With pretenses being dropped, Joe Biden is now admitting the “Inflation Reduction Act” had nothing to do with inflation, but was -factually- the severe leftist “Green New Deal.” This will not come as a surprise to most here, as we discussed this ruse extensively – SEE HERE and SEE HERE.

Allow me to say with clarity how much I appreciate YOU, the CTH members, who have long given up this insufferable game of pretending. There is a comfort amid our association who look at the issues with intellectual honesty and pragmatic insight. YOU make a difference, not only here on these pages of our fellowship, but also amid your family and community who have learned to value your voice. I cherish you.

In the fall of 2022, we accepted the named legislation “Inflation Reduction Act” (IRA) was a legislative misnomer intended to obfuscate the true construct of the bill. The IRA was factually the ‘green new deal’ program packaged under the guise of an ‘inflation reduction’ premise. In order to discuss the outcome of the content the American people are learning to stop the game of pretending around the purpose of the legislation.

First, here is Joe Biden making the admission yesterday in Wisconsin. Everything from the administration behind him is a ruse, a lie and a self-serving construct. WATCH:

.

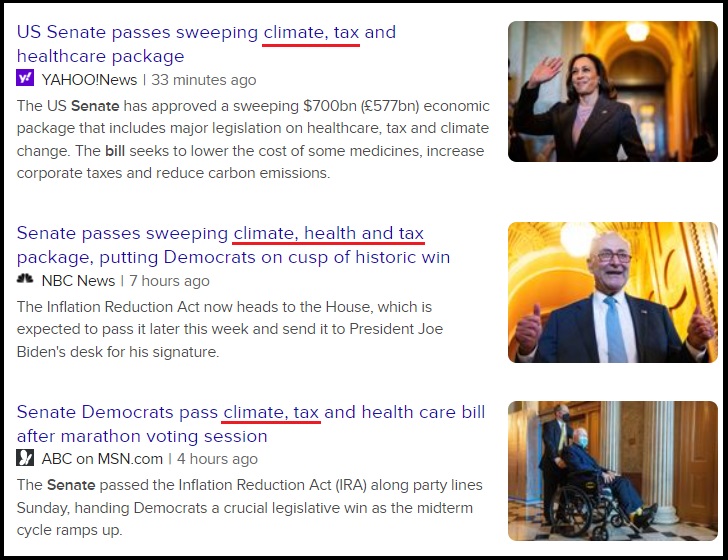

Prior to the 51-50 passage of the massive $700+ billion democrat spending bill, they called it the “inflation reduction act.” However, after Senate passage they are now calling it the climate change bill.

Deep inside the legislative language of the falsely titled “inflation reduction act”, aka The Green New Deal legislative vehicle constructed by lobbyists and passed by congress, people are now starting to realize a carbon-trading system was created.

Ultimately, a carbon trading system has always been the holy grail of the people who run the western financial system and want to create mechanisms to control wealth by using the ‘climate change’ agenda.

Ultimately, a carbon trading system has always been the holy grail of the people who run the western financial system and want to create mechanisms to control wealth by using the ‘climate change’ agenda.

A carbon trading system is a very lucrative financial transfer mechanism with a potential scale to dwarf the derivative, Wall Street betting, market. Secondarily, such a market would cement the climate change energy policy making it very difficult to reverse. The new creation as explained by the Wall Street Journal, holds similarities to the EPA ethanol program.

BACKGROUND – The Renewable Fuel Standard (RFS) is a government mandate, passed in 2005 and expanded in 2007, that requires growing volumes of biofuels to be blended into U.S. transportation fuels like gasoline and diesel every year. Approximately 40 percent of corn grown in the U.S. is used for ethanol. Raising the amount of ethanol required in gasoline will result in the need for more biofuel (corn).

The EPA enforces the biofuel standard by requiring refineries to submit purchase credits (known as Renewable Identification Numbers, or RINs) to the Environmental Protection Agency (EPA) proving the purchases. This enforcement requirement sets up a system where the RIN credits are bought and sold by small refineries who do not have the infrastructure to do the blending process. They purchase second-hand RIN credits from parties that blended or imported biofuels directly. This sets up a secondary income stream, a trading market for the larger oil companies, refineries and importers.

Understanding how that system operates, back in June I said, ‘the RIN credit trading platform is similar to what we might expect to see if the ‘Carbon Trading’ scheme was ever put into place’. Well, based on the legislation within the Green New Deal/Inflation Reduction Act, that’s exactly what is happening.

(Via Wall Street Journal) – WASHINGTON—A brand-new market for green tax credits is taking shape as bankers and advisers figure out how to funnel tax breaks from energy companies that generate them to profitable corporations eager for smaller tax bills.

The market is forming because Congress last month expanded renewable-energy tax credits and made them transferable in the law known as the Inflation Reduction Act.

