Everything I have outlined about Twitter is going to surface as accurate over time. There are two major elements: (1) DHS govt influence, now evidenced in the Twitter Files, and (2) the Twitter financial issues, which explain the recent hiring of Linda Yaccarino, which are soon to surface.

Yesterday, Elon Musk responded to criticism of Twitter censorship, vis-a-vis government demands, with this Tweet: “Please point out where we had an actual choice and we will reverse it.”

The Musk supporters are saying Musk has to comply with government demands if their national laws require it. However, that angle doesn’t take into consideration the choice that Musk/Twitter always have.

If the platform content is not approved by a government, and that govt then demands removal or censorship of that content, Twitter always has two options. One, to comply with the demand and block or restrict the user content (which is the direction they have taken) – or two, stop allowing the platform to operate in the country demanding the censorship. It is the latter option that everyone always avoids mentioning.

However, the issue appears to be bigger and goes to the heart of the second aspect of Twitter we have noted.

Twitter is not viable as a business model under the construct of its creation. Twitter operates on Amazon Web Services (AWS) cloud and Google Cloud.

Both big tech monopoly systems are extremely expensive, and as a result Musk is stuck in contracts with AWS and Google that are major financial drains. Twitter does not operate any server infrastructure; the only asset that Twitter has on the tech engineering side is the software to operate the platform.

Absent any hardware infrastructure, Musk is vulnerable to the excessive costs of AWS & Google.

Absent any hardware infrastructure, Musk is vulnerable to the excessive costs of AWS & Google.

Keep in mind that all cloud-based systems are arguably U.S. government subsidized and end in server farms built and owned by the U.S. govt. Send something to a cloud-based system, or operate your tech through a cloud-based system, and you are essentially operating on govt hardware.

[This is the background #2 issue to Jack’s Magic Coffee Shop.]

As you can see from this article in March 2023 [MUST READ], Musk was behind in his payments to Jeff Bezos (Amazon, AWS) but up to date on his payments to Google.

In essence, even as the article admits, Elon Musk is making payment decisions based on determinations of how best to avoid advertising revenue interruptions. Keep this in mind.

As you can see in the article, Musk is on the hook for contracts with AWS through 2025. As written, “AWS is not willing to renegotiate the five-and-a-half year contract it signed with Twitter in 2020.” That is before Musk took ownership. “That contract required Twitter to pay $510m over that period. It was signed when Twitter was expecting to move its main timeline over to AWS, but that never occurred (instead it hosts Twitter Spaces and other services), meaning that Twitter is not fully making use of the contract.” So, Jeff Bezos (AWS) has a hook into Musk for roughly $100 million a year.

Additionally, “Twitter uses Google Cloud to a greater degree, with its own five-year contract worth $1bn. While Twitter is also looking to reduce its Google Cloud costs.” That puts Musk on the hook for $200 million a year to Google, and Google controls the vast majority of advertising revenue on the web.

Each system, AWS and Google, represents a threat vector for Twitter (Musk), insofar as Twitter cannot operate without the cloud services each provider contributes to the data processing.

Absent his own data processing systems, Musk is vulnerable to the AWS/Google demands -$300,000,000/yr just for them. Again, keep this in mind.

This is all part of the financial section I have written about extensively, and it has an impact on the content.

With this information as the overlay, how much freedom does Musk actually have with the platform when he is dependent on Google and Amazon to operate? The same Google who controls the majority of his revenue (advertising) controls his data processing. See the problem?

On content, look at what AWS did to Parler as an example of what they could do to Twitter if Musk is not compliant. On revenue, consider how Google already has influence over the monetization of any platform on the internet, combined with terms and conditions for content control they can exert through their revenue power.

♦ Amazon (AWS, CIA, U.S. Govt) then becomes the primary control lever for rules and guidelines on content – the government compliance stuff. How does it surface? Musk saying he must censor Turkish political opposition parties.

♦ Google then becomes the primary control lever for Twitter revenue. How does that surface? Musk hiring Linda Yaccarino as CEO of Twitter.

Can you see it now?

Do the irreconcilables start to reconcile?

Does Elon Musk saying, “Please point out where we had an actual choice and we will reverse it,” start to make sense now?

