Mike Rowe brought Victor Davis Hanson onto his podcast for an interview to discuss Class Warfare as contrast against the 2024 election stakes. The impetus for the interview was an article written by VDH a few months ago about the shift in the American electorate – SEE HERE.

Within the interview VDH walks through a summary of how a modern muscular tech industry replaced Mainstreet on the financial side of financial economics and American wealth. Essentially, how a small group of tech companies replaced the blue chip titans and industrialists on the global wealth scale.

As 8 billion people started being able to purchase the goods and services of a small American group of entrepreneurs, all focused heavily inside the tech and finance sector, the people who owned wealth shifted dramatically. Decades later, against the backdrop of globalism, the issue surfaces as the industrialists (Main Street corps) offshored their manufacturing, while the tech industrialists (Muscular Wall Street) started to be the wealthiest people in the USA as a result of selling their tech products to the world.

Within the discussion, the academically disposed VDH points out empirical data that bolsters his theories and analysis. Rowe is in general agreement as they both discuss the granular consequences. However, there is one fascinating part (prompted below) where VDH accurately identifies conservative economic hero Milton Friedman as one of the early globalist villains.

VDH is correct when he says that Friedman was a rabid open borders advocate, who had no issue with lowered wages for U.S. workers and embraced the global system of manufacturing which led to a destroyed U.S industrial base creating the Rust Belt. Few people on the conservative side of politics will ever admit how Milton Friedman was the original Bush-class economist. It’s good to see VDH set the record straight. WATCH:

Keep in mind, Milton Friedman was vociferously against tariffs of any kind. Friedman believed once the entire world was connected, all prices and economies would equalize. The pain felt within the American economy was simply something that had to be endured until American wealth was distributed and the entire world was balanced.

What follows below was my review of what would happen with Donald Trump policies put into place. This is very deep and in the weeds. This was originally written in December of 2016.

Traditional economic principles have revolved around the Macro and Micro with interventionist influences driven by GDP (Gross Domestic Product, or total economic output), interest rates, inflation rates and federally controlled monetary policy designed to steer the broad economic outcomes.

Additionally, in large measure, the various data points which underline Macro principles are two dimensional. As the X-Axis goes thus, the Y-Axis responds accordingly… and so it goes…. and so it has historically gone.

Traditional monetary policy has centered upon a belief of cause and effect: (ex.1) If inflation grows, it can be reduced by rising interest rates. Or, (ex.2) as GDP shrinks, it too can be affected by decreases in interest rates to stimulate investment/production etc.

However, against the backdrop of economic Globalism -vs- economic Americanism, CTH is noting the two dimensional economic approach is no longer a relevant model. There is another economic dimension, a third dimension. An undiscovered depth or distance between the “X” and the “Y”.

I believe it is critical to understand this new dimension in order to understand Trump economic principles, and the subsequent “America-First” economy his policies build.

As the distance between the X and Y increases over time, the affect detaches – slowly and almost invisibly. I believe understanding this hidden distance perspective will reconcile many of the current economic contractions. I also predict this third dimension will soon be discovered and will be extremely consequential in the coming decade.

To understand the basic theory, allow me to introduce a visual image to assist comprehension. Think about the two economies, Wall Street (paper or false economy) and Main Street (real or traditional economy) as two parallel roads or tracks. Think of Wall Street as one train engine and Main Street as another.

The Metaphor – Several decades ago, 1980-ish, our two economic engines started out in South Florida with the Wall Street economy on I-95 the East Coast, and the Main Street economy on I-75 the West Coast. The distance between them less than 100 miles.

As each economy heads North, over time the distance between them grows. As they cross the Florida State line Wall Street’s engine (I-95) is now 200 miles from Main Street’s engine (traveling I-75).

As we have discussed – the legislative outcomes, along with the monetary policy therein, follows the economic engine carrying the greatest political influence. Our historic result is monetary policy followed the Wall Street engine.

