6 Charts Show Crucial Facts About Spending, Taxes, Deficits Missing From Biden’s Budget

President Joe Biden discusses his proposed fiscal 2024 federal budget on Thursday in Philadelphia. The plan, with huge increases in spending and taxes, is likely to face a hostile Republican-controlled House of Representatives. (Photo: Chip Somodevilla/Getty Images)

The Biden administration on Thursday released an outline for its fiscal year 2024 budget. As expected, it promotes the same swampy, big-government agenda as last year, which the country desperately needs to avoid.

Beneath the administration’s spin, the ultimate message is that it thinks the federal government doesn’t have enough power and control over our families and businesses.

These charts, based on updated information from the nonpartisan Congressional Budget Office, show just how off-base Biden’s narrative is and why America needs exactly the opposite from its leaders.

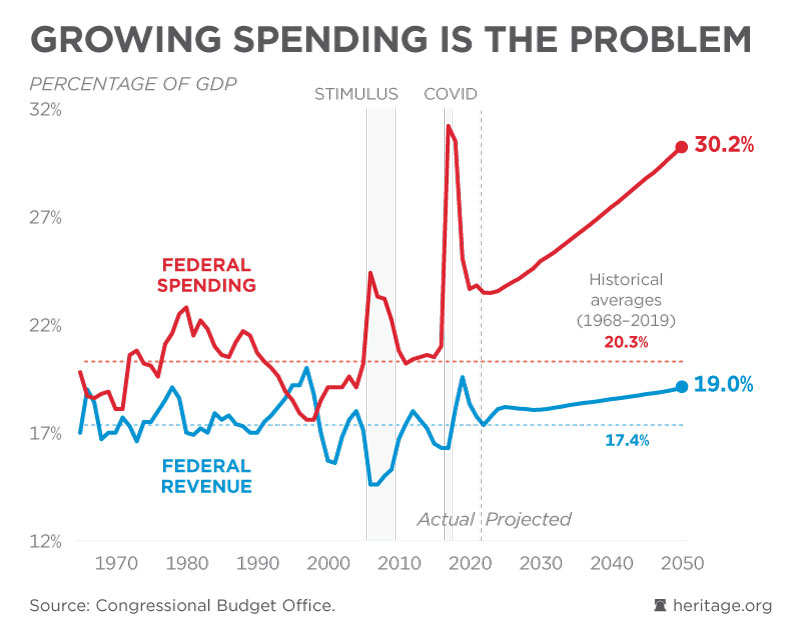

For more than 50 years prior to the COVID-19 pandemic, federal spending averaged a whisker over 20% of the economy. That temporarily spiked above 30% in 2020 and 2021 due to the immense (and extremely wasteful) spending spree by Congress.

The country is on course to return to that excessive level of spending without war, recession, or a pandemic as the underlying cause. Merely maintaining the status quo of allowing benefit and cronyistic programs to grow faster than the economy will make “emergency” levels of spending the new normal.

A relatively short exposure to firehose-style spending helped drive inflation through the roof. We can only imagine what would happen if that’s allowed to become permanent reality.

Incredibly, the Biden budget would increase spending above the baseline by $1.85 trillion over the next decade, making the problem even worse. It envisions a mindboggling $10 trillion in spending by 2033.

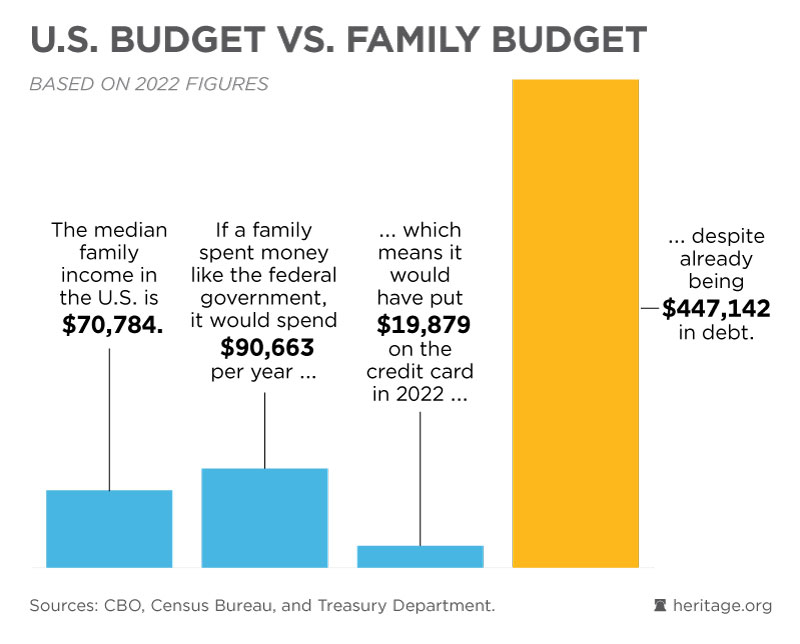

The raw numbers involved with federal budgeting are impossible to fully comprehend, which makes charts such as these so important.