Given that Musk is on the hook for $300 million/yr, and that’s just one expense, I suspect Musk is closer to bankruptcy with Twitter than most people think.

Given that Musk is on the hook for $300 million/yr, and that’s just one expense, I suspect Musk is closer to bankruptcy with Twitter than most people think.

The operating costs are too extreme for the business model. They always were; however, I suspect the USG was indirectly subsidizing Twitter through data processing when Jack Dorsey had ownership.

The subsidy would be part of the private-public partnership, where the USG was benefitting from their ability to control public information and public opinion.

With the USG control via DHS and FBI now in sunlight (Twitter Files), the financial side has always been the second -and hidden- big picture element around Jack’s Magic Coffee Shop.

Bottom line, Musk has to make decisions through one prism, THE ECONOMICS. Musk’s decision-making, pro freedom or not, is constrained by this financial dependency. Hence, a lot of the platform censorship elements remain (including some personnel) and now the outreach to appoint Google/WEF approved Linda Yaccarino in an effort to enhance the revenue.

As the end dates of the contract terms with AWS and Google start to come closer, decisions will have to be made if Musk wants a sustainable platform. Either he builds out new hardware (extremely costly and likely cost prohibitive), or he looks for an existing platform that he might be able to merge with and operate.

If you are a platform owner of reasonable scale, and you control your own servers and data-processing, watch out for David Sacks (repping for Elon) to tap you on the shoulder. Twitter is in a bind, or Musk needs to sink buckets of money he doesn’t have into building something. The financial viability is now the primary prism, not principles of free speech.

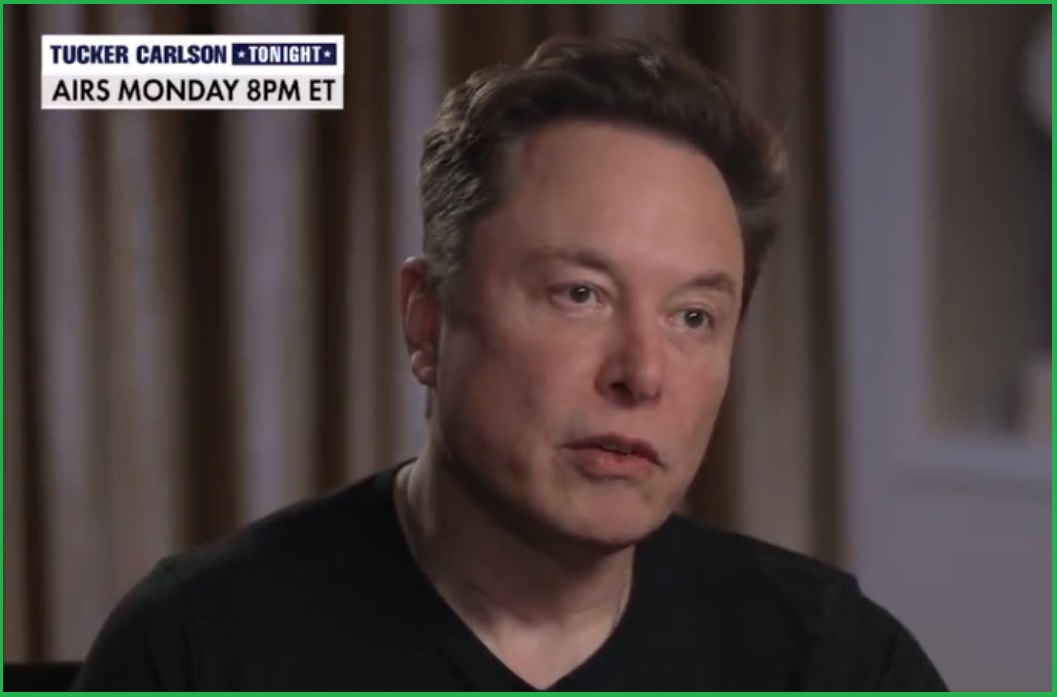

On the content side, Elon Musk needs content providers, which explains the thirst for Tucker Carlson and even the DeSantis launch to gain some operational impact. That’s likely where his key tech advisor David Sacks again comes into play. On the type of content, that’s where Linda Yaccarino steps in as the Google/WEF bridge to approved content revenue.