[…] there had to be a point where the value of the second economy (Wall Street) surpassed the value of the first economy (Main Street).

[…] there had to be a point where the value of the second economy (Wall Street) surpassed the value of the first economy (Main Street).

Investments, and the bets therein, needed to expand outside of the USA. hence, globalist investing.

However, a second more consequential aspect happened simultaneously. The politicians became more valuable to the Wall Street team than the Main Street team; and Wall Street had deeper pockets because their economy was now larger.

As a consequence Wall Street started funding political candidates and asking for legislation that benefited their interests.

When Main Street was purchasing the legislative influence the outcomes were beneficial to Main Street, and by direct attachment those outcomes also benefited the average American inside the real economy.

When Wall Street began purchasing the legislative influence, the outcomes therein became beneficial to Wall Street. Those benefits are detached from improving the livelihoods of main street Americans because the benefits are “global” needs. Global financial interests, investment interests, are now the primary filter through which the DC legislative outcomes are considered.

There is a natural disconnect. (more)

Here is an example of the resulting impact as felt by consumers:

♦ TWO ECONOMIES – Time continues to pass as each economy heads North.

Economic Globalism expands. Wall Street’s false (paper) economy becomes the far greater economy. Federal fiscal policy follows and fuels the larger economy. In turn the Wall Street benefactors pay back the politicians.

Economic Nationalism shrinks. Main Street’s real (traditional) economy shrinks. Domestic manufacturing drops. Jobs are off-shored. Main Street companies try to offset the shrinking economy with increased productivity (the fuel). Wages stagnate.

Now it’s 1990 – The Wall Street economic engine (traveling I-95) reaches Northern North Carolina. However, it’s now 500 miles away from Main Street’s engine (traveling I-75). The Appalachian range is the geographic wedge creating the natural divide (a metaphor for ‘trickle down’).

By the time the decade of 2000 arrives – Wall Street’s well fueled engine, and the accompanying DC legislative attention, influence and monetary policy, has reached Philadelphia.

However, Main Street’s engine is in Ohio (they’re now 700 miles apart) and almost out of fuel; there simply is no more productivity to squeeze.

From that moment in time, and from that geographic location, all forward travel is now only going to push the two economies further apart. I-95 now heads Northeast, and I-75 heads due North through Michigan. The distance between these engines is going to grow much more significantly now with each passing mile/month….

However, and this is a key reference point, if you are judging their advancing progress from a globalist vessel (filled with traditional academic economists) in the mid-Atlantic, both economies (both engines) would seem to be essentially in the same place based on their latitude.

From a two-dimensional linear perspective you cannot tell the distance between them.

It is within this distance between the two economies, which grew over time, where a new economic dimension has been created and is not getting attention. It is critical to understand the detachment.

Within this three dimensional detachment you understand why Near-Zero interest rates no longer drive an expansion of the GDP. The Main Street economic engine is just too far away to gain any substantive benefit.

Despite their domestic origin in NY/DC, traditional fiscal policies (over time) have focused exclusively on the Wall Street, Globalist economy. The Wall Street Economic engine was simply seen as the only economy that would survive. The Main Street engine was viewed by DC, and those who assemble the legislative priorities therein, as a dying engine, lacking fuel, and destined to be service driven only….

Within the new 3rd economic dimension, the distance between Wall Street and Main Street economic engines, you will find the data to reconcile years of odd economic detachment.

Here’s where it gets really interesting. Understanding the distance between the real Main Street economic engine and the false Wall Street economic engine will help all of us to understand the scope of an upcoming economic lag, which, rather remarkably I would add, is a very interesting dynamic.

Think about these engines doing a turn about and beginning a rapid reverse. GDP can, and in my opinion, will, expand quickly. However, any interest rate hikes (fiscal policy) intended to cool down that expansion -fearful of inflation- will take a long time to traverse the divide.

