The 44-hour collapse of Silicon Valley Bank (SVB) is having some reverberations amid the tech sector as companies who carried unsecured deposits with the bank are facing an uncertain future.

Tech company Roku streaming services holds $487 million in cash reserves at SVB representing 26% of their liquid holdings. Those unsecured funds are now tenuous, depending on what steps are taken next. Additionally, Etsy an online brokering retailer for mostly independent sellers, has also run into a snag with processing disbursement payments to those same sellers. Etsy used SVB as a depository and payment transfer provider to the merchant accounts.

Tech company Roku streaming services holds $487 million in cash reserves at SVB representing 26% of their liquid holdings. Those unsecured funds are now tenuous, depending on what steps are taken next. Additionally, Etsy an online brokering retailer for mostly independent sellers, has also run into a snag with processing disbursement payments to those same sellers. Etsy used SVB as a depository and payment transfer provider to the merchant accounts.

According to Axios, “Circle’s usd coin (USDC), the second largest stablecoin in the world” is also in a tough position “because a portion of its cash reserves were held at SVB, which the U.S. government took control of on Friday.” These and other ancillary issues are now part of a larger conversation about whether SVB is representative of a weakness that may impact other banks. However, current consensus is that a contagion effect is not expected.

SVB was exclusively a tech sector bank. Small to mid-size tech companies who relied on SVB may have some immediate issues; but the larger banking sector seems much more solid and less exposed to the long-term treasuries that SVB was holding. “People are used to having zero interest rates and easy money, and it’s gone. And there are people who will manage that well and people who will not,” former Congressional Budget Office Director Doug Holtz-Eakin said during an interview on “Cavuto Coast-to-Coast” Friday. {link}

Meanwhile, congress is meeting with treasury and FDIC officials to discuss if taxpayer intervention is needed. {insert eyeroll here}:

March 11 (Reuters) – U.S. lawmakers met with the Federal Reserve and Federal Deposit Insurance Corporation on Friday to discuss the collapse of SVB Financial Group (SIVB.O), Coindesk reported on Saturday citing a source.

Democratic U.S. Representative Maxine Waters held briefings with officials from the two regulators and the Treasury Department, hours after the startup-focused SVB’s collapse, the report said.

[…] Separately, Representative Ro Khanna said in a tweet on Friday that he reached out to both the White House and the Treasury Department to discuss the situation with the bank.

U.S. Treasury Secretary Janet Yellen on Friday met with banking regulators on the collapse of SVB, as she and the White House expressed confidence in their abilities to respond to the bank failure. (more)

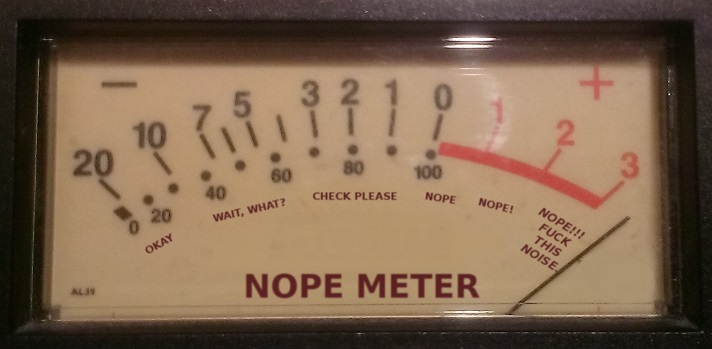

Nothing makes the Nope Meter peg with greater emphasis than hearing the name Maxine Waters and bank bailout in the same sentence.

I already made my position pretty clear yesterday. NO BAILOUTS!

The tech sector has a tremendous amount of capital at hand. Let the tech companies who used SVB as a launch vehicle sell some of their own stock holdings and backstop the bank as an investment mechanism. There is no need for the U.S. taxpayer to get involved.

I am more concerned about this failure being used as a tool to initiate a conversation about digital currencies. The ‘never let a crisis go to waste‘ team, are likely chomping at the proverbial bit….