In fiscal year 2022, the federal deficit was the equivalent of nearly $20,000 for a middle-class family. To carry the analogy further, this family would already be more than $447,000 in debt, but with no new assets to show for it.

Any family with such an unbalanced budget would be bankrupt in no time flat. We shouldn’t assume that the nation can avoid a similar fate for much longer.

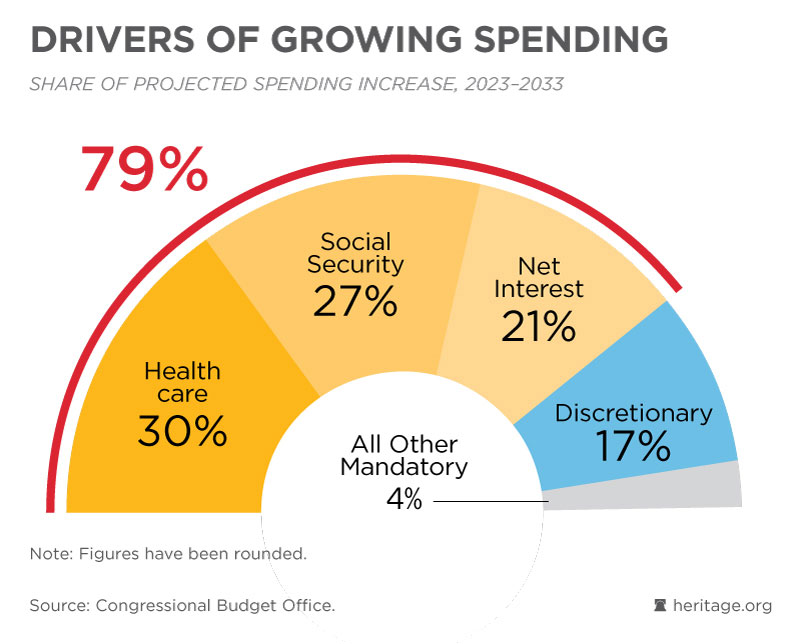

It has been incredibly reckless for Washington insiders to assume low interest rates would be around forever. With interest rates rising, the country is faced with the prospect of dedicating more than $1 trillion dollars per year to interest payments by the end of the decade, and trillions more per year not too long after that.

Servicing the federal debt will soon be an anchor dragging on the economy, steadily eroding the growth and prosperity that we take for granted. Any attempt to artificially push interest rates down would threaten to make inflation worse, squeezing families from both sides.

Federal spending is projected to grow much faster than the economy. Of that incredible growth, a full 79% would arise from net interest payments, Social Security, and Medicare.

Too many politicians want to either ignore this reality, or—like Biden—pretend that the solution is to raise taxes while refusing to take any meaningful action to reform key benefit programs with long-term stability in mind.

Incredibly, Biden is proposing a whopping $4.7 trillion tax increase in the budget plan, or more than $35,000 per household.

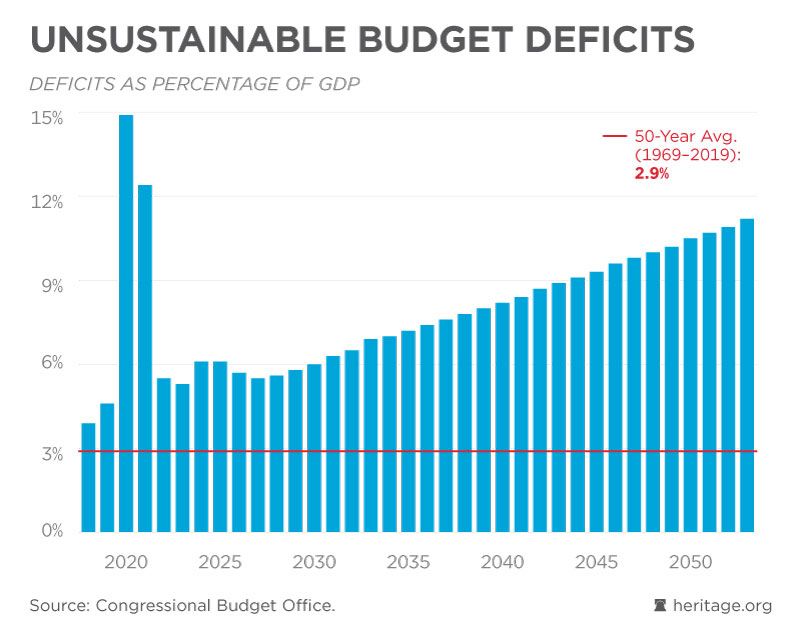

Biden and his staffers love to brag about the 2022 deficit being lower than it was in 2020. This talking point is, frankly, misinformation. Biden’s decisions have consistently made things worse.