Additionally, inflation on durable goods will be insignificant – even as international trade agreements are renegotiated. Why? Simply because the originating nations of those products are going to go through the same type of economic detachment described above.

Those global manufacturing economies will first respond to any increases in export costs (tariffs etc.), by driving their own productivity higher as an initial offset, in the same manner American workers went through in the past two decades. The manufacturing enterprise and the financial sector remain focused on the pricing.

♦ Inflation on imported durable goods sold in America, while necessary, will ultimately be minimal during this initial period; and expand more significantly as time progresses and offshored manufacturing finds less and less ways to be productive. Over time, durable goods prices will increase – but it will come much later.

♦ Inflation on domestic consumable goods ‘may‘ indeed rise at a faster pace. However, it can be expected that U.S. wage rates will respond faster, naturally faster, than any fiscal policy because inflation on fast-turn consumable goods become re-coupled to the ability of wage rates to afford them.

The fiscal policy impact lag, caused by the distance between federal fiscal action and the domestic Main Street economy, will now work in our favor. That is, in favor of the middle-class.

Within the aforementioned distance between “X” and “Y”, a result of three decades traveled by two divergent economic engines, is our new economic dimension, which, if successful, will be forever known as “MAGAnomics”….

“We support reinstating the Glass-Steagall Act of 1933 which prohibits commercial banks from engaging in high-risk investment,” said the platform released by the Republican National Committee. (link)

What you just read above was written in December of 2016, before President Trump’s economic policies were put into place.

Compare what was stated, what was predicted, a completely new paradigm in American economic perspective, to what happened.

It was the Fourth Quarter of 2019…..

Right before the pandemic would hit a few months later, despite two years of doomsayer predictions from Wall Street’s professional punditry, all of them said Trump’s 2017 steel and aluminum tariffs on China, Canada and the EU would create massive inflation – it just wasn’t happening!

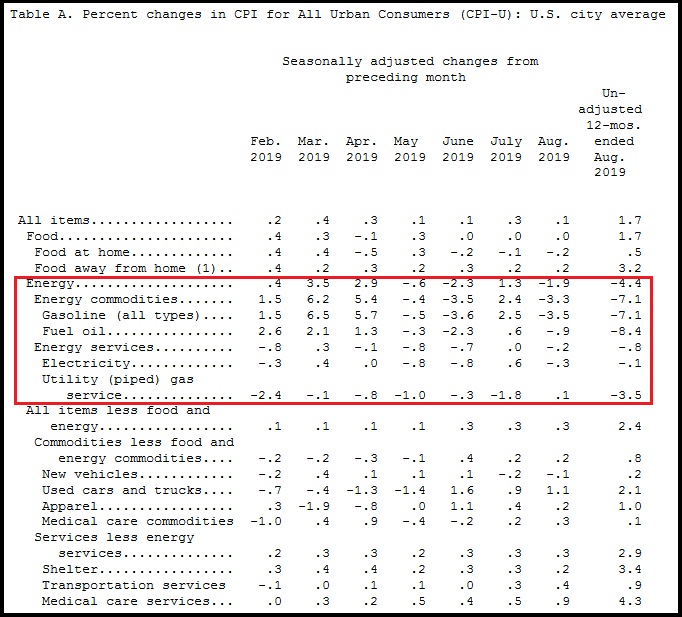

Overall, year-over-year inflation was hovering around 1.7 percent [Table-A BLS]; yup, that was our inflation rate. The rate in the latter half of 2019 was firmed up with less month-over-month fluctuation, and the rate basically remained consistent. [See Below] The U.S. economy was on a smooth glide path, strong, stable, and Main Street was growing with MAGAnomics at work.

A couple of important points. First, unleashing the energy sector to drive down overall costs to consumers, and industry outputs was a key part of President Trump’s America First MAGAnomic initiative. Lower energy prices help the worker economy, middle class and average American more than any other sector.

