Inflation Data Released Yesterday Shows White House July 4th Price Claims Were Total Crap

The Gaslighting Intensifies as

Inflation Hits Another Major High

It was just a few weeks ago that the press and the Biden administration were assuring everyone that the current inflation highs are just a temporary transition. Paul Krugman even penned a piece for The New York Times entitled “The Week Inflation Panic Died.”

As Democrats and their media allies explained, all those higher prices you are paying for groceries, materials, products, and energy are largely just a figment of your imagination. Things aren’t really that bad. I mean, hotdog prices were down 16 cents.

That Krugman wrote that piece should have been the clue that we were about to get bad news. After all, he is perhaps the worst economic mind in existence, being consistently wrong on essentially every issue despite his credentials and received awards.

Well, the bad news has arrived. For the month of June, inflation was up 5.4% year over year, the worst mark since the financial collapse of 2008.

I’ve written a lot on the causes of the current outsized inflationary cycle so I won’t rehash everything here. Suffice it to say, Joe Biden’s policies are directly responsible. You can not blow $2 trillion of freshly printed, unpaid-for money into an already organically recovering economy and not expect to cause massive inflation. That’s what happened here, and it’s obvious to anyone looking at the timeline of events.

It’s really the gaslighting that is so remarkable here, though. Note the AP reporter’s framing as this news dropping amid “hopes for lower inflation.” Hopes based on what exactly? Expressed by whom? Democrats are pressing for even more spending and regulation, which will only make the inflation worse. Yes, the Biden administration has been lying, claiming the inflation was going to slow down, but that’s hardly dispositive to the point where a journalist should be citing their assertions.

Fortunately, we have our stalwart “fact-checkers” to let us know that none of this is Biden’s fault.

Let’s recap exactly what the current president has done on this front since taking office.

He’s canceled the Keystone XL pipeline, a massive transporter of energy that not only helped the environment but lowered the costs of distribution and created thousands of jobs. Biden also froze some leases and stopped drilling in ANWR, which has had so many environmental studies done on it that I’ve lost count at this point. Further, as I mentioned above, he passed a massive “relief” bill along party lines that produced big-time inflation in all commodities.

Yet, according to Kessler, those 7-year high gas prices that just so happened to coincide with Biden’s presidency and his sweeping policy changes have absolutely nothing to do with Joe Biden. Convenient, right?

These people are shameless. Yet, it’s not going to save the Democrats in 2022. They own this and voters know they own it. No amount of gaslighting will change that.

It was just a few weeks ago that the press and the Biden administration were assuring everyone that the current inflation highs are just a temporary transition. Paul Krugman even penned a piece for The New York Times entitled “The Week Inflation Panic Died.”

As Democrats and their media allies explained, all those higher prices you are paying for groceries, materials, products, and energy are largely just a figment of your imagination. Things aren’t really that bad. I mean, hotdog prices were down 16 cents.

That Krugman wrote that piece should have been the clue that we were about to get bad news. After all, he is perhaps the worst economic mind in existence, being consistently wrong on essentially every issue despite his credentials and received awards.

Well, the bad news has arrived. For the month of June, inflation was up 5.4% year over year, the worst mark since the financial collapse of 2008.

I’ve written a lot on the causes of the current outsized inflationary cycle so I won’t rehash everything here. Suffice it to say, Joe Biden’s policies are directly responsible. You can not blow $2 trillion of freshly printed, unpaid-for money into an already organically recovering economy and not expect to cause massive inflation. That’s what happened here, and it’s obvious to anyone looking at the timeline of events.

It’s really the gaslighting that is so remarkable here, though. Note the AP reporter’s framing as this news dropping amid “hopes for lower inflation.” Hopes based on what exactly? Expressed by whom? Democrats are pressing for even more spending and regulation, which will only make the inflation worse. Yes, the Biden administration has been lying, claiming the inflation was going to slow down, but that’s hardly dispositive to the point where a journalist should be citing their assertions.