[…] The tax-credit sales mark a shift in the U.S. strategy for attracting public and private capital to renewable-energy projects, and they will happen alongside existing climate-finance markets such as carbon offset purchases. The deals won’t start in earnest until 2023, but lawyers and financiers are already structuring transactions. They are discussing arrangements in which credits would be sold at discounts from face value, and they are determining how to cushion tax-credit buyers against potential risks.

“The conversations are happening. The market making is happening right now,” said Nicholas Knapp, senior managing director at CohnReznick Capital in New York.

Within a year or two, it could be easy for a corporation with no direct renewable-energy investment — a profitable retailer, pharmaceutical maker or high-tech company — to purchase tax credits. Because of the expected discounts, companies could earn an instant profit, paying $90 or $95 for a $100 coupon off their income-tax liability.

These transferable credits, however, expose a potential dilemma for Democrats. The party aimed to raise corporate tax bills and prevent large, profitable companies from paying too little. But the tax-credit transfers open a new avenue for many of those same companies to pay less.

“They can basically purchase the tax credits, advance their ESG goals and get certain economics from the credits without taking any construction or operational risk of the project,” said Hagai Zaifman, a partner at Sidley Austin LLP in New York who helps structure renewable-energy deals. (read more)

We know exactly who we have to thank for this.

WARNING FROM AUGUST, 2022:

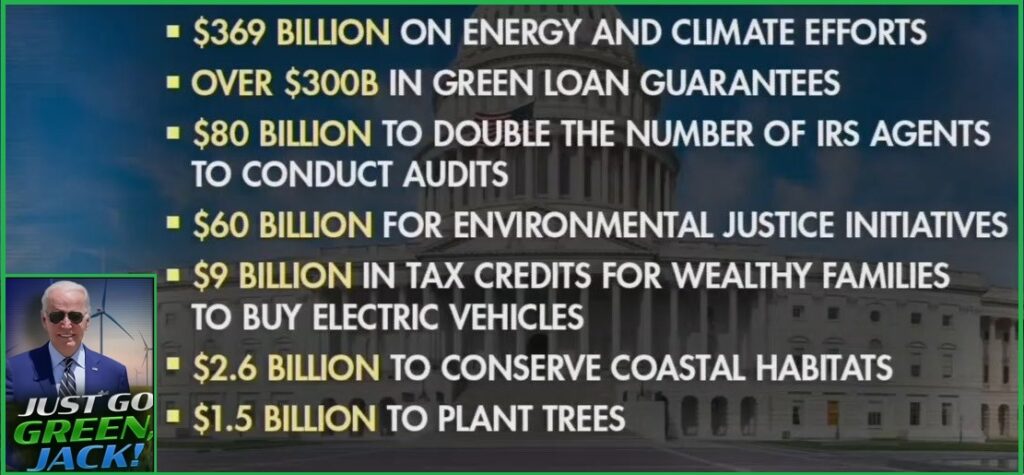

The bill itself contains absolutely nothing that will lower inflation; in fact, the bill itself will raise supply-side inflation in direct proportion to the energy production it reduces. To offset the contracted revenue caused by a much smaller economy, the Democrats have doubled the IRS tax army that will enforce personal income tax compliance.

The income tax compliance portion of the bill is very significant on two fronts. First, it literally doubles the size of the IRS, giving them much more power to conduct audits and capture taxes from income earned. As a review of tax audits has shown, the ordinary U.S. taxpayer is the target of this increase enforcement mechanism, not corporate tax review.

WASHINGTON – […] The bill, a product of 18 months of intense wrangling, passed by a margin of 51 to 50 on Sunday with Vice-President Kamala Harris casting the deciding vote. It was previously blocked by two Democrat senators who shared Republican concerns about its cost.

The Senate bill includes $369bn for climate action, the second largest investment on Green New Deal spending in US history. The largest bill on climate change was the previous Obama-era American Recovery and Reinvestment Act (AARA), that paid billions of dollars to solar groups (ex. now bankrupt Solyndra) and climate energy companies connected to Democrat donors.

In the current bill, high income households will receive up to $7,500 in tax credits to buy an electric car, or $4,000 for a used car. Rich people will get discounts on their $100,000+ automobiles. Billions more will be spent, yet again, on the production of “clean technology” such as solar panels and wind turbines.

Keeping the cultural war as a top priority, the Senate has also included $60 billion for ‘environmental justice‘ given to the leaders of black communities that have “suffered the most from fossil fuel pollution” according to the bill authors. This mechanism helps Joe Biden pay back the black community, specifically BLM and the AME church network, who were instrumental in executing the ballot harvesting fraud that pushed Biden into office.

“After more than a year of hard work, the Senate is making history,” Schumer said shortly before final passage. “This bill will kickstart the era of affordable clean energy in America, it’s a game changer, it’s a turning point and it’s been a long time coming.” [link]

And just like that, the inflation reduction language is dropped.

The bill passed containing the same provisions as it always did, it’s the Green New Deal spending and tax proposal.

.