Which brings us to the second important point. Notice how food prices had very low year-over-year inflation – 0.5 percent. That is a combination of two key issues: low energy costs, and the fracturing of Big Ag’s hold on the farm production and the export dynamic:

(BLS) […] The index for food at home declined for the third month in a row, falling 0.2 percent. The index for meats, poultry, fish, and eggs decreased 0.7 percent in August as the index for eggs fell 2.6 percent. The index for fruits and vegetables, which rose in July, fell 0.5 percent in August; the index for fresh fruits declined 1.4 percent, but the index for fresh vegetables rose 0.4 percent. The index for cereals and bakery products fell 0.3 percent in August after rising 0.3 percent in July. (link)

For the previous twenty years, food prices had been increasingly controlled by Big Ag, and not by normal supply and demand. The commodity market became a ‘controlled market’. U.S. food outputs (farm production) was controlled and exported to keep the U.S. consumer paying optimal prices.

President Trump’s trade reset was disrupting this process. As farm products were less exported, the cost of the food in our supermarket became reconnected to a ‘more normal’ supply and demand cycle. Food prices dropped, and our pantry costs were lowered.

The Commerce Dept. then announced that retail sales climbed by 0.4 percent in August 2019, twice as high as the 0.2 percent analysts had predicted. The result highlighted retail sales strength of more than 4 percent year-over-year. These excellent results came on the heels of blowout data in July, when households boosted purchases of cars and clothing.

The better-than-expected number stemmed largely from a 1.8 percent jump in spending vehicles. Online sales, meanwhile, also continued to climb, rising 1.6 percent. That’s similar to July 2019, when Amazon held its two-day blowout Prime Day sale. (link)

Despite the efforts to remove and impeach President Trump, it did not look like middle class America was overly concerned about the noise coming from the pundits. Likely that’s because blue collar wages were higher, Main Street inflation was lower, and overall consumer confidence was strong. Yes, MAGAnomics was working.

Additionally, remember all those MSM hours and newspaper column inches where the professional financial pundits were claiming Trump’s tariffs were going to cause massive increases in prices of consumer goods?

Well, exactly the opposite happened [BLS report] Import prices were continuing to drop:

This was a really interesting dynamic that no one in the professional punditry would dare explain.

Donald Trump’s tariffs were targeted to specific sectors of imported products. [Steel, Aluminum, and a host of smaller sectors etc.] However, when the EU and China responded by devaluing their currency, that approach hit all products imported, not just the tariff goods.

Because the EU and China were driving up the value of the dollar, everything we were importing became cheaper. Not just imports from Europe and China, but actually imports from everywhere. All imports were entering the U.S. at substantially lower prices.

This meant when we imported products, we were also importing deflation.

This price result is exactly the opposite of what the economic experts and Wall Street pundits predicted back in 2017 and 2018 when they were pushing the rapid price increase narrative.

Because all the export dependent economies were reacting with such urgency to retain their access to the U.S. market, aggregate import prices were actually lower than they were when the Trump tariffs began:

[…] Prices for imports from China edged down 0.1 percent in August following decreases of 0.2 percent in both July and June. Import prices from China have not advanced on a monthly basis since ticking up 0.1 percent in May 2018. The price index for imports from China fell 1.6 percent for the year ended in August.

[…] Import prices from the European Union fell 0.2 percent in August and 0.3 percent over the past 12 months.

So yes, we know President Trump can save Social Security and Medicare by expanding the economy with his America First economic policy. We do not need to guess if it is possible or listen to pundits theorize about his approach being some random ‘catch phrase’ disconnected from reality. Yes folks, we have the receipts.

This was MAGAnomics at work, and this is entirely what created the middle class MAGA coalition. No other Republican candidate has this economic policy in their outlook, because all other candidates are purchased by the Wall Street multinationals.

America First MAGAnomics is unique to President Trump, because he is the only one independent enough to implement them.

That’s just the reality of the situation. They hate him for it…