Fortunately, we have our stalwart “fact-checkers” to let us know that none of this is Biden’s fault.

Let’s recap exactly what the current president has done on this front since taking office.

He’s canceled the Keystone XL pipeline, a massive transporter of energy that not only helped the environment but lowered the costs of distribution and created thousands of jobs. Biden also froze some leases and stopped drilling in ANWR, which has had so many environmental studies done on it that I’ve lost count at this point. Further, as I mentioned above, he passed a massive “relief” bill along party lines that produced big-time inflation in all commodities.

Yet, according to Kessler, those 7-year high gas prices that just so happened to coincide with Biden’s presidency and his sweeping policy changes have absolutely nothing to do with Joe Biden. Convenient, right?

These people are shameless. Yet, it’s not going to save the Democrats in 2022. They own this and voters know they own it. No amount of gaslighting will change that.

Gas Prices Doubled, Annualized Total Inflation Rises to 5.4% and Climbing

On July 4th, a little more than a week ago, the White House made the preposterous claim that holiday food was cheaper than last year. Everyone who buys groceries knew that level of propaganda was unmitigated nonsense and the consumer pricing data released today shows exactly that.

According to the BLS, June prices jumped 0.9%. Every month this year the CPI has been rising faster than the prior month, which essentially means inflation is rising at an ever-increasing rate. Annualized inflation (June 2020 -vs- June 2021) now shows an overall inflation rate of 5.4%.

However, at a 0.9% monthly rate -if the level stabilizes- that means the real inflation rate is 10.8% Yeah, that’s a serious problem.

The BLS data (see table 7) shows that gasoline has doubled in price year-over-year. Unleaded regular gasoline is now 46.4% higher than last year. That level of fuel price increase is crushing the working class and blue collar workforce.

Inflation overall is currently rising three to four times faster than wages. That means real wages are dropping as Americans are paying more for everything, including fast turn consumable products like food and fuel. Again, we repeat… durable good sales will suffer as disposable income shrinks. Additionally, rising housing prices combined with diminishing blue collar wages is an unsustainable trend.

JoeBama economic policies are crushing the middle-class. The multinational corporations, Wall Street and the investment class benefit as Biden policies directly create a U.S. service driven economy {Go Deep}. Under JoeBama, the wage and wealth gap is growing again after three years of Trump policies closing it. Working class wages are dropping, and investment class earnings rise. This is the intentionally created outcome when America-First policies are cancelled.

Overall energy prices have jumped more than 32% year-over-year. This is a direct outcome of Biden policy. Used vehicle prices are up a whopping 45% vs 2020.

The financial media are working overtime to protect Joe Biden from the outcome of policy by deflecting blame to COVID-19, but the issues are far more substantive than their weak justifications. All of this was predictable. After several months of claiming the inflation was transitory or temporary, now the same financial media are shifting the narrative to say we need to just accept long term inflation is the new normal.

I cannot express my frustration adequately as we watch this play out and know how much propaganda is being pushed to justify it. {Go Deep} and {Go Deep}. CTH has outlined for years how these direct economic outcomes are a result of actual government policy.

