Head of Minneapolis Federal Reserve Says Inflation Will Get Worse and Prices Will Never Come Down

Neel Kashkari is head of the Minneapolis Federal Reserve. If you know the financial lingo, you can see the dire forecast behind the opaque language. In plain-speak, Kashari is saying when it comes to prices and inflation, “we’re screwed“…

In this interview with CBS talking head Margaret Brennan, Kashkari admits inflation is still going up, and it will get worse. Keep in mind, the lingo of the inflation conversation is discussing “percentages of change.” Kashkari claims the percentages of change will start to slow in a few years, but the prices will never return to their former level.

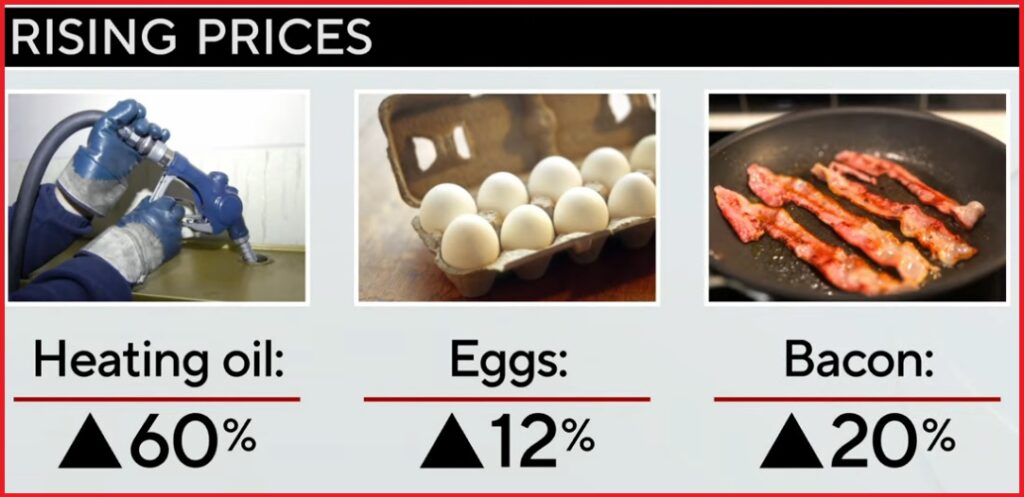

The percentage of inflationary change (this year vs last year) will continue going up, as prices continue to skyrocket over almost every sector. CTH points out this issue, because as the Fed continues printing current money, the value of future money drops and the price of goods continues to climb. The fast-turn goods rise in price quickest (now recorded at 6.2%), and the inflation on slow-turn durable goods lags but hits even harder.

Current real inflation inside the ‘total’ economy, the cumulative snowball that is coming down the mountain, is over 20% and still growing. This situation puts the forecast prices of 2022 goods at an alarming level. WATCH:

The fed has no tools to slow the rate of current inflation, as interest rates are disconnected {Revisit The New Dimension in Modern Economics} from the cost of goods produced. The only thing the Fed can do is to stop purchasing debt (Quantitative Easing), stop purchasing our own bonds, at a slower rate.

Despite being a progressive himself, even Neel Kashkari is telling congress to stop spending money.

Maybe you don’t have kids at home, maybe you don’t pack lunches or care what the cost of a pound of bologna will be, maybe you are retired and the stove hasn’t been operated all year as you prefer to dine out…. but I can assure you, to a demonstrable certainty, that almost all middle class working Americans will be making decisions on what food products they can afford. Head lettuce at $4 to $5 each, eggs at $3/doz, milk around $6/gal, butter around $8/lb, and citrus so expensive getting an orange in your Christmas stocking will be a trend again in 2022.

The background conversations in the raw material, processing, manufacturing, wholesaling and food contract networks are enough to make you lose sleep.

