At a certain point in the economics of the great pretending cycle, one must wonder what circles they live in.

Fed Chair Jerome Powell announced another quarter-point interest rate hike and simultaneously noted the banking crisis will likely lead to tighter credit and borrowing for businesses on Main Street…. thereby further reducing the U.S. economic output. Yet here we are again, and not a single economic or financial pundit is even talking about the origin of the inflation the Fed action is pretending to address, the spike in energy prices.

At the core of the Biden policy issue that creates inflation, is the energy policy that has driven oil, gas, home heating, electricity and manufacturing/farming costs through the roof. The blocking of energy resource development/production is the top issue leading to massive increases in consumer prices overall. The Biden energy policy is entirely ignored by a federal reserve attempting to shrink inflation.

Follow the bouncing ball of consequence.

Biden restricts energy development [Main St Suffers]. Prices skyrocket [Main St Suffers]. The fed raises interest rates in an effort to reduce the economic activity to meet the lowered production of energy resource development [Main St Suffers]. The result of the interest rate hike creates liquidity issues for banks holding treasury securities [Main St Suffers]. The banks then reduce credit lines, reduce lending and tighten borrowing to match their lowered liquidity [Main St Suffers].

The Fed then notes further increases in rates may pause as they await the outcome of restricted banking credit and lending from the rate hikes previously installed. Nowhere in any of this is anyone talking about the nucleus of the issue – the stupid energy policy. The great pretending continues in the West, while smiling panda lunches with Vladimir Putin.

[Transcript] – “At today’s meeting, the committee raised the target range for the federal-funds rate by a quarter percentage point, bringing the target range to 4.75 to 5 percent, and we are continuing the process of significantly reducing our securities holdings. Since our previous FOMC meeting, economic indicators have generally come in stronger than expected, demonstrating greater momentum in economic activity and inflation.

We believe, however, that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would in turn affect economic outcomes. It is too soon to determine the extent of these effects, and therefore too soon to tell how monetary policy should respond.

As a result, we no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation; instead, we now anticipate that some additional policy firming may be appropriate. We will closely monitor incoming data and carefully assess the actual and expected effects of tighter credit conditions on economic activity, the labor market, and inflation, and our policy decisions will reflect that assessment. (read more)

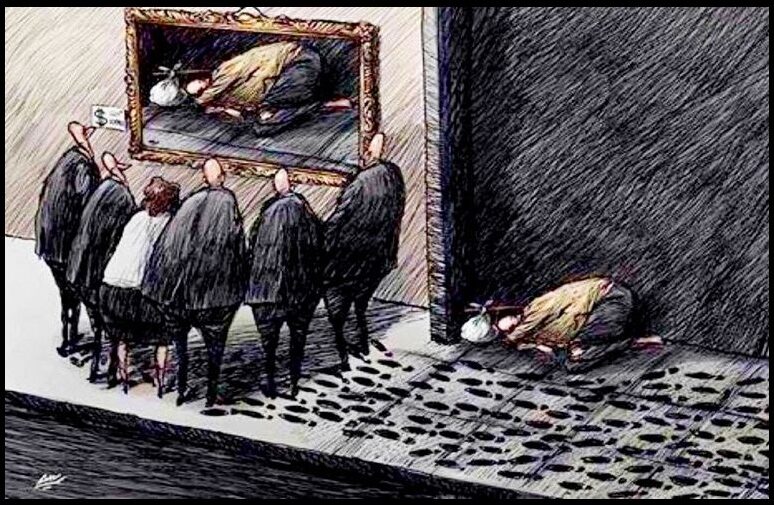

We are in an abusive relationship with our government.