Finding solid information, accurate data, to update the perspective of the ongoing boycott of Bud Light products is a little challenging. You would think the data would be easily found; alas, in this era of hyper partisanship, data that would reflect the truth of the situation is less visible. Go figure.

That said, this market share report from Union does give us a little more perspective on the outcome. According to the market share report, the decline in Bud Light sales overall is 34.2% over the past six months. Interestingly, some regions have much larger declines than others. For California, “Union reported only minor changes in market dominance in the state. Bud Light’s sales share in California slid by 0.8 points to 6.6%, while Miller Lite’s sales share increased by 1.7 points to 12%.”

(Via MSM) – The hospitality consumption data platform Union reported a significant decline in Bud Light’s sales share in the Carolinas. From April through June 30, the brand’s sales share dropped by 6.9 points, falling from 19.4% to 12.5%. This decline has been attributed to the fallout from Bud Light’s partnership with Dylan Mulvaney, which sparked controversy and calls for a boycott.

[…] Local bar owners in the Carolinas have also reported a significant impact on Bud Light’s sales. For instance, Chris Dimattia, the owner of Recovery Room Tavern in Charleston, SC, mentioned that he used to sell 10 cases of Bud Light each week, but now only sells one to three cases of the boycott brew, resulting in a 70% to 90% drop in sales. At Blind Tiger Pub, another Charleston bar, Bud Light sales are described as “almost non-existent” by general manager Clayton Dukes. Dukes expressed his concern that the boycott may persist for an extended period, prompting him to replace Bud Light draft with Michelob Ultra due to the low sales.

The negative impact on Bud Light’s sales was not limited to the Carolinas. In New York and New Jersey, the brand also lost ground to its rival, Miller Lite. The combined sales share of Bud Light in these states fell by 5.1 points, while Miller Lite’s sales share increased by about two points.

Similarly, in Texas, where Bud Light faced significant challenges after the controversy, Miller Lite now holds a commanding 12% sales share, more than double that of Bud Light’s 5.6% share. Surprisingly, the boycott’s impact on Bud Light sales was negligible in California, where Mulvaney hails from. Union reported only minor changes in market dominance in the state. Bud Light’s sales share in California slid by 0.8 points to 6.6%, while Miller Lite’s sales share increased by 1.7 points to 12%.

[…] Bud Light’s significant sales slide by 34.2% over the past six months has put the brand in a challenging position. The fallout from Mulvaney’s controversial posts and the subsequent partnership has evidently had a negative impact on the brand’s sales and reputation. (full article)

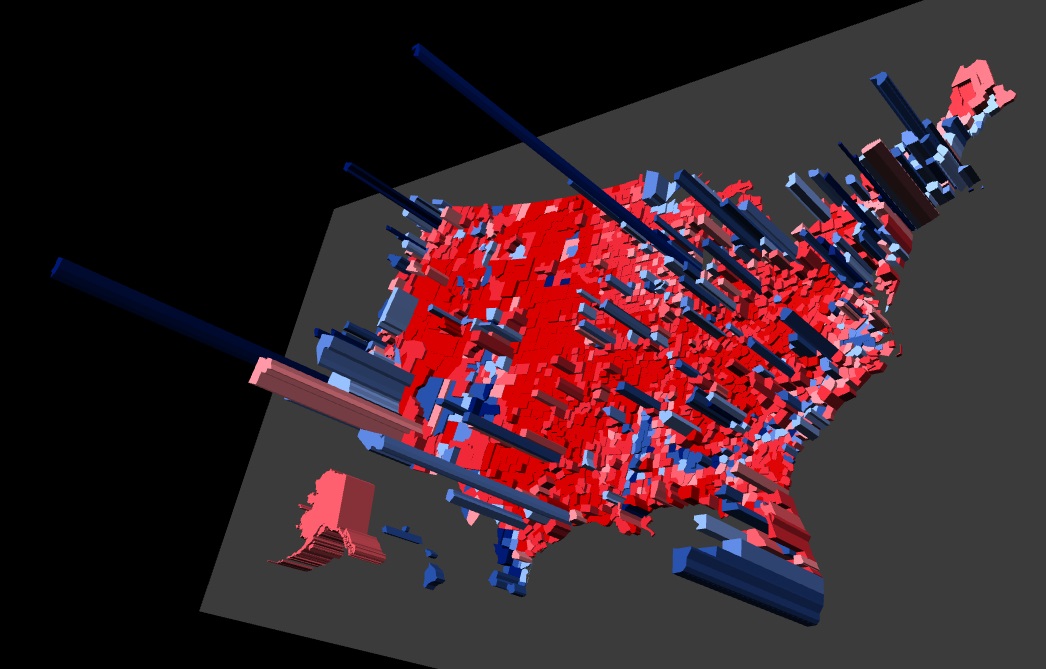

It would be interesting to map out the percentage change in Budweiser market share and overlay with a comparative map of regional political affiliation.

Regardless of the company ability to overcome the challenge, a total decline in sales of 34.2% over the six-month period would indicate the brand will not soon recover position. Going woke has consequences.