Despite the fact the Western Alliance have created the policy that will deliver pain to their citizens, not a single government leader will look at this move as a bad thing.

The pain will not be felt by the elites, it will only hit the citizenry. Lowered oil production outputs that drive up gasoline prices and fuel inflationary drivers, expedite the Build Back Better narrative and objective.

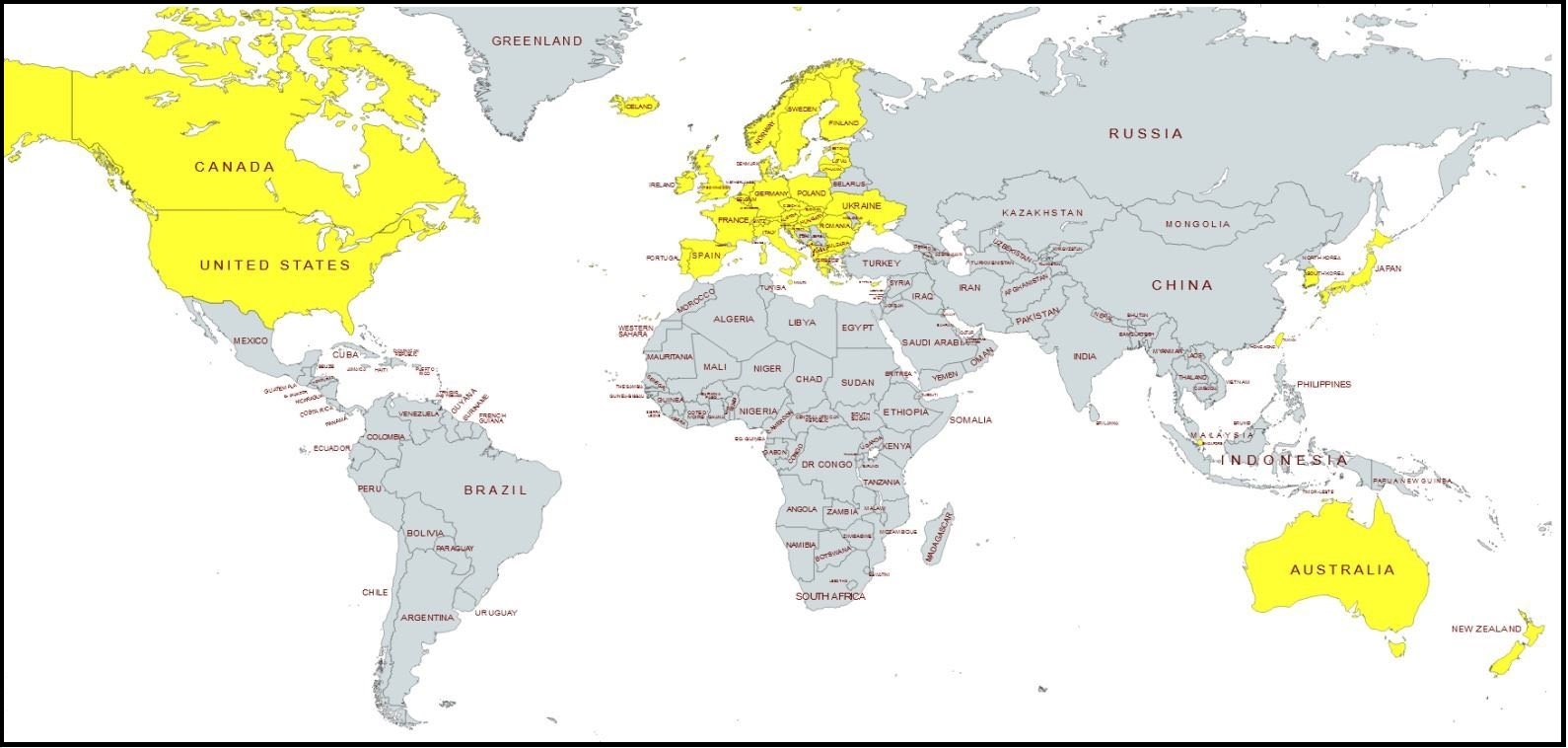

However, that said, in context to this announcement, a pain that will hit the Western economies of the alliance represented in yellow, the last 18 months of moves by Mexico makes President Andres Manuel Lopez-Obrador look remarkably prescient. The new strategic relationships and trade partnerships between China, Russia, Iran, Saudi Arabia, India and beyond, take on an added geopolitical dimension.