[…] Tyson sent a letter to at least two regional distributors last month in which it said that prices on Ball Park, Hillshire Farm, Jimmy Dean, State Fair and all deli meats will increase by a range of 5% to 10.2% beginning Jan. 2 for “all retail customers.” … “We continue to face accelerating levels of extraordinary inflation,” Tyson said in the letter. “The sustained duration and significant impact of the inflation necessitates additional pricing action.” (link)

The traditional net terms at 30, 60 or 90 days are right now a hot topic, as producers and suppliers in the food supply chain can no longer commit to contractual prices for future goods delivered. The upstream price increases are so large, the downstream suppliers will not contract on fixed prices, EVEN for the big box retailers.

Only those who know the scale of Walmart buying office pressure and dominance can appropriately contextualize a current WM supplier telling the behemoth to “go spit” if they don’t like the fact that price guarantees are no longer part of the equation. Yeah, it is THAT bad.

We are only a few months away from seeing massive inflation that will fundamentally change the way everyone looks at food shopping, or highly consumable purchases, and what the middle class formerly considered to be “luxury” purchases. Inflation, in the background, is going to come through the supply chain like a thundershock…. and it’s not just food.

This recent insider comment caused me to do some digging, and this is 100% accurate:

“I am an executive in the detergent chemical industry that supplies all of the major pharmaceutical companies, and am in charge of pricing and purchasing of large quantities of raw materials – both commodities, and surfactants, which are the main ingredients in detergents. Here is a brief overview of the situation.

Commodities, such as sodium bicarbonate (baking soda), sodium carbonate (soda ash), and other basic additives that adjust pH, thickness, anti-redeposition, rinseability, and other properties are up around 10-15% on a raw material cost basis from February. Not a single material is unaffected.

Citric acid is up nearly 40-50% when it can be found, at minimum. There is a nationwide allocation, which means that they give material to whom they feel like. One of the major domestic manufacturers of these materials shut down production of citric acids and other acidulants due to maintenance. Many companies in my industry are paying nearly 300% (not a typo – three hundred percent) increases on citric acid.

Domestic primary surfactants, which are made by a handful of companies such as Stepan Company, Solvay, Huntsman, and many more, are up 15-20%, due mainly to oil cost, transportation, etc.

Domestic specialty surfactants, specifically of a class called ethoxylated surfactants, are nearly gone. Not hard to get, not difficult to find – gone. In February, the ice storm took out piping and power lines along the entire gulf coast. The two towns that got hit hardest were Houston, TX, and a little town called St. Charles, LA. St. Charles is where all ethoxylation takes place in the USA for everyone from Dow to Sasol to BASF, and is the key process to make these specialty ethoxylated surfactants. Then, after 4 months of shutdowns, just when everything was getting back into swing, Hurricane Ida wrecked everything all over again.

Dow, one of the largest companies in the world, only restarted production at their facility there in early October.

The crisis of transportation and at the ports is only adding to this crisis of manufacturing in the chemical industry. News to everyone? It was never covered, not even once, on the news.

If truckers are going to be forced to be vaccinated come January, there will be even less trucks than there are now.

The wheels of the world are being purposefully and deliberately ground to a halt. We’d be better off with the mafia back in control of the ports worldwide.

This is going to get so much worse before it gets any better, and the administration in office is doing everything in their power to make sure it is as bad as possible.” (link)

And this on “Industrial Price Increases“:

Kamala Harris is worried about feeding children of the world, while we are literally weeks away from millions of working class, non-subsidized Americans being worried about feeding their own kids. Infuriating is an understatement.

Please prepare yourselves and your families accordingly. The proactive window to prepare for what’s coming in the short term is approximately 60 days from today; and then spending options begin to diminish quickly.

Yes, the rate of price increase may indeed level off. However, we will not see prices dropping or returning to their prior position even after this is over. The price of goods is climbing, will continue to climb and will eventually reach a point that they stop climbing – if policies change and/or the 2022 mid term election gets rid of the communists who are spending the money; but those prices are not going to come back down, ever.

A current loaf of bread, widget or (fill_in_the_blank) at $4.69 will climb to near $6.00 in 2022, and that will be the new normal price of that widget, bread or item from that moment into the future. If you accept that behind you is a massive price increase about to hit on almost everything you purchase, anything you can do now to offset the impact to your household budget when the full weight of these price increases hit is going to be well worth doing.

This is all being done by design.

Post a Comment