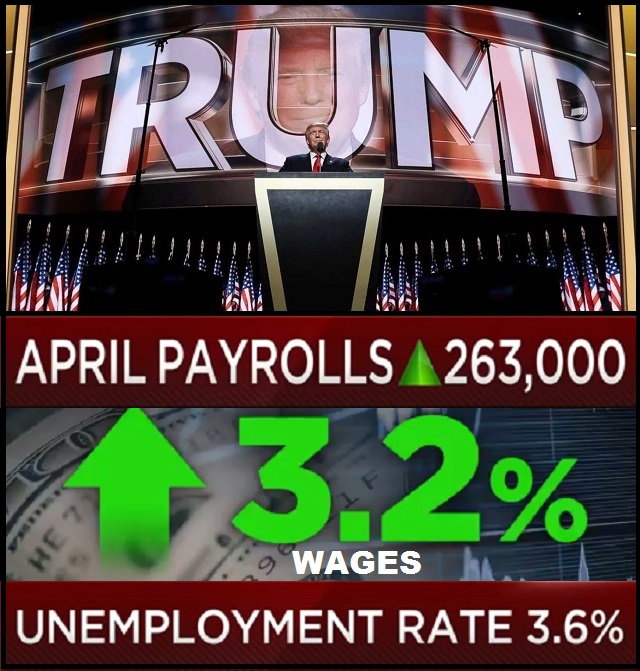

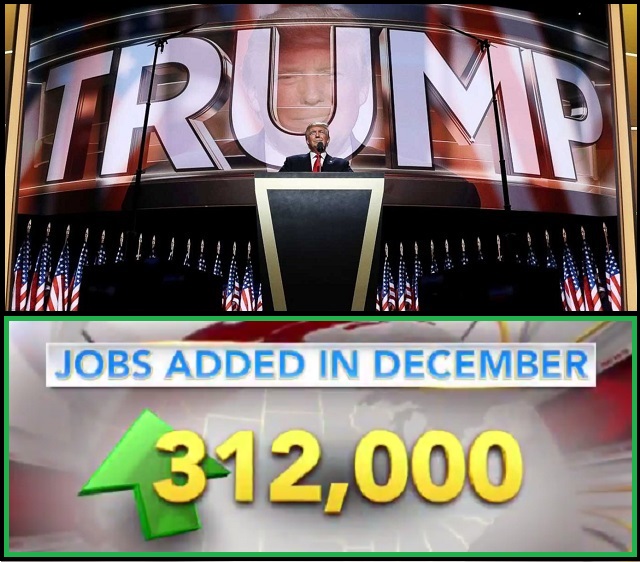

Everything the Biden administration is doing is making things worse, and now we are seeing big drops in real wages as the inflation rate is far beyond wage growth. Under Biden inflation is massive and wage growth is non-existent. This is an exact reversal of the Trump-era outcome where inflation was low and wage growth rates were high.

You might remember when President Trump initiated tariffs against China (steel, aluminum and more), Southeast Asia (product specific), Europe (steel, aluminum and direct products), Canada (steel, aluminum, lumber and dairy specifics), the financial pundits screamed at the top of their lungs that consumer prices were going to skyrocket. They didn’t. CTH knew they wouldn’t because essentially those trading partners responded in the exact same way the U.S. did decades ago when the import/export dynamic was reversed.

Trump’s massive, and in some instances targeted, import tariffs against China, SE Asia, Canada and the EU not only did not increase prices, the prices of the goods in the U.S. actually dropped. Trump’s policies led the largest deflation in consumer prices in decades. At the same time Trump’s domestic economic policies drove employment and wages higher than any time in the past forty years. With Trump’s policies we were in an era where job growth was strong, wages were rising and consumer prices were falling. The net result was more disposable income for the middle class, more demand for stuff, and ultimately that’s why the U.S. economy was so strong.

♦Going Deep – To retain their position China, the EU responded to U.S. tariffs by devaluing their currency as an offset to higher prices. It started with China because their economy is so dependent on exports to the U.S.

♦Going Deep – To retain their position China, the EU responded to U.S. tariffs by devaluing their currency as an offset to higher prices. It started with China because their economy is so dependent on exports to the U.S.

China first started subsidizing the targeted sectors hit by tariffs. However, as the Chinese economy was under pressure they stopped purchasing industrial products from the EU, that slowed the EU economy and made the impact of U.S. tariffs, later targeted in the EU direction, more impactful.

When China (total communist control over their banking system) devalued their currency to avoid Tariff price increase, it had an unusual effect. The cost of all Chinese imports dropped, not just on the tariff goods. Imported stuff from China dropped in price at the same time the U.S. dollar was strong. This meant it took less dollars to import the same amount of Chinese goods; and those goods were at a lower price. As a result ,we were importing deflation…. the exact opposite of what the financial pundits claimed would happen.