Further, the 2022 deficit was still well above the historical average. Unless something changes, deficits will be twice the historical average by 2029 and keep climbing from there.

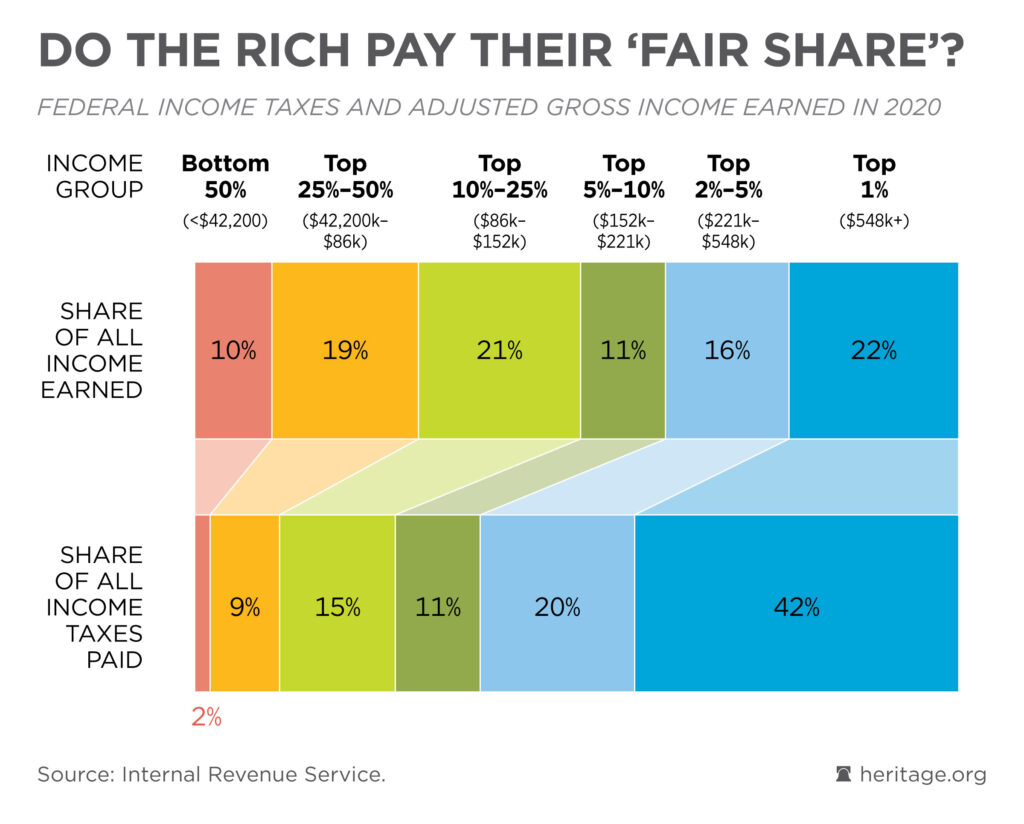

Biden and the Left have spent decades claiming that high-income households don’t pay their “fair share” of taxes. The Biden budget’s signature policy is a tax hike based on that assertion.

Once again, reality says otherwise. The top 1% of households pay more income tax than the bottom 90% combined and pay roughly twice as much in taxes relative to their share of income.

The Left never defines what “fair share” means, other than “more,” and they typically want to use that “more” to cover spending increases.

It’s crucial for Americans to understand that raising taxes on businesses and entrepreneurs would not only damage economic growth and private investment, but it would also utterly fail to generate enough revenue to satisfy the Left’s agenda.

The harsh reality is that a European-style government with cradle-to-grave benefits would require European-style taxes, and that would mean hammering the middle class with tax hikes.

A proper solution to federal finances, such as that of The Heritage Foundation’s Budget Blueprint, would focus on shrinking bloated bureaucracies and reforming programs such as Medicare in a way that treats both older and younger Americans fairly.

In contrast, Biden’s budget would leave future generations with crushing burdens of debt and taxation. More than merely rejecting this bleak vision for the country, Congress must go in the opposite direction if we are to have any hope.