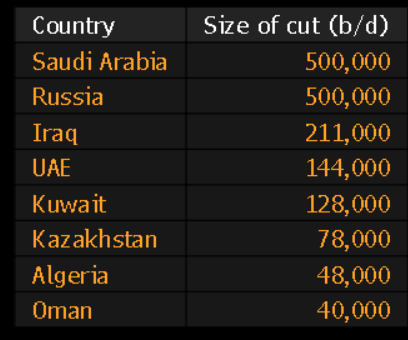

DUBAI, April 2 (Reuters) – Saudi Arabia and other OPEC+ oil producers on Sunday announced further oil output cuts of around 1.16 million barrels per day, in a surprise move that analysts said would cause an immediate rise in prices and the United States called inadvisable.

The pledges bring the total volume of cuts by OPEC+, which groups the Organization of the Petroleum Exporting Countries with Russia and other allies, to 3.66 million bpd according to Reuters calculations, equal to 3.7% of global demand.

Sunday’s development comes a day before a virtual meeting of an OPEC+ ministerial panel, which includes Saudi Arabia and Russia, and which had been expected to stick to 2 million bpd of cuts already in place until the end of 2023.

The latest reductions could lift oil prices by $10 per barrel, the head of investment firm Pickering Energy Partners said on Sunday, while oil broker PVM said it expected an immediate jump once trading starts after the weekend.

“I expect the market to open several dollars higher … possibly as much as $3,” said PVM’s Tamas Varga. “The step is unreservedly bullish.” (read more)

We have been closely monitoring the signs of a global cleaving around the energy sector taking place. Essentially, western governments following the “Build Back Better” climate change agenda stop using coal, oil and gas to power their economic engine, while the rest of the growing economic world continues using the more efficient and traditional forms of energy to power their economies.

We have been closely monitoring the signs of a global cleaving around the energy sector taking place. Essentially, western governments following the “Build Back Better” climate change agenda stop using coal, oil and gas to power their economic engine, while the rest of the growing economic world continues using the more efficient and traditional forms of energy to power their economies.

Within the BBB western group (identified on map in yellow), the logical consequences are increased living costs for those who live in the BBB zone, and increased prices for goods manufactured in the BBB zone. In the zone where traditional low-cost energy resources continue to be developed (grey on map), we would expect to see a lower cost of living and lower costs to create goods. Two divergent economic zones based on two different energy systems.

This potential outcome just seemed to track with the logical conclusion. The yellow zone also represented by the World Economic Forum, and the gray zone also represented by an expanding BRICS alliance. Against this predictable backdrop, we have been watching various events unfold – some obvious and some less so.

FLASHBACK to July 2022:

[…] “China’s invitation to the Kingdom of Saudi Arabia to join the ‘BRICS’ confirms that the Kingdom has a major role in building the new world and became an important and essential player in global trade and economics,” Mohammed al-Hamed, president of the Saudi Elite group in Riyadh, told Newsweek. “Saudi Arabia’s Vision 2030 is moving forward at a confident and global pace in all fields and sectors.”

[…] “This accession, if Saudi joins it, will balance the world economic system, especially since the Kingdom of Saudi Arabia is the largest exporter of oil in the world, and it’s in the G20,” Hamed said. “If it happens, this will support any economic movement and development in the world trade and economy, and record remarkable progress in social and economic aspects as Saudi Arabia should have partnerships with every country in the world.” (read more)

That would essentially be the end of the petrodollar, and – in even more consequential terms – the end of the United States ability to use the weight of the international trade currency to manipulate foreign government. The global economic system would have an alternative. The fracturing of the world, created as an outcome of energy development, would be guaranteed.

Keep in mind, in early June 2022, Federal reserve Chairman Jerome Powell stated, “Rapid changes are taking place in the global monetary system that may affect the international role of the dollar.” {LINK}

The Western Alliance (yellow) would be chasing climate change energy policy to power their economies. The rest of the world (grey), including Mexico, would be using traditional and more efficient energy development. The global cleaving around energy use would be complete.

The Western Alliance (yellow) would be chasing climate change energy policy to power their economies. The rest of the world (grey), including Mexico, would be using traditional and more efficient energy development. The global cleaving around energy use would be complete.