In response to a lessening of overall economic activity, the EU then followed the same approach as China. The EU was already facing pressure from the exit of the U.K. from the EU system; so, when the EU central banks started pumping money into their economy and offsetting with subsidies, they essentially devalued the euro. The outcome for U.S. importers was the same as the outcome for U.S-China importers. We began importing deflation from the EU side.

In the middle of this there was a downside for U.S. exporters. With China and the EU devaluing their currency, the value of the dollar increased. This made purchases from the U.S. more expensive. U.S. companies who relied on exports (lots of agricultural industries and raw materials) took a hit from higher export prices. However, and this part is really interesting, it only made those companies more dependent on domestic sales for income. With less being exported there was more product available in the U.S for domestic purchase…. this dynamic led to another predictable outcome, even lower prices for U.S. consumers.

From 2017 through early 2020, U.S. consumer prices were dropping. We were in a rare place where deflation was happening. Combine lower prices with higher wages and you can easily see the strength within the U.S. economy. For the rest of the world this seemed unfair, and indeed they cried foul – especially Canada.

From 2017 through early 2020, U.S. consumer prices were dropping. We were in a rare place where deflation was happening. Combine lower prices with higher wages and you can easily see the strength within the U.S. economy. For the rest of the world this seemed unfair, and indeed they cried foul – especially Canada.

However, this was America First in action. Middle-class Americans were benefiting from a Trump reversal of 40 years of economic policies like those that created the rust belt.

Industries were investing in the U.S. and that provided leverage for Trump’s trade policies to have stronger influence. If you wanted access to this expanding market, those foreign companies needed to put their investment money into the U.S. and create even more U.S. jobs. This was an expanding economic spiral where Trump was creating more and more economic pies. Every sector of the U.S. economy was benefiting more, but the blue-collar working class was gaining the most benefit of all.

♦ REVERSE THIS… and you now understand where we are with inflation. The Joebama economic policies are exactly the reverse. The monetary policy that pumps money into into the U.S. economy via COVID bailouts and federal spending drops the value of the dollar and makes the dependency state worse.

With the FED pumping money into the U.S. system the dollar value plummets. At the same time, JoeBama dropped tariff enforcement to please the Wall Street multinational corporations and banks that funded his campaign. Now, the value of the Chinese and EU currency increases. This means it costs more to import products and that is the primary driver of price increases in consumer goods.

Simultaneously a lower dollar means cheaper exports for the multinationals (Big AG and raw materials). China, SE Asia and even the EU purchase U.S. raw materials at a lower price. That means less raw material in the U.S. which drives up prices for U.S. consumers. It is a perfect storm. Higher costs for imported goods and higher costs for domestic goods (food). Combine this dynamic with massive increases in energy costs from ideological policy and that’s fuel on a fire of inflation.

Annualized inflation is now estimated to be around 8 percent, and it will likely keep increasing. This is terrible for wage earners in the U.S. who are now seeing no wage growth and higher prices. Real wages are decreasing by the fastest rate in decades. We are now in a downward spiral where your paycheck buys less. As a result, consumer middle-class spending contracts. Eventually this means housing prices drop because people cannot afford higher mortgage payments.

Gasoline costs more (+50%), food costs more (+10% at a minimum) and as a result real wages drop; disposable income is lost. Ultimately this is the cause of Stagflation. A stagnant economy and inflation. None of this is caused by COVID-19. All of this is caused by economic policy and monetary policy sold under the guise of COVID-19.

This inflationary period will not stall out until the U.S. economy can recover from the massive amount of federal spending. If the spending continues, the dollar continues to be weak, and as a result the inflationary period continues. It is a spiral that can only be stopped if the policies are reversed…. and the only way to stop these insane policies is to get rid of the Wall Street Democrats and Republicans who are constructing them.

Post a Comment