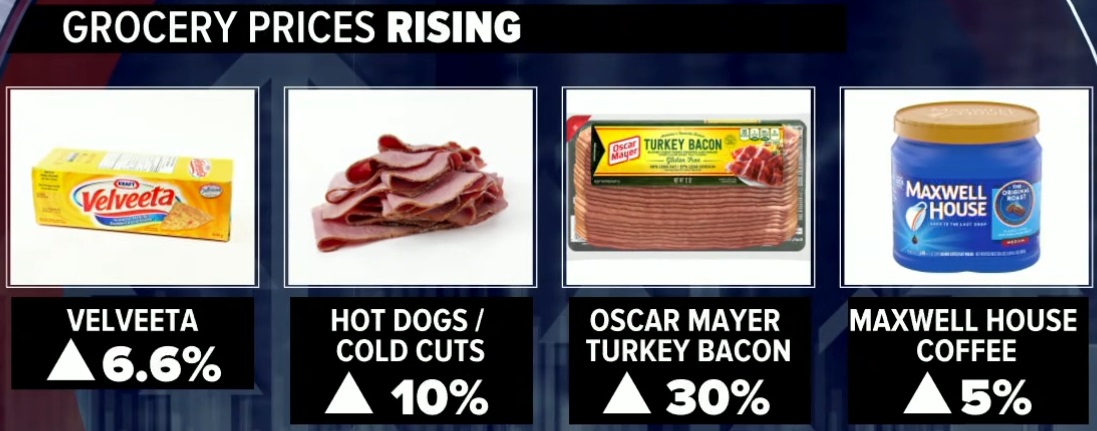

For the next wave, Kraft-Heinz is telling wholesalers the fulfillment shipments arriving in March will be up to +30% on the next categories. Oscar Mayer proteins will be the biggest increase at the top end (+30%), Maxwell House coffee on the lower end (+5-10%) and the juice and drink category around +20%. [A $5 beverage pack will cost $6 in a few short weeks.]

The processing sector is still dealing with cumulative cost increases. The fulfillment terms are still catching up with the increased costs. These announcements are ON TOP OF the current price increases we are feeling. We are entering hyper-inflation.

If you look at the notification timing from Kraft foods, January 24th, you will see the categories we predicted to come next are the exact categories being outlined in this wave.

(VIA ABC) […] The increases range from 6.6% on 12oz Velveeta Fresh Packs to 30% on a three-pack of Oscar Mayer turkey bacon. Most cold cuts and beef hot dogs will go up around 10% and coffee around 5%. Some Kool-Aid and Capri Sun drink packs will increase by about 20%.

“As we enter 2022, inflation continues to dramatically impact the economy,” Kraft Heinz said in a letter dated January 24 to at least one of its wholesale customers that was viewed by CNN Business. The wholesaler shared the letter on the condition of anonymity to protect the company’s relationship with its suppliers.

[…] If retailers decide to pass on any of the increased costs, these items will be more expensive for shoppers in stores. US consumer prices rose 7% annually in December, the steepest climb in 39 years. Kraft Heinz has already raised prices on some of these same foods in recent months.

In October, the company said it would increase prices on Oscar Mayer cold cuts and hot dogs. In November, it said prices on Oscar Mayer beef, lean beef and Angus hot dogs, cheese dogs and other products would go up by around 9%.

But since those November hikes, Kraft Heinz said in the letter, it has faced “constrained supply, logistic bottlenecks and weather-driven crop losses.” The company’s costs have increased, including on raw ingredients and freight, leading it to bump prices yet again. (read more)

These same major manufacturers are the same companies that make the “off label” or “private label” products that are sold under various retail brand names. After the big guns raise their prices, the private label price increases will come in the next wave, because they are made by the same people using the same raw materials and the same processes.

Keep in mind the points we noted in December:

(1) The outlined price increases noted are against current price terms and contracts. Meaning, these are price increases from right now to the next fulfillment. These are not inflation price increases which are compared to a year ago. These are increases from the current price right now.

(2) The price increases are not the final price increase. This is the price of a contract today from the field to the distribution center. The retailer also has additional price increases (transportation, energy, labor, etc) which they need to add to the wholesale price before you see the final price at retail (grocery store).

The final field to fork price is not yet known but will be higher than noted above. We are only seeing the notifications from field through processing and into warehousing and distribution.

Additionally, the more an item needs to be processed, the higher the price increase will be. Food items that require multiple raw materials, ingredients and bases for processing (ex. condiments), when combined with increased packaging costs (oil, energy), will be much higher than foods with less processing, handling and packaging.

Additionally, the more an item needs to be processed, the higher the price increase will be. Food items that require multiple raw materials, ingredients and bases for processing (ex. condiments), when combined with increased packaging costs (oil, energy), will be much higher than foods with less processing, handling and packaging.

This has always been the nature of this specific supply chain.

Example: Many products, food, drinks and even cleaning products, contain citrus bases, additives, flavorings and distillation. Those products will be much higher in price due to the price increases in raw materials, combined with higher energy and petroleum costs. It is an issue of cumulative price increases in the production of the product from beginning to end.

CTH has recommended preparing for these massive increases in 2022 prices, by thinking about the base products you use to make meals at home and holding an extra supply of shelf stable products, so you won’t hit the grocery store and face those massive increases.

A working class family, who typically spends $200 to $300 a week on groceries, is already getting hammered at the gas pumps and grocery store. Another $50 to $100 bucks on top of the grocery bill each week can be very stressful.

Even if you don’t have kids at home, perhaps your adult children have kids. Your proactive position can help them, perhaps your neighbors and others, at times of greatest need. Pride can often stop people from asking for help, so look behind the eyes of those who hesitate to accept it.

The price increases will not only hit retail grocers hard, but they will also hit restaurant and industrial food supply companies like Sysco. Food away from home will increase in price, because the food suppliers are all experiencing the same price increases.

Food, fuel and energy price increases will continue to be the most impactful problem into 2022. The problem will compound, because buying offices of the large multinational corporations enter this phase of consumer and commodity squeeze by looking to leverage their size for competitive advantage.

Large multinationals will make advance order purchases today at higher prices. Advanced purchasing becomes a competitive advantage, and they leverage that in the supply chain. The downstream consequence is a material shortage, because the commodity is wiped out, which drives up the price and then those same multinationals execute distribution to a higher profit.

This gaming of inventory for profit, or inventory evaluation/capitalization, is a less discussed outcome of rapid inflation. Multinationals have deep pockets, and they can maximize profits by executing advanced purchase orders to lock in commodity prices. Unfortunately, the little guys have a tough time competing against them when the inventories dry up.

While the examples above all relate to fast turn consumable goods, the same purchasing leverage is used by large corporations on durable goods. Retailers, large and small, then begin competing to secure inventories while supplies are limited; this too drives up prices. It’s a hot mess of competition that squeezes the consumer even harder.

The only thing that stops this process is the inevitable collapse in demand, but that outcome sucks also. In the interim, I hope and pray to have provided y’all with enough advanced notification so that all of us can ride this inflation storm out just a teensy bit better than if we didn’t know it was coming.

Post a Comment