This is not some grand conspiracy, ‘out there‘ deep geopolitical possibility, or foreboding likelihood as an outcome of short-sighted western emotion. No, this is just a predictable outcome from western created events that pushed specific countries to a natural conclusion based on their best interests.

You can debate the motives of the western leaders who structured the sanctions against Russia, and whether they knew the outcome would happen as a consequence of their effort, but the outcome was never really in doubt. Personally, I believe this outcome is what the west intended. The people inside the World Economic Forum are not stupid – ideological, yes, but not stupid. They knew this global cleaving would happen.

For a deep dive on BRICS, as predicted by CTH, {SEE HERE}. The bottom line is – the 2022 punitive economic and financial sanctions by the western nations’ alliance against Russia was exactly the reason why BRICS assembled in the first place.

Multinational corporations in control of government are what the BRICS assembly foresaw when they first assembled during the Obama administration. When multinational corporations run the policy of western government, there is going to be a problem.

In the bigger picture, the BRICS+ assembly are essentially leaders who do not want corporations and multinational banks running their government. BRICS leaders want their government running their government; and yes, that means whatever form of government that exists in their nation, even if it is communist.

BRICS leaders are aligned as anti-corporatist. That doesn’t necessarily make those government leaders better stewards, it simply means they want to make the decisions, and they do not want corporations to become more powerful than they are. As a result, if you really boil it down to the common denominator, what you find is the BRICS+ group are the opposing element to the World Economic Forum assembly.

The BRICS team intend to create an alternative option for all the other nations. An alternative to the current western trade and financial platforms operated on the use of the dollar as a currency. Perhaps many nations will use both financial mechanisms depending on their need. This is how they replace the U.S. as the global superpower.

The BRICS team intend to create an alternative option for all the other nations. An alternative to the current western trade and financial platforms operated on the use of the dollar as a currency. Perhaps many nations will use both financial mechanisms depending on their need. This is how they replace the U.S. as the global superpower.

The objective of the BRICS group is simply to present an alternative trade mechanism that permits them to conduct business regardless of the opinion of the multinational corporations in the ‘Western Alliance.’

The BRICS team, especially if Saudi Arabia, Iran and Argentina are added creating BRICS+, would indeed be a counterbalance to the control of western trade and finance. This global cleaving is moving from a possibility to a likelihood. If Saudi Arabia joins BRICS, the fracture becomes almost certain.

March 29, 2023, CHINESE national oil company CNOOC and France’s TotalEnergies have completed China’s first yuan-settled liquefied natural gas (LNG) trade through the Shanghai Petroleum and Natural Gas Exchange, the exchange said on Tuesday (Mar 28).

Approximately 65,000 tonnes of LNG imported from the UAE changed hands in the trade, it said in a statement. TotalEnergies confirmed to Reuters that the transaction involved LNG imported from the UAE but did not comment further. (read more)

This exchange between the UAE and France is taking place without dollars. If the process continues, the dollar weakens. In the geopolitical world of currency valuations and trade, this might be considered the Archduke Ferdinand moment for the end of the petrodollar. The question will become, can they grow this process with OPEC+ support and begin eventually trading oil in yuan?

MEXICO – Three new oil refineries together with new railroads and highways are under construction right now as the government continues positioning itself for energy independence. [Video Here]

The energy plan, which runs counter to the expressed demands of Canada and the United States, includes two regional ‘green’ refineries that will have the ability of turning used cooking oil into fuel. However, the plan also includes new oil refinery capacity that will permit cheap gasoline independent of the need for Mexican oil to be refined in Texas and returned.

All of the refinery projects are on schedule to be completed by the end of this year and into 2024. In essence, Mexico will have very cheap gasoline and diesel fuel in the near future. This was previously outlined as a goal by AMLO in July 2022, and is against the interests of the Biden administration. Now, those plans are becoming a reality. Mexico is not joining the North American (Western Alliance) suicide mission of windmills, solar panels and reliance on unstable green energy.

Ever since the July 2022 Oval Office press conference at the White House, CTH has been saying to keep an eye on Mexico, because these energy plans align more with the BRICS nation agenda than the goals and objectives of the World Economic Forum (western nations).

It is not accidental the U.S. government, including our intelligence agencies and DHS, has been seeding a negative overall impression of Mexico ever since. However, you can see how prescient Mexico has been when contrast against current geopolitical events.