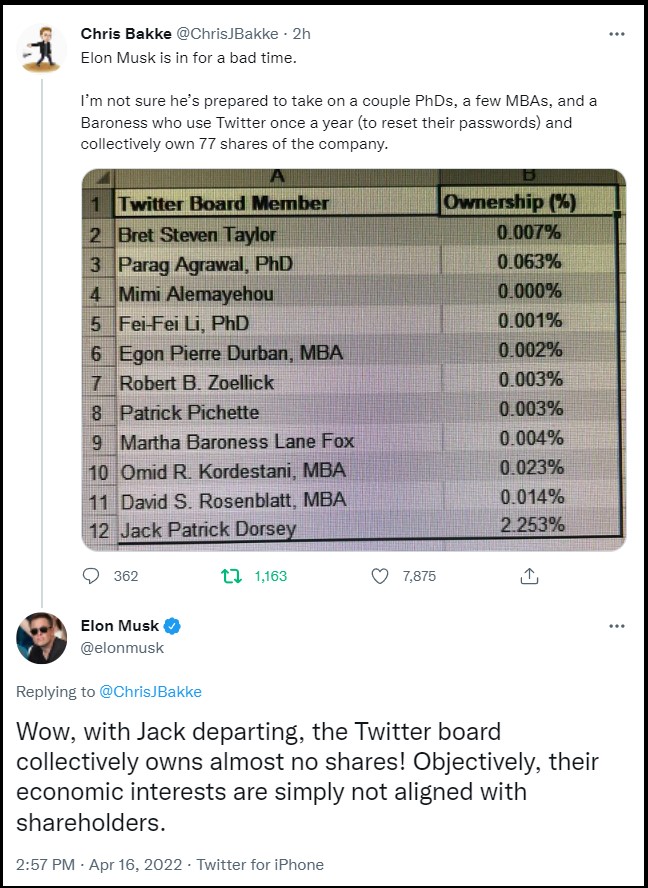

In the ongoing public battle over Twitter as a speech platform, one actual user of Twitter, Chris Bakke, wanted to see who exactly these Board of Directors are, who are attempting to stop Elon Musk from purchasing it.

Chris Bakke then noted how little of the actual stock is owned by the company’s Board of Directors. Sans Twitter Founder Jack Dorsey, the combined ownership of the entire board equates to 77 shares of stock, worth around $3,200 bucks.

The Board of Directors [SEE BoD LINK HERE] consists of academics, tech executives, business and policy wonks, and a random baroness who doesn’t even use the service. These are the people who are making fiduciary decisions for all Twitter stock owners without any financial stake in the decisions they make for the company.

BOARD MEMBERS – (2) Bret Taylor, Independent Board Chair; Co-CEO, Salesforce (former Google exec). (3) Parag Agrawal,CEO, Twitter. (4) Mimi Alemayehou, Senior Vice President for Public – Private Partnership at Mastercard. (5) Dr. Fei-Fei Li, Professor at Stanford (former Google exec). (6) Egon Durban, Co-CEO, Silver Lake. (7) Robert Zoellick, Former Chairman of the Board of Directors of AllianceBernstein Holding L.P. (8) Patrick Pichette, General Partner, Inovia Capital; Former Senior Vice President and Chief Financial Officer, Google. (9) Martha Lane Fox, Founder and Chairperson, Lucky Voice Group; Former Co-Founder and Managing Director of lastminute.com; Crossbench Peer, House of Lords. (10) Omid Kordestani, Former Executive Chairman, Twitter (former Google exec). (11) David Rosenblatt, CEO, 1stdibs.com, Inc. (former Google exec). (12) Jack Dorsey, Co-Founder, Twitter; CEO and Co-Founder, Square.

Further evidence the motivations behind the Twitter board have nothing to do with stewardship for their shareholders. Again, this is yet another datapoint highlighting the background structure of Twitter that Musk is exposing.

Twitter is not making a decision to decline the generous offer by Elon Musk because of stewardship or fiduciary responsibility to shareholders. The financials of Twitter as a non-viable business model highlight the issue of money being irrelevant. Twitter does not and cannot make money. Growing Twitter only means growing an expense. Growing Twitter does not grow revenue enough to offset the increase in expense.

There is only one way for Twitter to exist as a viable entity, people are now starting to realize this.

What matters to the people behind Twitter, the people who are subsidizing the ability of Twitter to exist, is control over the global conversation.

Control of the conversation is priceless to the people who provide the backbone for Twitter.

Once people realize who is subsidizing Twitter, everything changes.

That’s the fight.

{Go Deep}